Top Day: DB's Fallout, Yuan's Rise, Gold Bid

- Deutsche bank is down 4% this morning

- Global stocks are weaker with Japan's Topix index the worst performer

- Gold is showing signs of life as the Yuan joins the IMF's SDR

Deutsche Bank is sinking fast and taking global equity markets with it.The largest bank in Germany is down 54% this year and is trading at new lows this morning down 4%. Bank CEO Cryan insists that there is "no basis" for speculating that clients are leaving. In other news, clients are leaving. Among them are Izzy Englander’s $34 billion Millennium Partners, Chris Rokos’s $4 billion Rokos Capital Management, and the $14 billion Capula Investment Management, according to Bloomberg.Our Primer on the Deutsche Bank crisis here.

Global Stocks are in the tank this morning with Japan, and Europe down 1.6% and 1.1% respectively with the banking sector serving as the albatross around their necks. The S&P 500 is little changed thus far this morning

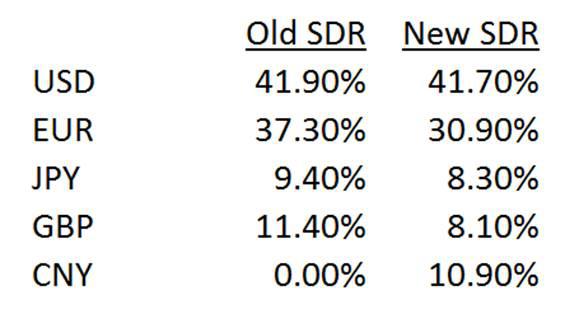

China's Yuan will be included in the IMF basket of currencies that comprise the SDR on Oct 1. China hopes its inclusion will prompt more foreign investment in its assets. China is in need of external investment now as its economy is sputtering of late.

Further reaching implications are the slow demise of the USD as global reserve currency. Note however, it is the EURO that gives up the most to make way for the Yuan. Prescient given the current situation no?

GOLD is up $3.30 at 6:30 this morning and we can't help but notice that the yellow pet rock is once again above $1325, our level of support. The EU crisis, the pending hard Brexit, the Yuan's inclusion in SDR's can only be bullish for Gold in the long and intermediate terms. Just don't expect a spike while everyone is panicking looking what they can unload in Europe to increase cash reserves. Priceless pianos were burned for firewood during the Reich bank hyperinflation of the 1920's. Some banks will actually sell Gold to raise their dollar amounts this month.

Just remember, if Gold is NOT money, then why do the largest 4 central Banks in the world not only hoard it, but are adding ot it on every dip? Don't take it from us.

Alan Greenspan:

"Gold is the premier currency. Why do all of the developed countries have Gold reserves?"

- [VIDEO] Greenspan Comes Clean on Gold, Silver as "Premier Currency"

- How Obama's IRS Polices the US Debt Prison

- The Deutsche Bank Crisis in Brief

good Luck

Soren K.

Read more by Soren K.Group