OVERNIGHT RECAP

Last night, global equities firmed up aftert he Nikkei rallied almost 4% trading15,708 last. Precious metals opened the session stronger from Chinese buying and likely on the back of perceived continued easy money policies. Since the Asian open, Gold has retraced much of its gains, now trading $1360.00 up $2.00 from its setlement friday. Silver is still up 1.50% trading $20.40 last and Copper is up 2%. As our cover photo shows, Bonds will continue to trend towards negative yields. Governments will be buying equities next and commodities will be the last to enjoy to truly benefit these policies, but benefit they must- Soren K.

Headlines

- GLOBAL STOCKS RISE

- NIKKEI STRONGER ON ELECTION CONFIRMATIONS AND US JOBS- abenomic's gets another shot

- OIL AT 2 MONTH LOWS

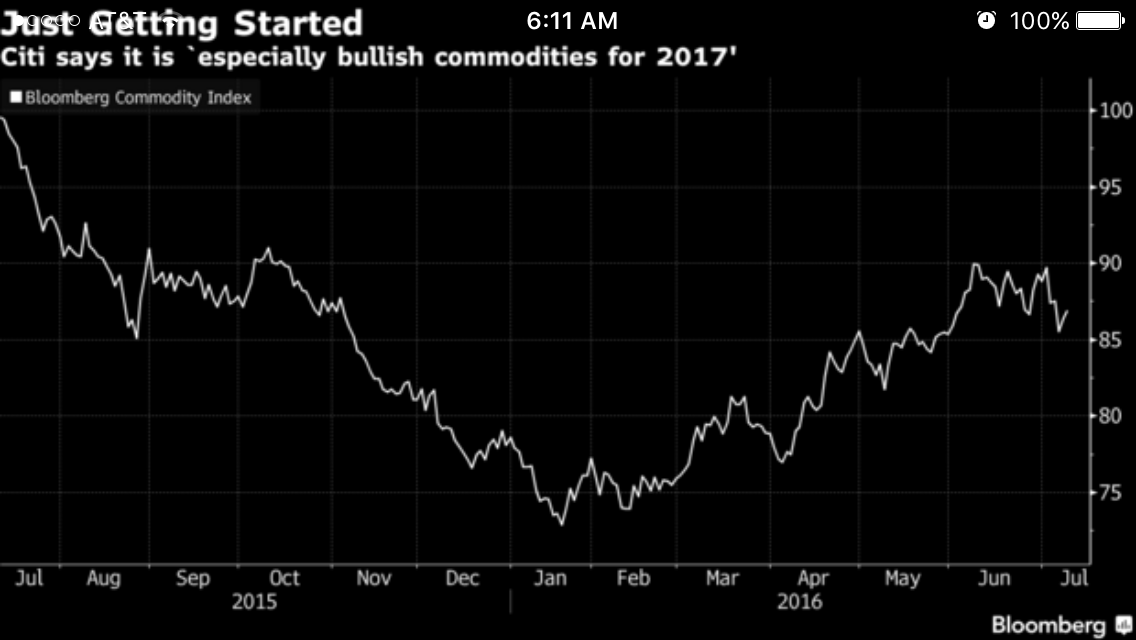

- BULLISH COMMODITES IN 2017, EXPECT BREXIT WORRIES TO FADE- CITIBANK- chart below

- CHINESE RETAIL CONTINUES TO PUT MONEY IN GOLD- BBERG- and eggs too, no really

- BOE LIKELY TO CUT RATES SOON- RTRS

Gold Overnight

-For interactive Chart Click here

Markets

Equities- Asia leads, rest of world follows last night

- S&P Fut 2127 +0.31%

- Dow Fut 18101 +0.35%

- Nikkei 15708 + 3.98%

- Hang Seng 20880 +1.54%

- FTSE, DAX- up slightly

Currencies - most currencies weaker vs the USD as perception of coming fiscal and monetary easings. Gold stronger vs FX market

- EU 1.1044

- GBP 1.29

- JPY 102.32

- GOLD/EU 1239.00

- GOLD/GBP 1057.33

- GOLD/JPY 137,900.00 +494 yen- pretty cool right?

Commodities- oil lower, PM group higher, Copper leads now.

- BRENT 46.10 - 0.66

- WTI 44.70 - 0.71

- NAT GAS: 2.85 0.05

- COPPER: 215.75 +3.85

- GOLD: 1360.30 + 1.90

- SILVER: 20.40 + 0.30

- GRAINS: all slightly firmer

CITI Bullish Commodities

Citi Call implies:

- Clients into Commods second 1/2 of 2016

- Easy money will continue and stocks arent giving the returns it used to- inflation to us

- View Oil as near a bottom

Nikkei and the continued failure of easy money to prop stocks

Last night up 3%- party time

Longer Term- easy money hangover?

Comment:

Japan is further embracing its Abenomic's policies. Their goal is a stronger stock market and a weaker yen. Insanity is doing something repeatedly with the same result. The Nikkei is up, but as the charts above reveal, rallies are short lived. The "unintended consequences" of this global think on monetary and now Fiscal policies will soon out match the desired effects. We feel flat equities, higher raw material prices and gold higher against all currencies are in our future

Related stories:

Technical Analysis for July10th

Gold starts the evening strong

Our posts will have better spelling- really.

HUMOR- Hillary and the FBI in pictures

Good Luck

Soren K.

Read more by Soren K.Group