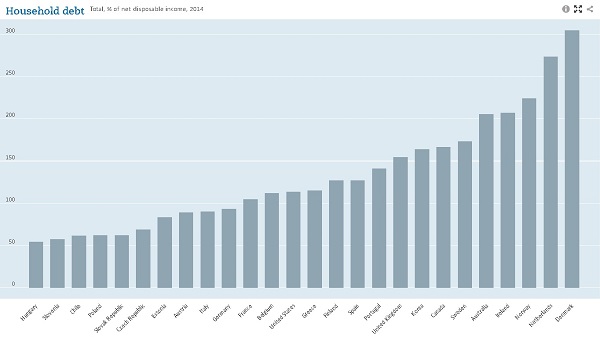

Unfortunately, it is not just Americans who have trouble meeting ends meet, some of their neighbours to the north are facing the same issues. Last week, I informed readers that 75% of Americans who make less than $50,000 a year said that they would have trouble finding $1,000 for an emergency expense. The survey also showed that 67% who make between $50,000 and $100,000 would have difficulty raising $1,000. Yesterday, according to a survey from Canadian financial firm Manulife Bank of Canada, more than one-third of Canadians didn’t have enough funds to pay a bill. In a breakdown of the firm’s spring debt survey, 4% of respondents said they found themselves low on cash almost every month; 10% said it has happened a few times in the past 12 months and 23% said it happened once or twice in the past year. Although the majority of respondents didn’t have any problems – 63% said they have never been caught without enough cash – the amount of people who are living paycheck-to-paycheck is alarming. This just demonstrates that debt levels around the world are at dangerously high levels and if something isn’t done we could be facing another global financial meltdown. The Organization for Economic Co-operation and Development (OECD) doesn’t have global debt stats for 2015, but for 2014 the statistics are kind of scary. It is interesting that the U.S. isn’t even the worst. According to the data in 2014, household debt was 113.4% of total disposable income; Canadian consumer debt level was 166.4% of income and they still aren’t that bad; Australian consumer debt was 205.8% of total disposable income. Coming in first place is Denmark with its consumer debt 304.9% of its income.

It’s not just the U.S. that is relying on domestic consumption to drive growth this year; Canada and Europe are also hoping their consumers can buy enough iPhones, and couches to keep the wheels turning. Unfortunately, I just don’t see it; too much pressure is being put on consumers and they are getting in way over their heads.

The global consumer is reaching a breaking point and unless things change soon, the entire world could be facing a major financial meltdown.

It’s not just the U.S. that is relying on domestic consumption to drive growth this year; Canada and Europe are also hoping their consumers can buy enough iPhones, and couches to keep the wheels turning. Unfortunately, I just don’t see it; too much pressure is being put on consumers and they are getting in way over their heads.

The global consumer is reaching a breaking point and unless things change soon, the entire world could be facing a major financial meltdown.

Read more by Just_another_wiseguy