The oil market price is setting up for one heck of a fall. Now, could this large oil correction cause the next stock market crash? Time will tell. However, the indicators in the oil market are showing the largest net commercial short positions in history. The current net commercial short positions in the oil market are even higher by 174,000 contracts than the level when the oil price fell from $105 in mid-2014 to a low of $30 at the beginning of 2016.

Furthermore, there was a previous trend in the 1980’s that suggests we are setting up for a MAJOR stock market crash. I discuss the details of the current record net commercial short positions and the similar setup that took place during the 1980’s in my newest video, Will The Coming Big Oil Price Drop Cause The Next Stock Market Crash?

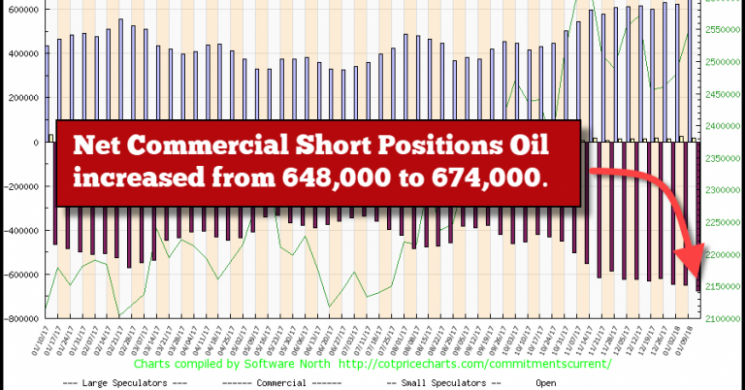

Here is one of the charts discussed in the video presentation above:

As we can see in this COT Report (Commitment Of Traders), the commercial net short positions jumped from 648,000 to 674,000 in the past week. However, this chart only shows the change traders’ positions over one year. To see how large the present commercial net short positions, please check out the short 12-minute video.

I believe the oil and stock markets are setting up for one large correction or even a market crash. Thus, as the stock markets crack, we will likely see a huge move by retail investors into Gold ETF’s as well as precious metals investors tremendously increase their demand for physical gold and silver investment.

Read more by MarketSlant Editor