Overnight Summary

The USD is at a 3 week high. The Fed's Fischer conducts verbal Open Market Operations this morning. Grains were slammed yesterday. People are talking about the dearth in new oil found. Meanwhile Global oil consumption itself may be at a peak. Gold is weaker on its way to $1316- $1300 support area. Stocks were higher overnight except in the US where they were largely unchanged. Apple will be getting taxed, Gartman was right on his call for oil yesterday. Consumer confidence is out today. The FRB's Fischer is a person who "gets it". By that we mean he is no academic delicate flower. And his Bloomberg interview today corroborates our opinion that his "Aug Jobs number is key" comment is not feasible. He's hedging it already.

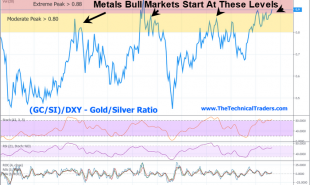

UPDATED 9:15 AM- Technical Brief: Gold Today and 5 Years from now

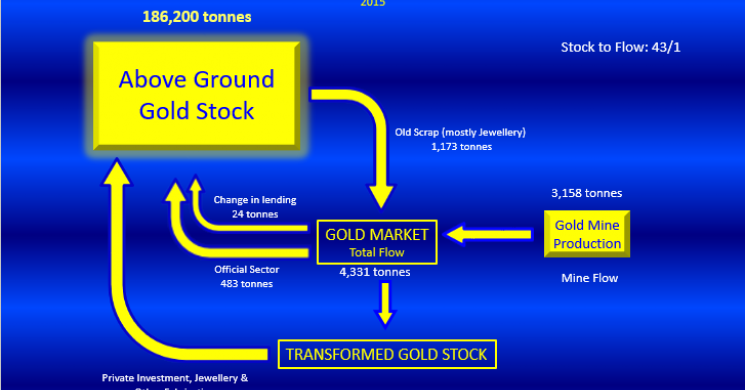

Gold Flows For 2015

Global News

- Here's What You Need To Know About Apple's $14.5bn EU Tax Bill: Fortune

- Hillary Clinton Piles Up Research in Bid to Needle Donald Trump at First Debate: NYT

FISCHER: WE'RE CLOSE TO FULL EMPLOYMENT- true, do you want fries with that?

FISCHER: I DON'T THINK YOU CAN SAY `ONE AND DONE'- already hedging his statement from Jackson Hole

FISCHER: WE TAKE MARKETS INTO ACCOUNT- more wiggle room for the J-Hole bluff

Market News

- Fed's Fischer says US job market 'very close' to full strength: RTRS- he says alot of other things too. See above

- Is The Market Overestimating Rate Hike Chances Again?

- Keep An Eye On This Key Technical Level For Oil Heading Into The Election

MarketSlant Yesterday

- [VIDEO] Jim Rickards on Central Bankers, Gold, and SDRs

- Why Gold Bulls Should Want a Rate Hike- Analysis

- "Abolish Cash"- KC Fed paper

- Norway's Bank Brings Home Gold- but that's not our business

Market Prices

YMBOLPRICECHANGE% CHG GC=F1,322.70-4.40-0.33% SI=F18.83-0.02-0.13% PL=F1,080.00-1.10-0.10% HG=F2.08+0.00+0.07% NG=F2.92+0.03+0.86% CL=F47.29+0.31+0.66% GLD126.30+0.25+0.20% USO10.85-0.1-0.91%

Currencies

EUR/USD1.1166-0.0025 (-0.22%)USD/JPY102.2815+0.4615 (0.45%)GBP/USD1.3099-0.0007 (-0.05%)USD/CAD1.3034+0.0022 (0.17%)USD/HKD7.7571+0.0014 (0.02%)USD/CNY6.6776+0.0004 (0.01%)AUD/USD0.7554-0.0023 (-0.30%)Economic Calendar

DateTime (ET)StatisticForActualBriefing ForecastMarket ExpectsPriorRevised FromAug 298:30 AMPersonal IncomeJul0.4%0.4%0.4%0.3%0.2%Aug 298:30 AMPersonal SpendingJul0.3%0.2%0.3%0.5%0.4%Aug 298:30 AMCore PCE PricesJul0.1%0.1%0.1%0.1%--Aug 309:00 AMCase-Shiller 20-city IndexJun-5.3%5.1%5.2%-Aug 3010:00 AMConsumer ConfidenceAug-97.597.097.3-Aug 317:00 AMMBA Mortgage Index08/27-NANANA-Aug 318:15 AMADP Employment ChangeAug-190K170K179K-Aug 319:45 AMChicago PMIAug-54.054.555.8-Aug 3110:00 AMPending Home SalesJul-0.7%0.7%0.2%-Aug 3110:30 AMCrude Inventories08/27-NANANA-Sep 17:30 AMChallenger Job CutsAug-NANA-57.1%-Sep 18:30 AMInitial Claims08/27-267K265K261K-Sep 18:30 AMContinuing Claims08/20-NANA2145K-Sep 18:30 AMProductivity-Rev.Q2--0.6%-0.6%-0.5%-Sep 18:30 AMUnit Labor Costs - Rev.Q2-2.5%2.1%2.0%-Sep 110:00 AMConstruction SpendingJul-1.0%0.6%-0.6%-Sep 110:00 AMISM IndexAug-52.052.252.6-Sep 110:30 AMNatural Gas Inventories08/27-NANA11 bcf-Sep 12:00 PMAuto SalesAug-NANA5.16M-Sep 12:00 PMTruck SalesAug-NANA9.10M-Sep 28:30 AMNonfarm PayrollsAug-200K180K255K-Sep 28:30 AMNonfarm Private PayrollsAug-190K175K217K-Sep 28:30 AMUnemployment RateAug-4.9%4.8%4.9%-Sep 28:30 AMAverage Hourly EarningsAug-0.2%0.2%0.3%-Sep 28:30 AMHourly EarningsAug-NANA0.3%-Sep 28:30 AMAverage WorkweekAug-34.534.534.5-Sep 28:30 AMTrade BalanceJul--$40.0B-$43.0B-$44.5B-Sep 210:00 AMFactory OrdersJul-2.2%2.0%-1.5%-

Read more by Soren K.Group