The Fed will be as successful in fighting the coming inflation as it has fought thae last 10 years deflation- Soren K.

This article was written by Jay Taylor a week ago, and grows in importance every day. It gives a historical perspective from one trader/ analyst that can't be ignored. Incorporating and applying the "tipping point" concept it hopes to help readers understand the macro cyclical nature of asset classes and how money migrates from one to the other depending on the circumstances. It is a must read educational tool Emphasis ours SK

Good Morning:

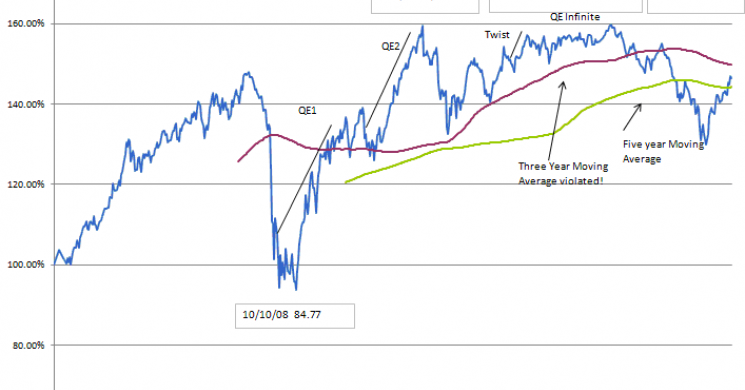

As we closed last week, my IDW seemed to be continuing a bounce that took it below both the three-year average and the five-year average. But what should impress you is that despite trillions of new dollar creation since 2008-09, overall prices of stocks and commodities have been rolling over into a mild decline.

I created my Inflation/Deflation Watch on January 31, 2005, because I wanted an objective view of whether the global financial system was inhaling (inflating) or exhaling (deflating). Of course, I have known the Austrian definition of inflation as being simply a growth in the money supply. From that point of view, the world has been not only inflating but hyper inflating.

But inside the Austrian definition of inflation, there is a point at which the fractional reserve banking system that creates money out of thin air begins to deflate, or, if you like, exhale. Looking at my chart you can see a gigantic exhaling episode in 2008-09 followed by QE1, QE2, the “twist” (monetizing the long end of the yield curve to push long-term rates down), and finally what is known as QE infinite. While the Fed has tried to con people into believing the economy is strong and thus ready for an increase in interest rates, it is clear the global economy is not only weak, but also is undoubtedly heading for another contraction. Thus, time after time after time, when the Fed sells the idea that it will raise rates the equity market throws a hissy fit and the Fed backs away with dovish talk and a continuation of QE whether it is labeled as such or not.

Regarding the subdued nature of prices as seen in my IDW, keep in mind that this topping out since 2011 has resulted during a time when the world’s reserve currency has attracted an enormous flow of capital back into the U.S. economy, (every global economic crisis has been outside the US, thus flight ot safety has benefitted the USD as reserve currency- SK) first and foremost into U.S. Treasuries. Of course if/when the U.S. faces global competition from another super power and can no longer expand the empire, confidence in the dollar (which is boosted by military force that requires dollars for oil) will decline and the price of goods and services denominated in dollars will rise and do so dramatically. (all that money sloshing around will leave dollars, adn thuse cause US Domestic inflation as priorities shift-SK) For the time being, it’s all about the effectiveness of the ruling elite’s con artistry. But in time, when confidence is lost due to a decline of the Anglo-American Empire or some other factor, such as the Fed losing control of interest rates, (if it took 10 yrs to get deflation under control, what makes them think they can mitigate the effeccts of a debased currency with the flick of a switch?-SK) prices as denominated in dollars could rise dramatically. With a loss of confidence in the perceived omnipotence of the Fed, psychology could change very suddenly and with it velocity of the dollar. ( Two points here, We feel the fed has already perceived its own nakedness and is now doesnt even believe its own hype. How long until the public perceives it? Secondly, as water or currency circles a drain, it picks up speed, to the author's point-SK) When people lose confidence in the system, they can be expected to trade in dollars as rapidly as possible for items of intrinsic value, the most obvious being time-proven monetary metals of value like gold and silver.

In Search of a Tipping Point

That leads me back to the excellent work of Michael Oliver to try to determine when such a tipping point might occur. Some time ago, around the middle of 2015, Michael put out a very interesting piece in which he explained that his momentum structural work was suggesting we were nearing a major tectonic shift or turn in direction of four markets, those being (1) precious metals, (2) commodities, (3) stocks, and (4) bonds, with the last to change direction being the U.S. T-Bond. Precious metals and commodities would turn into a major bull market and stocks and bonds would turn into a bear market of considerable significance.

