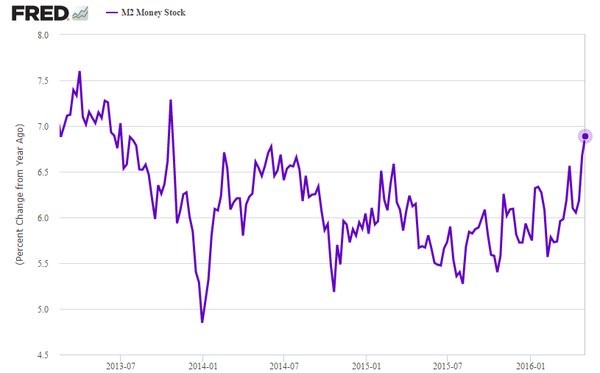

America’s broad money supply is growing nearly 7% every year, the highest level since 2013. What is the driver?

According to The Daily Shot newsletter released Friday, it is “new loan creation.”

“It's hard to look at this and suggest that US credit conditions have tightened,” they wrote.

Just look at Just_Another_Wiseguy's post earlier today, which showed that the average consumer owns almost $8,000 in credit card debt...

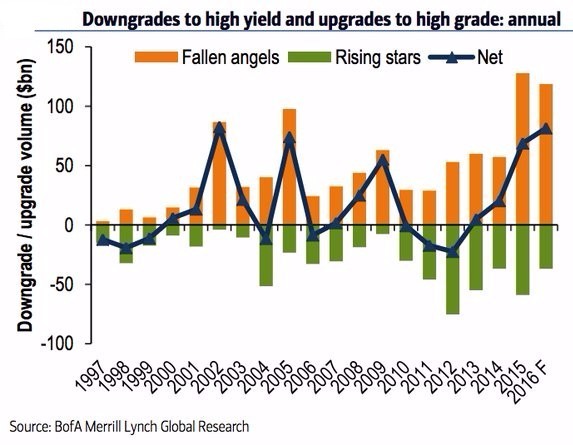

They also shared a chart looking at the bond market, which showcases bonds that went from investment grade to high yield – as they refer to as “fallen angels” – as well as those upped from high yield to investment grade – known as “rising stars.”

Look at the chart, seems like the fallen angels are winning.

Read more by Wall St. Whisperer