If everyone is jumping off of a bridge…

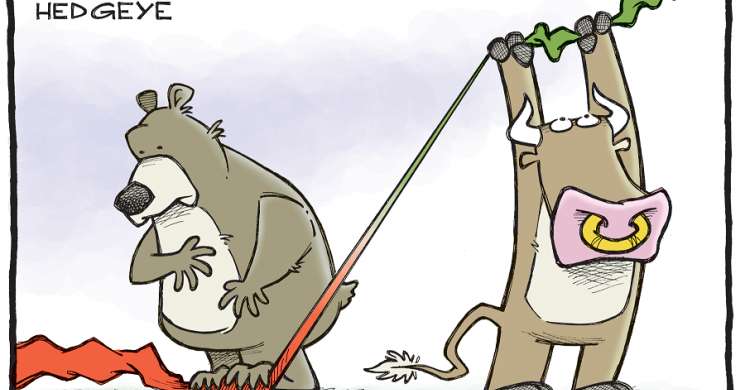

With everyone so bullish on gold - even the most bearish of banks- is it time for investors to worry about the metal’s price?

After Britain’s vote to leave the EU in late June, many banks have upped their gold forecasts recently. To their defense, the metal has had a good year, up nearly 28% YTD and still trading above $1,300 an ounce. However, one must keep asking why are they all upping their forecasts now?

Especially as hedge funds and money managers push bullish bets on both gold and silver to record highs, as the latest CFTC data shows. ETF inflows have also seen unprecedented demand with SPDR GLD, the world’s largest gold-backed exchange traded product, seeing inflows of 7.5 tonnes since the beginning of June, a 12% increase.

Could it be because gold does have more room to run or is it simply because their initial forecasts were extremely bearish to begin with?

Here’s a list of some of the banks’ updated forecasts:

- BoAML calling for $1,400 gold, $30 silver

- UBS increased short-term target to $1,400

- Goldman Sachs’ new 3-, 6- and 12-month targets are $1,300, $1,280, and $1,250.

- Commerzbank ups year-end target to $1,350

- Natixis calling for $1,450 gold in the next 2 months

- ABN Amro calling for $1,425 gold by end of September

- HSBC sees $1,400 gold

- Credit Suisse sees $1,500 gold in 2017

- Societe Generale raises its target to $1,330

And the list goes on….

There seems to be one lone wolf in the pack calling for gold prices to fall by $300. Wells Fargo said it expects prices to fall to $1,050 an ounce.

What side of the fence are you sitting on?

Gold Recap: be careful, but dont worry. What do you think Soren K? Speak up!

Read more by Wall St. Whisperer