Economies are meant to serve people, not the-other-way-around, and a happy economy is one that maximises human well-being. Economies that benefit only a few of the most privileged in society, are not accomplishing this primary role and they cannot grow or even be sustained for very long. Consider two failed economic models that neglected the well-being of its participants: Slavery and Feudalism, they ended in Civil War and revolution, respectively.

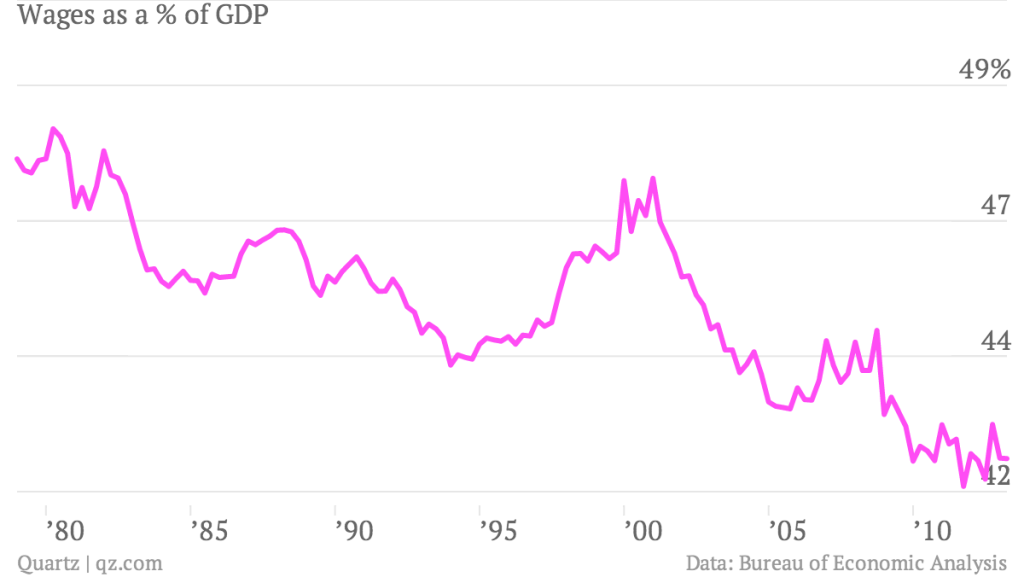

It is to everyone’s advantage to have widespread participation in the economy, but the last several decades have seen a relentless increase in the influence of capital at the expense of labor. This has resulted in anaemic overall growth, a lower velocity of money, and a widening income disparity. This drama has been playing out at the corporate level in what we are calling “A Tale of Two Retailers”: Walmart (NYSE: WMT), and Costco (NASDQ: COST). But first, some background to the story.

The Economy as Ecosystem

The REAL ECONOMY can be thought of as a type of ecosystem which, like all ecosystems, can be represented as a food and energy pyramid. Ecosystems and the real economy are built on a foundation of producers with progressively smaller and interconnected layers of consumers.

In all economies, the Producer level is where we find the majority of the labor force: the scientists, technologists, inventors, manufacturers, service providers, and others. This foundational layer interacts with the various consumer layers in ways too complex to describe. In biological ecosystems, these interactions between layers are illustrated as food webs which are analogous to the interactions between individuals and corporations in the real economy.

The energy (or capital) content at the Producer (labor) level of the pyramid has to be maximized in order to have a sustainable ecosystem (economy). Not investing in the producer level, leads to an inversion of the Pyramid where the top gets bigger and fatter than the bottom, which not only makes growth impossible, but creates an unstable situation where the pyramid eventually topples over—like it did during slavery and serfdom. You need happy, healthy producers (labor) because they are the source of wealth for the entire economy.

In addition, and unlike an ecological pyramid, the producers in an economy are also consumers. So if you restrict the amount of capital that is available at the producer level, then you automatically restrict the flow of capital into the consumer levels which then results in a lower velocity of money, leading to stagnation or even deflation. Put simply, underpaid workers cannot afford to buy things and that leads to fewer sales for our businesses.

