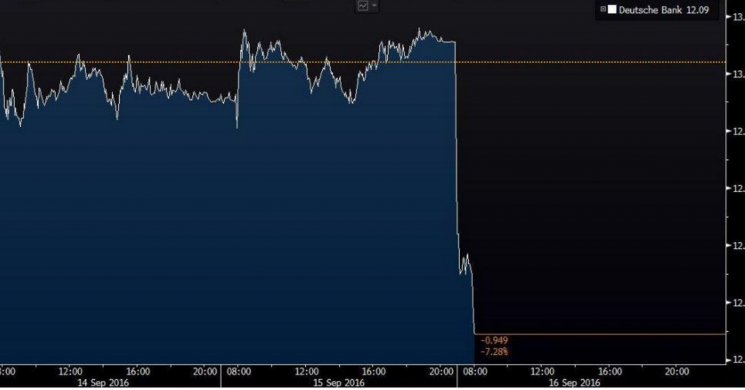

After receiving a $14 billion (£10.6 billion) claim from the US Justice Department to settle an investigation into mortgage-backed securities, Deutsche Bank shares tumble 8.2%.

“Deutsche Bank has no intent to settle these potential civil claims anywhere near the number cited,” the company said in a statement early Friday.

“The negotiations are only just beginning. The bank expects that they will lead to an outcome similar to those of peer banks which have settled at materially lower amounts.”

Since 2008, Deutsche Bank has paid more than $9 billion in settlements and fines, according to Bloomberg. Reaching a mortgage deal would clear the bank’s major hurdle.

“While this number seems very large, it’s obviously a first negotiation point,” an analyst at Atlantic Equities told Bloomberg Television. “There’s going to be an awful lot of management time spent on it to get to a sensible number.”

CEO, John Cryan, has struggled to increase profit margins, mainly by selling risky assets and eliminating jobs. Unresolved legal probes and claims concerns investors that the lender will be forced to raise capital.

Deutsche Bank was once one of Europe's most successful players on Wall Street. Deutsche Bank dropped as much as 8.2 per cent, the biggest drop since June 27 and was down 6.7 per cent at €12.22 this morning.

This $14 billion fine ranks among one of the largest paid by banks to U.S. authorities in recent years. In 2013, JPMorgan Chase & Co (JPM.N) agreed to pay $13 billion to settle allegations by the U.S. authorities that it overstated the quality of mortgages. In 2014, Bank of America Corp. (BAC.N) agreed to pay over $16 billion in penalties to settle similar charges.

“They are dropping like a stone,” said Tomas Kinmonth, a credit strategist at ABN Amro Bank. “The fine, even if reduced, could surpass all provisions held by the bank.”

Deutsche Bank shares are down 8% today https://t.co/nTxqdmUyH2Bloomberg's @MooreMichaelJ explains why: pic.twitter.com/v3SyUDTlgH

— Bloomberg TV (@BloombergTV) September 16, 2016

Banks today https://t.co/jlL8lXPlTMDeutsche Bank -7%Credit Suisse -4%RBS -4%UBS -2%Barclays -2%HSBC -0.4% pic.twitter.com/pXndEDlpeX

— Bloomberg (@business) September 16, 2016

No wonder #DeutscheBank $DB $DBK refuses to settle - fine (EUR 12.5bn) almost equal to market cap (16.6bn)... pic.twitter.com/MuYv9KupX0

— MacroTourist (@Gloeschi) September 16, 2016

Read more by HashtagTrumped