Since all three major U.S. stock indexes closed at record highs yesterday, investors are hoping that the markets don’t replicate what happened the last time the Dow Jones, Nasdaq and S&P 500 simultaneously broke records, CNBC reports.

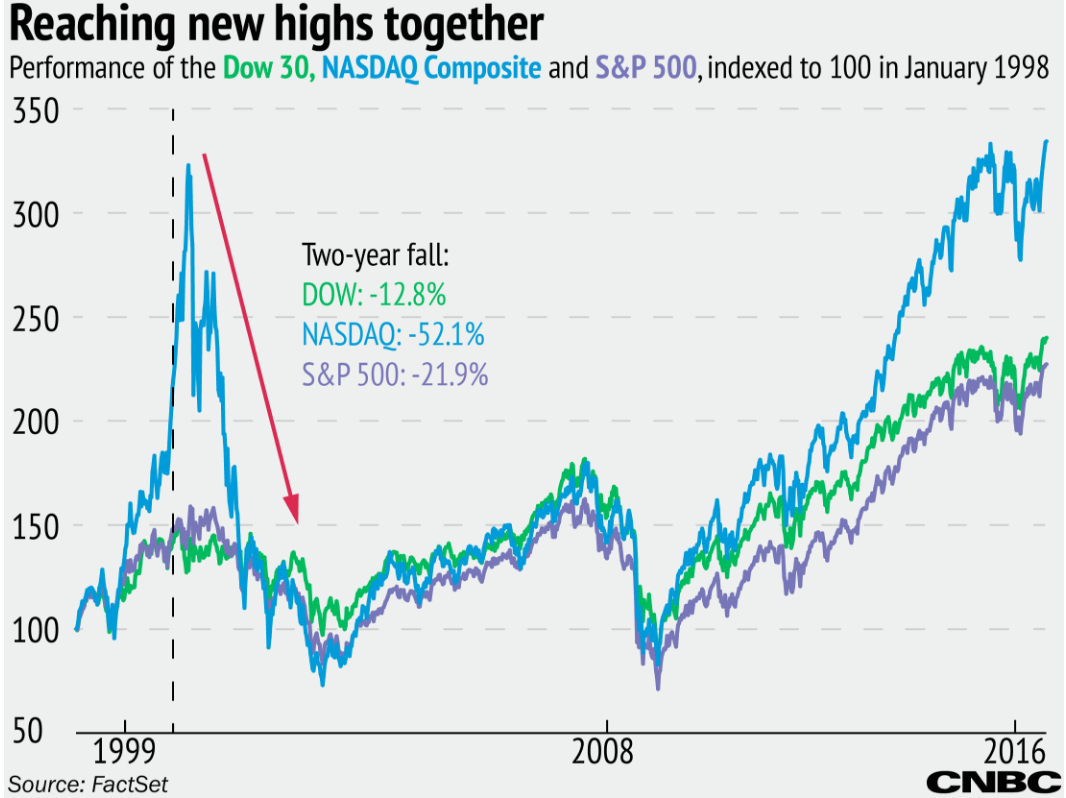

The last time the all three closed together at historic highs was in 1999 (December 31st). To paint the picture of what that day looked like, Bill Clinton was President and the dot-com bubble was nearing its burst. That tech bubble burst in March 2000, leading to a decline in all three major indexes.

By the following year, the Nasdaq was down by almost 40 percent, the S&P 500 down 10 percent and the Dow 6 percent. And the year after that, the three US stock indexes declined even further. By the end of 2001, “the Nasdaq had lost half its value, and closed down 52 percent…The S&P 500 closed down 22 percent in that time and the Dow 13 percent.”

Should investors worry? Well, in 1999 the long bull run ended that saw those same three indexes close at record highs together a stunning 131 times from 1986 to 1999, according to the Kensho analytics tool. “So even though Thursday's "trifecta" has not happened in a long time, it does not indicate a higher likelihood of a sudden downward move now,” reports CNBC.

Photo credit: CNBC

Read more by HashtagTrumped