GDP Revision Hides A Nasty Truth, and Sinking Markets Entrench

Well, it looks like Q4 2016 was not quite as bad as many were thinking. The Commerce Department reported that Q4 GDP climbed by 2.1% compared to previous reports of 1.9% growth.

However, this is still a notable drop from the election quarter Q3 report, which was an astounding 3.5% growth — although most analysts and traders feel that was an election adjustment number designed to get Hillary Clinton elected.

Here’s the bad news in this improved Q4 GDP — consumers are spending a lot more for health care than originally estimated, thanks to Obamacare. It is not that consumers have more cash in their pockets to buy goods, it’s just that their cost to pay for more expensive health care is outstripping their budgets.

Technical Downtrend In Place

We often see window dressing advances during the last week of the month through the first week of the new month into the jobs report. But trading has mostly been a sideways affair as March gives way to April and the coming tax season. As we have repeatedly advised, the volume traders, i.e., dealer banks, are likely to hold prices up to psychologically assist the government in collecting taxes the first half of April up through April 18th.

But that support seems to be wearing thin. Note the largest exchange in the world, the NYSE, clearly shows a downtrend, which began in March and has firmly set a lower high and a lower low, creating a downtrend channel with prices being held in check by the overhead resistance line:

Notice that in late February and for all of March the NYSE has set two lower lows and lower highs with prices currently just under the upper resistance line, suggesting that the coming week may not advance much during the first week of April and could likely continue the downtrend following the jobs report on Friday of this coming week.

Oil is Out of Touch

The crude oil market saw crude oil prices move back up to cross above the $50 a barrel mark this week, partly from technical support as prices fell just below the 200MA and partly from announcements from OPEC members that they are willing to continue production controls.

Notice how prices have fallen below both the 50MA (blue line) and the 200MA (red line) in the month of March. From a technical perspective, it looks like breaking down below the 200MA is being challenged and that is why we see prices getting support. Unfortunately, the 50MA is also now acting as technical resistance overhead and is not too far away.

Remember, we have traditionally seen over many decades that the path of crude oil prices is closely in sync with the path of equity prices. They aren’t in sync right now and there is nothing on the horizon that suggests crude oil will ever catch up with this Election Rally bubble — suggesting that equities will eventually come down to the more “earthly” oil price patterns.

From a more fundamental basis, this week we have heard that OPEC members are in favor of extending their production control agreements. Kuwait voiced support to extend OPEC/non-OPEC production cuts beyond the June deadline. In fact, Kuwaiti oil minister Essam al-Marzouq said that several other nations are in favor of the extension.

Whether this jawboning by OPEC members will drive prices above the resistance at the 50MA is somewhat doubtful with the U.S. Shale markets increasing percentage share on an ongoing basis as their wellhead cost per barrel keeps going down. Once again, OPEC looks more and more like it is no longer in the driver’s seat and has been relegated to backseat driver.

Why Obamacare Repeal & Replace Got Resurrected

Just a week ago, it was thought that Obamacare Repeal and Replace was dead in the water. Speaker Paul Ryan had pulled the new health care reform bill when far too many Republicans refused to vote for it. Yet at the same time, when quick blame was placed on the Republicans who handed Trump his first significant failure in congress, these very same Republicans begged to not give up on the health care reform, appearing willing to continue negotiating until an acceptable Repeal and Replace can make it out of the House.

The President clearly was ok with having Obamacare just fail on its own so he could lay more critical blame on the fully opposition party, the Democrats. He had already taken names and was willing to campaign against these House Republicans who were up for election in 2018. So why did Paul Ryan accept a continued battle to work with these recalcitrant Republicans who refused to vote with him on the Trump/Ryan bill?

There is some evidence that Obamacare could technically fail as soon as May 22nd. Is this why the bickering Republicans in the House finally realized they need to do something right now on Obamacare Repeal and Replace? Is it possible that there may never be a better time for health care reform than right now?

What is so special about May 22nd?

The Trump administration has until May 22 to decide whether it will continue to pursue the Obama administration’s appeal to provide subsidies to insurers who participate in the Obamacare federal exchanges.

It is clear to all who lean on rational thought that Obamacare is being kept on life support because of the subsidies from the government for and on behalf of individuals who qualify. But, in addition, the government also extends lifeline subsidies directly to the health care insurers as an incentive to participate in the mandated (un)affordable health care plan.

These direct subsidies to the insurers were designed to run out on May 22, 2017 — just months after Obama’s two-term presidency came to an end. And as one of his last tasks, Obama put in place directions to renew these direct subsidies to insurers.

But the Trump administration has to follow through on Obama’s subsidy plans and that is how Obamacare could blow up. If the Trump administration does not extend insurer subsidies on May 22nd what do you think will happen to Obamacare?

Without these subsidies, more insurers will drop out of Obamacare. And those who remain will obviously continue to raise premiums and deductibles to the point that only the very wealthy can afford to participate in Obamacare. The death of Obamacare could be expedited considerably if the Trump administration drops the Obama appeal to continue these subsidies.

Another date that could help bring on Obamacare death is June 21. This is when insurers must decide if they are going to participate in Obamacare and if so, what their rates will be for the policies they will offer.

When asked how important the subsidies are in making a decision to stay in Obamacare, Molina Healthcare CEO, Dr. Mario Molina, said, “We need some clarity on what’s going to happen with cost-sharing reductions (the subsidies) and how they’re going to apply to the mandate.”

When asked if they would leave Obamacare if the subsidies were stopped, Molina replied, “It would certainly play into our decision. We’ll look at this on a market-by-market basis. We could leave some. We could leave all.”

It seems unlikely for the Trump administration to appeal for an extension to the insurer subsidies — unless he wants to hold it as a blackmail vehicle for getting some support from Democrats for his SCOTUS pick or for some other Trump initiative. Most Republicans in congress are probably expecting Trump to drop the appeal for continued insurer subsidies.

If the House Republicans can get a Repeal and Replace bill to the Senate before May 22nd, then it will virtually guarantee that the Trump administration will not seek continued insurer subsidies.

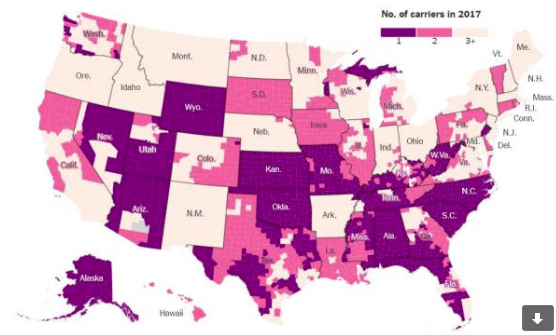

To get an idea how Obamacare is failing, take a look at the number of counties in the country that have worked to only one insurer in Obamacare. Many of these counties will soon have no Obamacare insurers:

These failing “red counties” are growing fast and will grow even faster if the Trump administration drops subsidies to insurers.

Will the bickering Republicans in the House take advantage of this narrow window to make sure Trump won’t extend a lifeline to the dying Obamacare health plan?

https://www.outsiderclub.com/pubs/oc

Read more by The Hound