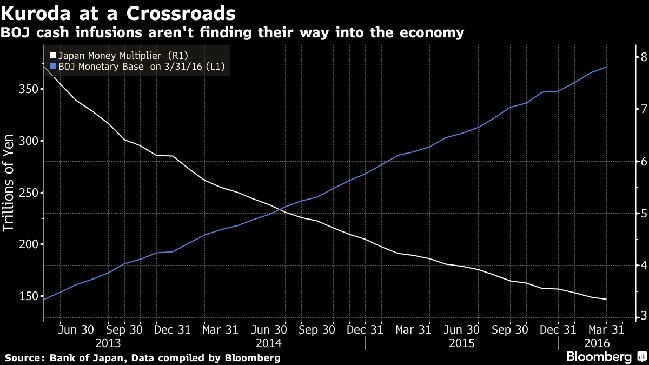

Global Financial Markets have a problem: they are addicted to loose monetary policy, which was made clear after the freak out seen when the Bank of Japan didn’t provide the next fix. The yen, seen a as a safe-haven proxy, rallied almost 3.5% against the U.S. dollar in reaction to the non-announcement; at the same time, the Nikkei Stock Average ended the day down 3.6%, the largest daily percentage loss since mid-February. The only explanation that I can come up with to this reaction is that markets have a major problem and something else needs to be done. The BOJ’s decision shouldn’t have come as a major surprise. According to Bloomberg only a small majority of economists were actually expecting to see new stimulus. But why expect anything? It has only been a month since the bank increased its purchases of government bonds and stocks and has only been four months since it introduced negative interest rates. I don’t think it is too unreasonable to wait and see if the measures already taken can impact financial conditions. Unfortunately, while we should wait, I am not optimistic that it will work, mostly because it hasn’t. Bloomberg has a great chart showing that as the bank of japan pumps more money into its crippled system, less is actually making it into the real economy.

The reality is that we have to try something new, but it will be difficult to get financial markets on board as they are clearly addicted to the current system.

The U.S. should be watching the situation in Japan because it could be a glimpse in the future. Despite the unprecedented liquidity, inflation in Japan remains weak and growth is anemic. If their steps aren’t working, why would it work in the U.S.?

Instead of pumping money directly into the financial system I still think the best way to stimulate growth, especially in a consumer-based economy, is to get people working and making money.

The reality is that we have to try something new, but it will be difficult to get financial markets on board as they are clearly addicted to the current system.

The U.S. should be watching the situation in Japan because it could be a glimpse in the future. Despite the unprecedented liquidity, inflation in Japan remains weak and growth is anemic. If their steps aren’t working, why would it work in the U.S.?

Instead of pumping money directly into the financial system I still think the best way to stimulate growth, especially in a consumer-based economy, is to get people working and making money.

The U.S. has massive aging infrastructure provides the perfect opportunity to get people back to work. If you thought that this sounds like the New Deal - that was introduced by the Roosevelt administration to help propel the nation out of the great depression - you would be right. While there are positives and negatives to the new deal you can’t argue that it helped to create infrastructure that we have pretty much taken for granted. For example the Hoover Dam generates about 4.5 billion kilowatts of hydro-electricity a year. It was one of the greatest engineering feats at the time.

I realize that not everyone thinks that the New Deal was a great initiative; however, what other options do we have? If we continue down the road we are on, we might end up like Japan with massive debt and if Japan is a good example we will have even less to show for it.

According to a 2014 report from the Economic Policy Institute debt-financed 18 billion annual investment in infrastructure would boost U.S. GDP by $29 billion and create 216,000 jobs by the end of the first year. That is pretty impressive for a nation that has seen anemic growth since the end of the 2008 financial crisis.

I also think that if done right, there can be opportunities for the government and private industry to work together to get the best bang for our buck.

The U.S. has massive aging infrastructure provides the perfect opportunity to get people back to work. If you thought that this sounds like the New Deal - that was introduced by the Roosevelt administration to help propel the nation out of the great depression - you would be right. While there are positives and negatives to the new deal you can’t argue that it helped to create infrastructure that we have pretty much taken for granted. For example the Hoover Dam generates about 4.5 billion kilowatts of hydro-electricity a year. It was one of the greatest engineering feats at the time.

I realize that not everyone thinks that the New Deal was a great initiative; however, what other options do we have? If we continue down the road we are on, we might end up like Japan with massive debt and if Japan is a good example we will have even less to show for it.

According to a 2014 report from the Economic Policy Institute debt-financed 18 billion annual investment in infrastructure would boost U.S. GDP by $29 billion and create 216,000 jobs by the end of the first year. That is pretty impressive for a nation that has seen anemic growth since the end of the 2008 financial crisis.

I also think that if done right, there can be opportunities for the government and private industry to work together to get the best bang for our buck.

Read more by Just_another_wiseguy