As an investor as opposed to a trader, your editor needs to be assured he is on the right side of a secular market move. While a short-term move contrary to my position can be uncomfortable at times, what I need to know for my own planning and market positioning is whether a particular secular move is ending and about to go in the other direction. And sure, within secular moves, I would also like to know cyclical moves as well, so I can either lighten up or add to a given position with more intensity. But my really big concern is that I don’t get caught in a nasty five-year gold bear market like the one we just suffered through until the start of this year.

Now, I have been around this business a long time. I have never tried to understand or get good at market forecasting based on technical analysis. I have admired one of the great ones, Richard Russell, for many years. But as great as he was and as fun as he was to read, I have never found one who has been more helpful to me personally in feeling confident about being on the right side of a market or of having a sense when to reduce or add to my position than I have been with the work of Michael Oliver, which is the reason he is on my radio show almost every week and why I frequently pass along a idea or two of his frequently in this letter. What makes Michael’s work even more remarkable is that any kind of prediction, technical or otherwise, is made infinitely more difficult by constant and growing manipulation of markets by the Rockefeller, Soros, and Rothschild market and geopolitical control freaks of this world. While those evildoers may succeed in short-term market trickery, Oliver’s structure and momentum approach, which is based more on longer-term “physics of markets,” is more in tune with longer-term natural laws of the universe. Whatever the underlying factors, all I can say is that his calls for a huge number of markets have been absolutely spot on.

We have had a very profitable ride so far this year with our gold and silver related recommendations. And many if not most technical analysts are suggesting the bull market in gold is nearing an end and/or that we are about to face an ugly correction. Michael’s momentum work is suggesting that rather than looking for a major decline now, bears should realize that odds favor a major breakout to the upside. Here is an August 29 update on gold sent out by Oliver, titled, “Gold, Up Close” that I urge you to read and digest.

Gold, Up Close

Gold, Up Close

“In this weekend’s report we showed gold in terms of one of its long‐term momentum charts, quarterly momentum. That set of monthly bar charts indicated that the advance to this point by price was still fully confirmed by long‐term momentum. We restated our first major objective for gold between $1470‐$1540. No change. Current wobble does not alter MSA’s view, nor does it spook us.

“MSA can sometimes be wrong, but fortunately momentum, when assessed on different time‐scales, provides reference points of some validity, unlike those who believe that every sharp swing in price is meaningful and full of fundamental importance. And of course each of those price swings usually comes with financial market headlines to further encourage one side and discourage the other.

“Our observation about quarterly momentum was that zero damage was being done to the positive momentum trend, and that the series of highs in gold, up through the July high (so far the highest level seen in the new uptrend), are all confirmed by momentum action.

“Here we look at what might be called short‐term to intermediate term (in between) indicators. Note that when the peak close in price occurred in early July that In this weekend’s report we showed gold in terms of one of its long‐term momentum charts, quarterly momentum. That set of monthly bar charts indicated that the advance to this point by price was still fully confirmed by long‐term momentum. We restated our first major objective for gold between $1470‐$1540. No change. Current wobble does not alter MSA’s view, nor does it spook us.

“MSA can sometimes be wrong, but fortunately momentum, when assessed on different time‐scales, provides reference points of some validity, unlike those who believe that every sharp swing in price is meaningful and full of fundamental importance. And of course each of those price swings usually comes with financial market headlines to further encourage one side and discourage the other.

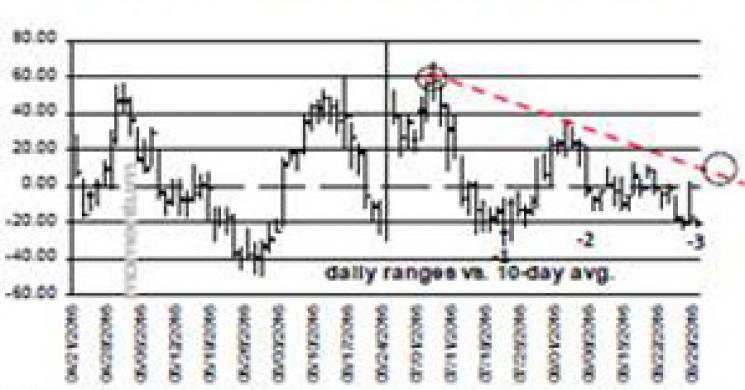

“Our observation about quarterly momentum was that zero damage was being done to the positive momentum trend, and that the series of highs in gold, up through the July high (so far the highest level seen in the new uptrend), are all confirmed by momentum action. Here we look at what might be called short‐term to intermediate term (in between) indicators. Note that when the peak close in price occurred in early July that both of these momentum charts were also making new high closes (circled). Therefore, confirmation, even by short term momentum of the strength of the price trend.

