Who says municipal bonds aren’t sexy? They were the top fixed-income asset class of 2015, compared to U.S. Treasuries and corporate bonds, and they even outperformed the S&P 500 Index. Still not convinced? Check out the following ways short-term munis can make you scream “Oh yes!”

1. Tax. Free. Income.

One of munis’ most titillating qualities is that they’re tax-free at the federal level.

But they can also be tax-free at the state level depending on where you live. There are only seven states without an income tax, meaning you’re on the hook if you live in those other 43 states. Municipal bonds can minimize the burden.

Disover the top five states in our Near-Term Tax Free Fund (NEARX) by percentage.

2. Capital preservation

Because munis are tax-free, you get to keep more of your wealth in your own pocket.

NEARX seeks preservation of capital and has had a net asset value (NAV) that’s floated in the $2 range. It’s demonstrated minimal fluctuation in its share price, even during the 2008-2009 financial crisis.

3. Low default rate

True or false? The odds are greater that you will be struck by lightning than a high-quality muni will default on a payment.

True! Between 1970 and 2014, not a single Aaa-rated muni defaulted, while Aa and A-rated bonds—the kinds NEARX heavily invests in—were highly unlikely to default.

Corporate bonds, on the other hand, had an increasing rate of defaults the lower their credit rating and further out from their issuance, according to Moody’s.

The chart below illustrates Moody’s findings of default rates between 1970 and 2014. It shows the rise in such rates between year one of a bond’s issuance, which could be at any time within the chart’s range, and year 10. You can see that munis’ default rate is near-zero and that Aaa-rated bonds don’t even register.

4. Calm in times of market turmoil

Speaking of “moody,” even when the S&P 500 was acting sporadically, munis were steady growers. Check out the following chart, which shows a hypothetical investment of $100,000 in the Near-Term Tax Free Fund and S&P 500 stocks at the end of 1999. (You cannot directly invest in an index.) The equity market had two massive declines during this period, while NEARX rose steadily. In fact, it took 14 years for the equity market to catch up. (Figures include reinvestment of capital gains and dividends, but the performance does not include the effect of any direct fees described in the fund’s prospectus which, if applicable, would lower your total returns.)

Granted, the two major drops in value during this period—first when the tech bubble burst, then during the financial crisis—were among the worst the market has ever witnessed. Investors shouldn’t expect NEARX to outperform at all times.

Granted, the two major drops in value during this period—first when the tech bubble burst, then during the financial crisis—were among the worst the market has ever witnessed. Investors shouldn’t expect NEARX to outperform at all times.

5. …AND in times of rising and falling interest rates

You might think longer is always better, but in the case of munis, it pays to be short. Short-term munis—such as the ones that mostly make up NEARX—are less sensitive to interest rate stimulation than longer-term instruments. (Bond prices fall when rates go up, and vice versa.) Below, we use Treasury yields to illustrate how munis could be similarly affected:

6. CD rates are abysmal right now

Speaking of which: Interest rates are at near-zero lows right now, which has tarnished the attractiveness of CDs. Plus, early withdrawals come with a penalty, unlike munis.

NEARX yields are as of 3/31/2016. CD rates from FDIC.gov national average as of 3/18/2016. NEARX SEC yield without waiver and reimbursement 0.08 percent.

7. And savings accounts are even worse

Remember when your savings account returned 6 percent? Yeah, that hasn’t been the case since the mid-1980s. Today, the savings rate (as of April 18, 2016) is a hardly-there 0.06 percent, according to the Federal Deposit Insurance Corporation (FDIC). You can do better than that.

Municipal bond funds, including NEARX, aren’t bank accounts; nor are they FDIC-insured, as bank accounts are. But it’s worth making the comparison.

8. Make America strong

Want to “make America great again”? Well, if you invest in short-term munis, you’re already doing it! This $3.7 trillion market funds everything from schools to roads to hospitals to utilities—and more.

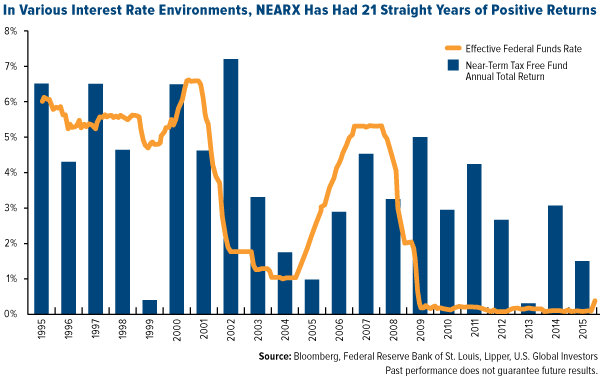

9. 21 straight years of positive returns

Since 1995, NEARX has delivered positive annual returns—no matter what interest rates were doing, no matter the condition of the market. This is not to say that NEARX will continue to perform like this indefinitely, only that the fund has a well-tested history of “no drama.”

Interested in learning more on “tax-free, stress-free income”? Listen to the replay of our muni bond webcast, hosted by myself and fixed-income investment strategist Juan Leon. Then, be sure to request information on this exciting product!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Past performance does not guarantee future results.

Expense ratio as stated in the most recent prospectus. The expense cap is a contractual limit through April 30, 2016, for the Near-Term Tax Free Fund, on total fund operating expenses (exclusive of acquired fund fees and expenses, extraordinary expenses, taxes, brokerage commissions and interest). Performance data quoted above is historical. Past performance is no guarantee of future results. Results reflect the reinvestment of dividends and other earnings. For a portion of periods, the fund had expense limitations, without which returns would have been lower. Current performance may be higher or lower than the performance data quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance does not include the effect of any direct fees described in the fund’s prospectus, which, if applicable, would lower your total returns. Performance quoted for periods of one year or less is cumulative and not annualized. Obtain performance data current to the most recent month-end at www.usfunds.com or 1-800-US-FUNDS.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Though the Near-Term Tax Free Fund seeks minimal fluctuations in share price, it is subject to the risk that the credit quality of a portfolio holding could decline, as well as risk related to changes in the economic conditions of a state, region or issuer. These risks could cause the fund’s share price to decline. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local taxes and at times the alternative minimum tax. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes.

The Near-Term Tax Free Fund invests at least 80 percent of its net assets investment-grade municipal securities. At the time of purchase for the fund’s portfolio, the ratings on the bonds must be one of the four highest ratings by Moody’s Investors Services (Aaa, Aa, A, Baa) or Standard & Poor’s Corporation (AAA, AA, A, BBB). Credit quality designations range from high (AAA to AA) to medium (A to BBB) to low (BB, B, CCC, CC to C). In the event a bond is rated by more than one of the ratings organizations, the highest rating is shown.

The CD interest rate is typically a fixed rate of interest, and payable on a set maturity date. The 30-day yield is used for bond funds, balanced funds, and stock funds. It consists of the interest income the fund pays over a 30-day period, net of expenses, expressed as an annualized percentage of the fund’s share price. Tax Equivalent Yield is the before-tax yield you would have to get from a higher-paying but taxable investment to equal the yield from a tax-exempt investment and was computed assuming a 43.4% tax rate.

Unlike bank savings accounts, an investment in a municipal bond fund is neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Near-Term Tax Free Fund seeks to preserve the value of your investment, it is possible to lose money by investing in the fund.

The Barclays 3-Year Municipal Bond Index is a total return benchmark designed for short-term municipal assets. The index includes bonds with a minimum credit rating BAA3, are issued as part of a deal of at least $50 million, have an amount outstanding of at least $5 million and have a maturity of 2 to 4 years. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Read more by Frank Holmes