REPOST: of Robert McEwen's Call for $1900 Gold as Possible

Gold Could Touch $1900 by Year End- Robert McEwen

Gold Has No Debt Attached to it

As of yesterday, Robert McEwen has predicted Gold prices could surge as much as 44 percent by the end of 2016 as confidence in the economy buckles. He predicted a price range of possibly between $1700 and $1900 by year end. Why? There will be increased uncertainty in global currencies and sovereign debt. Gold is the only monetary medium that has no debt attached to it.

Gold Has No Opportunity Cost Now

On Tuesday at a Gold conference in Colorado Springs, McEwen stated quite plainly “The big argument against Gold used to be its storage cost. Right now, it’s costing you money to store your cash”

McEwen doesn’t just talk big. He stands behind his statements with a track record of being right that goes back to 1999 when he founded two producers: McEwen Mining and GoldCorp.

Skin in The Game

And when he is wrong, he takes the loss, not some investment newsletter subscriber. As the chief executive officer of his company, he’s paid $1 a year and doesn’t receive bonuses, wagering that his share holdings will reap him ample rewards.

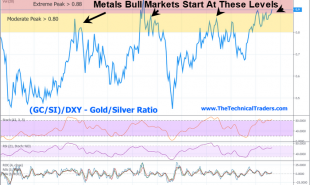

Primary Drivers for Gold's Next Run

He cited multiple reasons for his most recent prediction:

- US Election- Doesn’t Matter who wins, Gold Benefits

- Hillary has an “accommodative platform”

- Trump’s rhetoric unnerves people, despite his actual policies

We see the Election as a “due date” for the markets. A moment of clarity that we have problems-sk

- Larger Market- Crowd psychology is a big factor now

- Same amount of Gold in the World

- More people trading it

- Herd mentality will be worse this time

- There could be a “trigger event”- like the election maybe?

- Bank Instability

- The Fed has lost its mojo

- Derivative portfolios are bigger than in 2008

- Sovereign Debt is unsustainable

After today's double Fed Fiasco, who can argue with him?- SK

Background-

Bloomberg-This isn’t the first time McEwen, a 66-year-old former investment banker, has defied his own industry. In 2000, he launched an audacious experiment when he was at Vancouver-based Goldcorp. Offering $575,000 in awards, he threw open to the public more than five decades of proprietary data on the company’s under-performing Red Lake mine in Ontario and challenged geologists to locate the next 6 million ounces of gold.

Red Lake ended up becoming one of Goldcorp’s richest gold mines, producing more than $3 billion worth of the metal, he has said. BBG

- BOJ Analysis: Gold Gets it Right

- Fed Redlined Statement

- Yellen Conference Highlights with Comments

- Ignore the Fed, Trump Might Hurt U.S. Economy – Statista, Moodys Analytics

- Central Banking's 5 Stages of Death

Read more by Soren K.Group