“Now what gets MSA’s attention even more is that in the process of getting down here (price is all of 3.3% off of the high close, as of Friday’s close) that momentum action has generated three down waves, now in the third. My advice to the bears, and don’t you know they have been reborn in the past week, is that they had better really do some damage in this third wave, because when it turns up I suspect it will spark a new up leg (part of the larger first up leg that began from the annual and quarterly momentum breakout in February when price moved up into the mid‐$1100s).

“I have plotted downtrend lines on both momentum charts and labeled the waves. So, go ahead bears, do your thing! You had better do it deep and fast, because these indicators during the third wave have already spent seven market days in downticks from the most recent wave high, and if you carefully examine the 3/10 oscillator (a smoothing of daily momentum) it tends to produce waves that last seven to ten days roughly. There’s a clock at work here too, not merely directional action.

“If the bears do not blow some meaningful floors out, drop gold price seriously, then the issue will be to monitor first for stability in these readings in the next few days and then upticks on both of these momentum charts. Any move to the upside in these momentum readings that breaks out over the momentum downtrends that trace back on these daily oscillators to early July, across the three waves of corrective momentum decline, should be considered an important sign that the past two months of gold congestion/correction are over. MSA will update on this situation again in several days.”- Michael Oliver

A T-Bond Decline Will Be a Key to the Fall of the Anglo-American Empire

The T-Bond market has been one of the most amazing bull markets in history, albeit a total post-1971 fraud based on counterfeit money, backed by the petrodollar arrangement with Saudi Arabia and the military might of the Anglo-American Empire. Of course propaganda artists behind the throne, using our mass media, are hiding geopolitical truths from the people just as much as they are hiding economic truth. Small lies to start (remember when Nixon said going off the gold standard would last only a short time to destroy the speculators against the dollar?) require bigger and bigger lies and clandestine policies over time. Slick propaganda coupled with easy money and mass entertainment diversions have enabled liars and magicians to pull the wool over the eyes of Americans.

Yet, ultimately Pinocchio’s nose can no longer be hidden. Listen to my discussion with F. William Engdahl on my radio shows or, better yet, read his new book, which will soon be published in English. It is titled, Eurasian Century: China, Russia and the New Economic Silk Road. In this book, William talks about the massive infrastructure that is being built from China through Russia and China all the way to Turkey. You will start to see why the neoconservatives headed by Hillary Clinton are demonizing China and Russia. Underneath it all is fear on the part of Hillary Clinton’s closest political friends, who control our political and economic system for their own gains—people like George Soros and the Rothschild and Rockefeller clans, that the West is heading down toward second- or third-rate power status. And so they are seeking war with Russia and China in an effort to retain the empire.

But if Oliver is correct and we are on the verge of the Fed losing control of the T-Bond and thus the U.S. dollar, we can only hope and pray that the good Lord will choose to allow these evildoers to accept their just desserts or that they and the horrific nuclear war machines will be incapacitated one way or another. All of that of course is out of our hands. But at least, if we can see the T-Bond markets and the fraudulent U.S. dollar-dominated global infrastructure self destructing, we can and must continue to prepare for that fateful day.

Of course a decline of the system—which pray does not happen—should mean a bull market for gold to beat all gold bull markets. Here, too, Oliver’s work as discussed above should be very helpful in remaining confident that the fundamentals will ultimately win over the evils and hubris-infected policymakers at the Fed and the banker shareholders, who own and control it and the propaganda tools used to keep as many Americans as possible down on the mushroom farm.

Jay Taylorwww.jaytaylormedia.comwww.miningstocks.com

Read more by jaytaylor