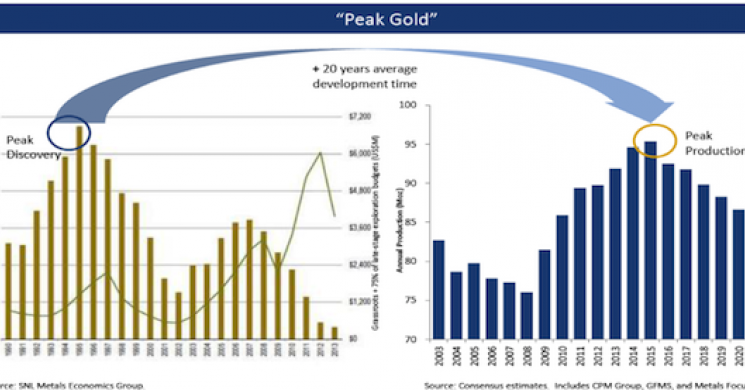

Peak Gold: Does it Even Matter?

- World’s gold output could peak as early as 2019: Mark Bristow

- Miners have replaced less than half of mined ounces since 2000

"Peak gold production may be reached within the next three years as miners fail to replace their reserves" Randgold CEO Mark Bristow.

Reasons Cited

- Quick mining- get in, get the easy gold and get out- think like fracking, only not so easily restarted up

- Lack of New Discoveries- there just isnt as much to get

- Financing Dificulties- easy money for financing new projects is gone

- Shrinking Capital Expenditure allocations- big mines arent investing in future drilling equipment

Major Miner Production is Down

Barrick, AngloGold, and Randgold all are producing less now. This can be in part a function of the lower price. But combined with other factors it is a sign of simply less gold available for mining, at least profitably. Note Bristow's hint here:

The company’s biggest challenge is finding fresh reserves that are at least as profitable as the gold currently mined, Bristow said.

Major Mines Are Getting Ready to Acquire Juniors

But it is noted that firms like Rand are sitting on their cash for acquisitions of smaller mines, not for digging new ones. This is a sign that it is easier to take someone elses gold than to spend money drilling deeper for less profits. Randgold may have about $500 million in net cash by the end of this year.

Less Supply Is Initially Bearish

Gold production frequently is counter the price trend. New supply comes online in reaction to higher prices via operating leverage quickyl. In reverse, miners stop looking for Gold when they sense price declines will continue. Many poorly run miners are underhedged and rush to shut down as Gold prices drop. Other better managed firms are able to ramp up production in rising price environments. This makes the price/supply cycle seem backwards.When mines last trimmed operations, bullion still slid as much as 29 percent into a bear market. Conversely, surpluses in 2010 and 2011 didn’t prevent prices from reaching records.

Industry Consolidation is Coming

Those mines that are poor at managing their production price risk or are financially leveraged will rush to close shop in a bear market. The bigger, better run majors will hoard cash and scoop them up before thenext bull run. But this time there will be more consolidation than before as cheap gold reserves are dwindling

Supply Analysis

- Polymetal International Plc. Gold Fields Ltd.’s CEO expects a “big dip” from about 2018

- HSBC Holdings Plc predicted the drop will be 25 tons this year.

- With prices at about $1,100, production probably will plunge 18 percent by the end of the decade-Metals Focus

Profit margins for the 15 largest producers have dropped as much as 45 percent since 2011, while their debt has doubled to about $34.7 billion, according to an analysis by Bloomberg Intelligence.

Goldman and Peak-ish Gold

Goldman Sachs analyst Eugene King : We have “20 years of known mineable reserves of gold.” If King’s projection turns out to be accurate, and the last “known” gold nugget is exhumed from the earth in 2035. Costs will go up, but the digging will continue if prices warrant it. So, the cure for low production is high prices. Peak gold does matter, but only at the margin. Demand is the key. Production is merely an indicator of demand.

Good Luck

Read more by Soren K.Group