Will Bitcoin Destroy the Gold Market?

Crypto series article 2

By Dave Bellamy Dec 2017 -Jan 2018

Introduction

In the first article, I discussed whether Bitcoin and crypto currencies might present a threat to the stability of the current financial system. Now I am moving over to discussing the gold market and other alternative investments that may be among the first to feel the effects of the cryptocurrency revolution.

Both these questions came to me very strongly now that Bitcoin has reached and surpassed the quite amazing price target of $10,000 per coin in late 2017.

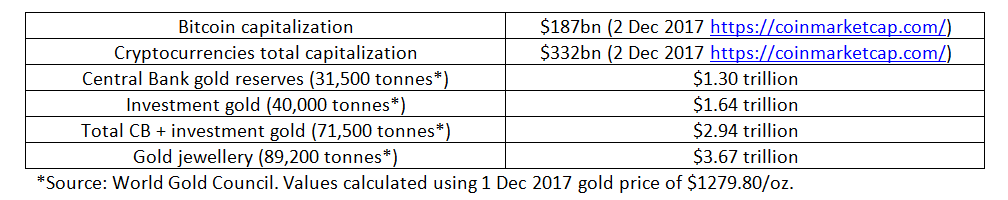

Bitcoin is the digital peer to peer currency launched around 2009 with little or no monetary value at the time. It was even discussed back then whether it would ever have any use or monetary value. Now each unit is worth over $10,000, varying from day to day as it trades and there are about 17 million Bitcoin units outstanding, giving a total market value of around $170 billion to the current Bitcoin currency supply as of early December 2017. The maximum number of Bitcoins that are available to be found or ‘mined’ was set at 21 million but that process is gradual since Bitcoins are essentially mined by maintain the ledger of transactions over time. This takes computer power and work, making it analogous to mining precious metals, for instance.

Potential Bitcoin and other Cryptocurrency values

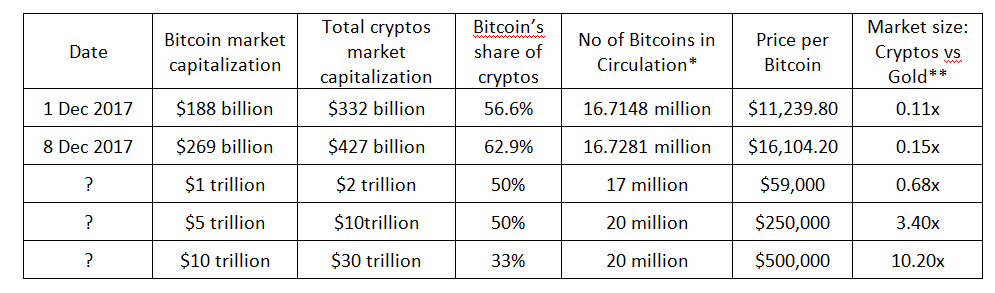

Now as Bitcoin has hit $10,000, speculation has raged as to what maximum value it might reach. Some have speculated it might go to $500,000 to $1,000,000 per coin. This is extravagant in my personal view but that is not investment advice.

A good place to look is https://coinmarketcap.com/ which currently states as of 1 Dec 2017 that the total market capitalization of all 1320 of the cryptocurrencies it monitors is $332 billion, with the lion’s share in Bitcoin ($188 bn), Etherium ($45 bn), Bitcoin Cash ($24.5 bn), Ripple ($9.9 bn), etc. All of the top 16 have over $1 billion and even number 50 on the list, Veritasium has a market cap of $196m!

The total crypto value is already 1/3 of a trillion! Bitcoin currently has 56% of the crypto market.

Table 1: Comparing this to gold in the financial system in various forms:

Table 2: This table shows my hypothetical Bitcoin estimates from the previous article in comparison to the gold market:

*I am allowing for the potential increase in the number of Bitcoins towards the maximum limit of 21 million.

** I am comparing the total crypto currency hoarding with the total value of all investment and central bank gold (likely almost the entire world supply of bars and coins) of $2.94 trillion.

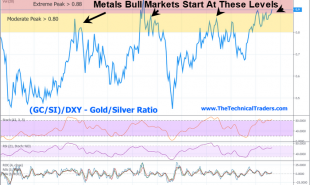

Money Flows out of metals into cryptos?

Further increase money flows into the cryptocurrencies would likely cause significant diversion of funds out of gold.

I personally would not be surprised to see a 1 or 2 trillion dollar market capitalization for cryptocurrencies in the near future. This would reach or possibly exceed the total value of all central bank gold reserves ($1.3 trillion) and approach the total value of all investable bars and coins ($2.94 trillion). At that point, there is a danger that cryptos will be a serious competitor not only to gold but also other alternative investments in the same universe such as silver bullion, gold and silver miners (junior exploration companies and even senior producers) and even perhaps other precious metal and commodities investments, which also tend to be inversely correlated to the value of the US dollar and are used as a hedge to depreciation of the conventional currencies.

I this is already happening. Bitcoin is zooming, while gold and silver, which are other alternative forms of currency, are languishing. The libertarian political mindset is common both to precious metals freaks and Bitcoin freaks so these markets are competing for that money. Cryptos are winning, hands down. How far will it go? What will happen when Bitcoin futures open on the same platforms as gold and silver futures in December 2017?

Signs of this occurring include the World Gold Council Gold Demand Trends report from 9 November 2017, which states that overall gold demand in the 3rd quarter of 2017 had fallen 9% year on year, mostly due to less money flowing into the Gold Exchange Traded Funds (ETFs). However, bar and coin demand was up a little and central bank buying was also up. Without the central bank buying, the demand figures would have been worse.