One of the reasons Michael has become my favorite technical analyst is that he has been “spot on” with regard not only to these major markets but to a host of other markets as well. But most importantly, he has been exactly right in his call for precious metals and commodities to enter a new bull market. On a global scale, equities have also entered into a bear market, although in the U.S. massive flows into what is perceived to be the safe haven U.S. dollar and U.S. T-Bonds have helped keep U.S. equities elevated even as earnings have been heading significantly lower. For some time Michael has been clear on his view that gold would lead into the new bull market for “stuff” and commodities would follow, with oil being the trailer in the commodity sector. Whether stocks or bonds would decline first, Michael has not been all that clear in his own mind. But now, given his latest work on the U.S. T-Bond, it is starting to look as if U.S. Treasuries may crack first, sending rates rising despite anticipated efforts by the Fed to hold them down. With rates starting to rise, an economy addicted to trillions of free crack cocaine monetary stimulus will without a doubt be doomed into another 2008-09 or worse! Not only will earnings fall dramatically, but with rates rising above anything that can be earned in the stock market, equities are likely to fall.

I’m offering a possible fundamentally-based explanation for what is likely to come. But Michael’s work continues to show that U.S. Stocks (S&P 500 as a proxy) continue to be technically vulnerable. More importantly, as I have written over the past couple of weeks, Michael’s work shows that T-Bonds have entered a blow-off phase, meaning that in the near term (next month or two) long-dated Treasuries are likely heading even lower, ridiculous as that may seem. However, blow offs are followed by a reaction that is beyond the control of market manipulators. In this case it means that interest rates will head much higher. Michel believes that U.S. T-Bonds could go from a sub 2% rate to 4% in a heartbeat. Can there be any doubt but such a rate rise would send stocks reeling?

More important is the fact that rates would rise despite a drastically weakening economy and efforts by the Fed to hold them down. And that, dear friends, is when I think the dollar will be doomed and that along with it will come the likely change in the geopolitical world in which we live. (Bonds will lead the reflation... inflation drive-SK)

SUMMARY

Last year Michael Oliver’s work pointed to a 180-degree turn in the direction of precious metals, commodities, stocks and bonds.

His call for gold and commodities to enter a new bull market is now well confirmed.

As for stocks, globally they are in a bear market while they have remained levitated in the U.S. despite a significant decline in earnings, In other words, stocks have become expensive from a historical point of view.(The FOMC is better at manipulating its markets than its global brethren in part-sk) With central banks like the Swiss Central Banks and the Bank of Japan buying major U.S. stocks and with the Fed backing away from interest rate rises every time the stock market declines, stocks have remained high and overvalued. Michael’s work continues to illustrate that stocks are vulnerable to a major decline. We await the trigger point for their demise, which by the way will also bring an unusual amount of pain to pension funds that have foolishly bought stocks in an attempt to enable them to make good on their promise to pay pensioners as promised.

Globally, bonds remain in a bull market as central bank manipulation continues to cause rates to fall. However, Michael’s work shows that the granddaddy of all bond markets, namely, the U.S. T-Bond market, is showing signs of a blow-off phase. Blow offs are always followed by a reversal. In other words, interest rates will soon rise whether the Fed likes it or not. While Michael’s technical work doesn’t explain the causes of such a rate rise despite the Fed’s wishes, a rising commodity sector should ultimately enable investors to reject negative real returns as their purchasing power under a low-rate regime will turn severely negative. Simply put, the markets will demand higher returns for their capital. The Fed will be powerless to push rates lower.

With the Fed’s inability to push rates lower, it will have lost its credibility and with the loss of the Fed’s credibility will come a loss of the dollar’s credibility. At first the Fed will try to fight rising rates with even more money creation but that will be akin to throwing gasoline on a fire to try to put it out. Much as happened in the 1970s, rates will rise, but commodity prices will rise faster, causing a vicious cycle of trading dollars for tangibles, led by the most convenient tangibles, like gold and silver. In anticipation of global insolvency, the Fed and other central banks, led by the BOJ, are talking now about implementing “helicopter money,” which simply means fiscal stimulus in the form of money shoved into the accounts of individuals and corporations rather than into central banks and their members.

It is this loss of confidence in the monetary authorities that leads to a loss of confidence in the dollar and its market demise to its intrinsic value of zero that is the basis upon which economist John Williams has been predicting hyperinflation. Inflation won’t be caused by a strong economy that needs to be cooled down with tight money. Quite the contrary, and unlike the 1970s, this round of inflation will be caused by a very weak economy and the destruction of the dollar created by infinite quantities of its supply.(interest rate rises will be market forces demanding to be paid more for default risk, not buying power this time- SK) Unfortunately this outcome will be the worst of all outcomes in that we will be in a depression at the same time prices for everything denominated in dollars (but not gold) will rise exponentially at the same time incomes plummet.

Jay Taylor

Read more by jaytaylor