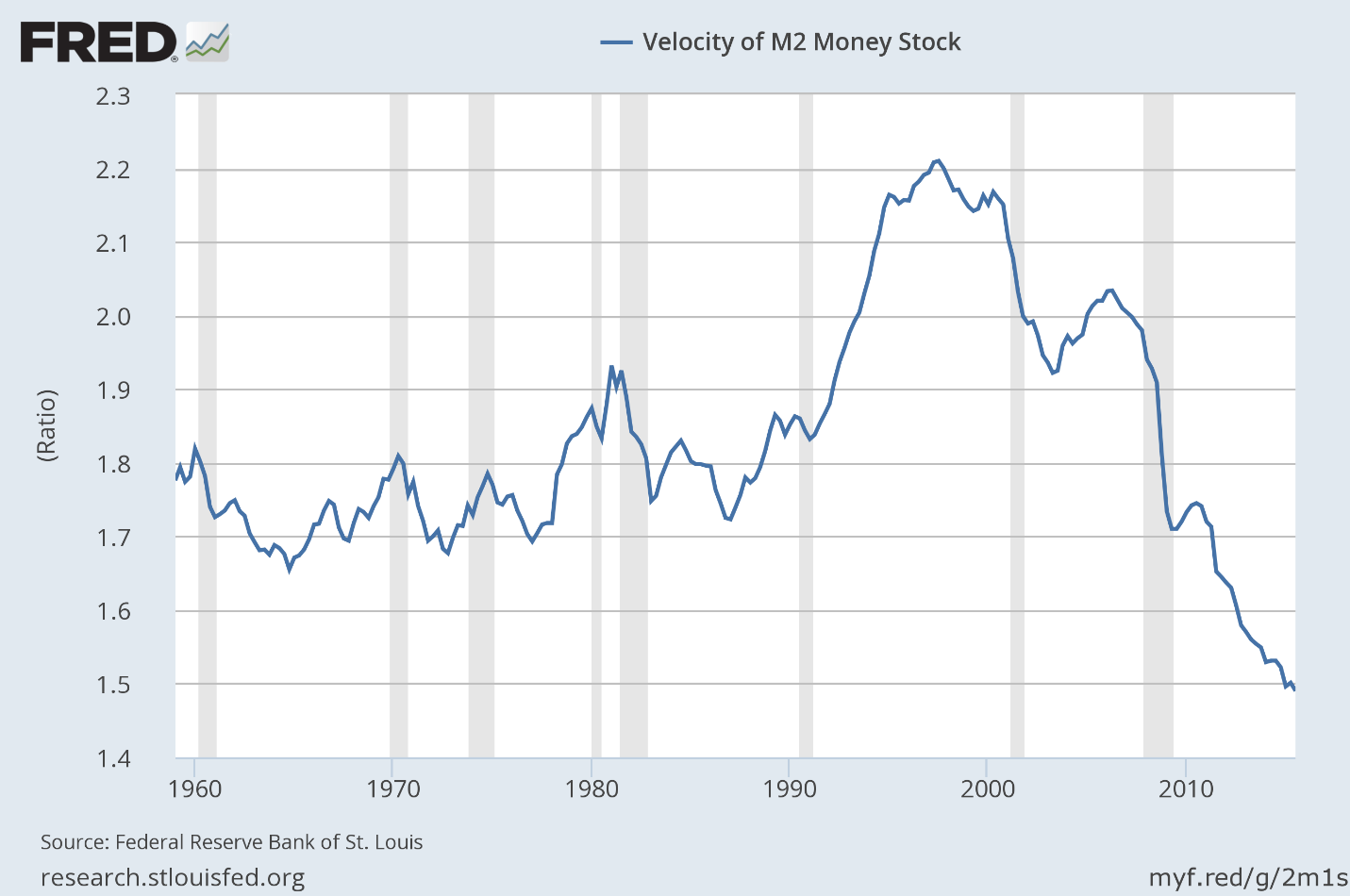

One look at the velocity of money graph below makes it obvious why the economic recovery has not been able to get off the ground.

Momentary policy (cheap money) alone is not enough to bring back a healthy economy. The financial infrastructure has been “fed and watered” back to health, and the equity markets have more than recovered their previous levels, but the real economy is still struggling badly. Why? Because labor infrastructure has not been capitalized sufficiently to allow for the growth of the economic pyramid, and unless we start to invest in labor, the top-heavy economic pyramid is going to tip over.

The only practical way for the majority to help grow the economy is through wage increases. However, the opposite has been occurring for so long that the general public accepts that unions are harmful and that everyone needs to work for less.

Technology has created huge productivity gains, but these have NOT been shared with labor, and there lies the problem; if you have a business that requires the hiring of others to help you make money and you can’t pay them a living-wage, then you don’t have a viable business idea. What you have is wage-slavery.

A Tale of Two Retailers

Paying employees better wages makes sense down at the individual corporate level as well, not just at the macro-economic level. Take Costco (NASDQ: COST) for instance, it has been paying its employees far above the minimum wage for years with an average of $21/hour, excluding overtime, and compare that to a direct competitor, Walmart (NYSE: WMT) which as one of the bastions of low-wage, anti-union business practices, has an average wage of $9.34/hour.

Looking at the graphs below, which business has been more successful? Which stock would you have wanted to own over the last year?

It turns out that there are more factors involved in the compensation equation than first meets the eye. Higher wages reduce staff turnover which costs companies 2.0 times the average yearly salary every time they have to replace a lost worker. Even though Walmart pays far less than Costco, the fact that the turnover rate of Walmart is 44% and that of Costco is only 17% (Harvard Business Review), means that Walmart’s overall replacement costs are 300% higher than Costco’s. This bites into the profits.

There are other benefits that come with paying higher wages as well; less shrinkage (theft) which costs retailers billions of dollars annually, less absenteeism, and greater customer satisfaction. It turns out that it’s really not a mystery why Costco has out-performed Walmart over the years.

This past November, Walmart finally threw in the towel and announced a policy change that involves investing in its employees and in technology, in an effort to prevent their stores from devolving into little more than a place to inspect products before buying them from an on-line retailer such as Amazon (NASDQ: AMZN). Seventy-five percent of the investment will be used to increase base wages to $10/hour by the start of 2016, and the rest will go into technological improvements. This should improve both in-store and on-line customer experiences, and create a more successful enterprise. Notice what has happened to the share price since the November policy announcement.

We recommend buying Walmart at this time, and consider Costco as a solid hold.

Why hold Costco if Walmart is going to improve and provide greater competition? Because we think that the U.S. is at the genesis of a paradigm shift when it comes to investment in labor, and that this shift is going to “supercharge” the economy which will finally lift all boats.

New York is planning an increase of the minimum wage to $15. Seattle, San Francisco, and Los Angeles have already started down this road, and as in “A Tale of Two Retailers”, low-wage businesses will not be able to compete. Both Walmart and Costco will grow since every dollar that is put in the hands of low-wage workers will enter the consumer economy, and through the multiplier effect, increase both the velocity of money and the GDP.

On the other hand, another billion dollars in the hands of a billionaire will end up as a number in a tax-haven bank account somewhere. As increasing investment in labor continues to spread, it has the potential to act as an antidepressant for the American economy which has not been very happy for the last half decade.

You cannot have growth through austerity—that is an oxymoron. Fortunately, though, we can all be richer (even the uber-rich) if the pie is bigger.

ANG Traders

www.angtraders.com

Read more by ANGTraders