In the more extreme scenarios, there is the possibility that cryptos could replace gold and precious metal investments as the Go To alternative investment to hedge against the conventional markets and currencies. It’s not impossible that a bubble in cryptocurrencies could cause a crash in precious metals if it continues to progress rapidly.

Right now, it’s too early to tell whether gold demand is seriously dented by cryptocurrency demand. However another sign is that the famous precious metals site www.kitco.com now has Bitcoin and crypto quotes on its front page and as of a few days ago, there is also some technical chart analysis of cryptos being done by their analyst Jim Wyckoff. This is on a site that actually sells precious metals bars and coins! Presumably this information is being presented because of popular demand and surely shows a shift of interest from precious metals into cryptocurrencies.

Famous financial author Doug Casey said in a recent Kitco interview at the Silver & Gold Summit that Bitcoin: may be the 'Gateway Drug' To Gold and that $50,000 Bitcoin was possible, especially in the light of the war on cash. I agree in some ways but I don’t think that cryptos are necessarily a gateway to gold, unless the cryptocurrencies bubble bursts, at least for a while. There could be big swings from gold into cryptos before the see saw goes the other way. It’s very difficult to call.

Frank Holmes doesn’t agree with me. He thinks that stock market offerings (IPOs) are being swamped by the number of initial coin offerings (ICOs). He doesn’t see any present danger to the gold and silver markets but I do. I think his interview linked below is ignoring the prospect of huge speculative flows into Bitcoin from gold and silver that can come from libertarian minded people and asset hedgers choosing Bitcoin over gold and silver on the basis of privacy, innovation and most of all at the moment, performance!

I would say, look at the performance of the stock market this year. It’s up. So is gold, agreed but the US stock market has gone from new highs to higher highs and gold is up from a low level at the start of the year, about $100 below where it was in mid-2016. Sure, gold has not taken a huge hit - but that was before $10,000 Bitcoin arrived to grab that extra attention away from the yellow metal. In the early days of December 2017, gold and silver are in a downtrend, with silver under $16, again. Wells Fargo analyst John LaForge stated that gold is in a secular bear market and will test the lows of $1050. In my view, there must be a fair amount of fatigue right now among precious metals speculators and this could be dangerous to those markets.

In terms of short term volatility, the introduction of Bitcoin futures in mid-December 2017 may also be having an effect on gold and silver, as investors reallocate and transfer liquidity into Bitcoin futures. Personally, I think there could be severe short and medium term implications for gold and silver as well as the miners. These will probably be resolved in favour of precious metals only if the crypto bubble bursts for some reason. Perhaps in the very long term, gold will still have a major place in the financial system - but right now it is looking shaky.

Just as I was about to publish, Jim Cramer chimed in saying that, “Gold has lost its moment,” recently, though he is concerned about whether the parabolic rise in Bitcoin is sustainable and still thinks gold is an important asset to own (see link below).

Also, in a fascinating interview on Russia Today, Rick Falkvinge, the Bitcoin Cash 'CEO' discusses the general implications for the financial system but does not mention gold, except in passing.

Conclusion

The debate is on! My current thought is that cryptocurrencies are a serious potential threat to the gold and silver markets in the short to medium term, at least. This includes mining, as I will explain in my next article called “Crypros – the New Gold Rush?” This state of affairs has probably only just started and may well continue until such time as one of more of the main cryptocurrencies has a serious crash. This could happen when the initial mania in cryptos ends, much like the bursting of the first Internet bubble in year 2000.

Political and financial flow restrictions such as prohibition or capital controls could also bring the crypto bubble to its knees but it is hard to see how that can completely burst the crypto bubble unless it is done on a worldwide scale. Until then, precious metals seem t be to be under threat.

I hope that you enjoyed the article and find it a useful pointer to further information and ideas. Please also see my sister article on the potential effect of the crypto revolution on the overall financial system.

Since the original writing of this article, Bitcoin has taken a correction and gold has been in an uptrend, so you can never really tell what is going to happen. Only the future will tell whether this article was written at a point of maximum pessimism for gold. In any case, 1 Bitcoin is still worth 10 ounces of gold as of 11 January 2018 when this is being posted to Marketslant.

References:

https://www.youtube.com/watch?v=Zbq5hB6nVQ8 Bitcoin: The 'Gateway Drug' To Gold - Doug Casey

https://www.youtube.com/watch?v=WdvPXuJK1CY Cryptos Are Taking Over Markets But Not Gold - Frank Holmes

https://www.youtube.com/watch?v=WCx1BVKBy9I Gold's Cycle Shows Metal May Retest Lows of $1,050 - Wells Fargo's 2018 Outlook with John LaForge

Bitcoin Will Outperform Everything Including Warren Buffett Says Max Keiser – Part 1:

Bitcoin Will Be Like Moses for Gold, Liberate Metal To $5,000 - Max Keiser - Part 2:

WGC Gold Trends https://www.gold.org/research/gold-demand-trends

Cramer on gold: http://www.kitco.com/news/2017-12-04/Jim-Cramer-Gold-Is-Losing-Is-Luster-To-Bitcoin.html

This article © Dave Bellamy 2017.

Dave Bellamy is a Materials Engineer with a long time interest in numismatics and monetary history

https://www.patreon.com/bellamyresearch

Disclaimer: This material is research and is presented for educational and entertainment purposes only. It does not constitute financial advice and are not a solicitation to buy or sell any financial instrument or commodity at any time. Investment decisions are solely the responsibility of the investor. Investors have the opportunity to do their own due diligence and also to consult a qualified financial adviser before making investment decisions. The author has made every effort to ensure accuracy of information contained herein; however the author cannot guarantee such accuracy.

Read more by BrexitNews