TODAY: PIMCO, the world's largest bond fund placed its latest bet on the market. The firm, with prescience positioned itself before the Fed announces more QE in our opinion. The Fed then likely steps into the bond market and rewards pre-positioned longs. PIMCO's foresight is literally un-believable for sure. But the logic truly is flawless and they are pretty good at this (see pic at bottom). Many sovereign bonds are at negative yields wth more QE on the table for them. Governments are turning to corporate bonds to inject liquidity. Yet US bonds, arguably the safest in the world are still a positive yield.

What is more, in his latest blog post for the Brookings Institution, Former fed chair Ben Bernanke notes that the central bank will be hesitant in raising rates.Bernanke believes the Fed's realization that it has been too optimistic about growth, and that as a result policy is probably less accommodative than it appears and is likely to lead to a reluctance to raise rates. He writes, "the current policy is not as stimulative as previously thought," he said.- So lowering interest rates to zero is not the solution. Now he tells us?- SK

Last 48 hours as Backdrop

- BOE CANT FIND ENOUGH SELLERS AS QE PURCHASES FALL SHORT- BBERG

- German government bonds rose as the nation sold 10-year debt at a record-low yield.

- Goldman Sachs Asset Management is betting a rally in emerging-market debt will last as global central banks pump cash into their economies

"The goal in the global deflationary battle is for each country to export its deflation as quickly as possible. This is especially important to emerging (submerging) markets where so much of their GDP is tied to exporting goods. Brazil, China, India etc cannot reflate their economies if their currency remains strong relative to the countries they wish to sell their goods to. Everyone's solution is to weaken their currency in an orderly fashion. But like water circling a drain, controlled descent cannot be maintained after a certain point."

USA-Will be the last to debase and export its deflation, as it has been most adept at keeping its markets afloat with a strong currency so far. Let's face it, Being the world's reserve currency and having your Central bank run by the best market "managers" in the world has its advantages.

How to prepare if we are right?

What we did not know was how to trade our opinion. Buy gold, short Forex, buy Tips? Turns out our time table is further down the road than we thought. At least PIMCO thinks so. One day after writing this, PIMCO gives us the answer key below, JUST BUY BONDS. So the macro trades are likely: Buy US Bonds Now (PIMCO), Buy Gold on dips (strong USD as other nations start their QE), and Buy Stocks on dips (Fed will intervene). Then after a crisis that causes aggressive intervention and starts blow off tops in Bonds and Stocks:sell the bonds, then the stocks, and add to the Gold as the USD gets hit. Timing is something totally different.

The PIMCO POSITION

Via Bloomberg:Pimco Total Return Boosts Government Stake to Most in 25 MonthsAugust 9, 2016 — 8:31 PM EDT. Pacific Investment Management Co.’s Total Return Fund increased its stake in government and related debt to 45.6 percent of assets as of the end of July, the highest level in 25 months.

The fund added to the position as benchmark U.S. 10-year note yields tumbled to a record low 1.318 percent on July 6 and then bounced back to end the month at 1.45 percent.

Total Return, based in Newport Beach, California, is the world’s biggest actively run bond fund with $86.8 billion in assets. Pimco publishes the holdings every month on its website.

Why did PIMCO do this? Consider the timing of this latest purchase in context:

1- US Bonds have a positive yield: On a relative basis, US Bonds are cheap compared to their global brethren- buy them

2- Gilts Become Beanie Babies Today, the BOE failed to get enough sellers to complete its first QE bond purchase in 4 years. That is the first time a government BUY order went unfilled. And simply means longs are playing the front running game in earnest now with CB. It also underlines the importance of stock vs flow when a Government intervenes in markets.- buy them

3- The ECB 's future choices won't be their own bonds due to negative yields the ECB is now looking at corporates and stock for QE stimulus- buy them

4- Russian bonds contain "gold-Dust"-Putin: You buy our Bonds, we buy your Gold, da?-

Is PIMCO first to know when the next coordinated round of QE will accelerate?

All this behavior corroborates that the QE Merry-go-round is revving up for another run. All we need is a crisis to nudge the Japanese to be more aggressive. Then the rest will debase their currencies in line with our expectations. The US will likely be last to do so, after it has successfully exported its own deflation. Going back to our previous article but now admiting we are getting ahead of ourselves in terms of timing:

Unintended Consequence Potential

The Goal is to end deflation. The risk is to ignite inflation or worse. The USA has skillfully applied the do as we say, not as we do concept into keeping other world bankers from just hitting the gas pedal even harder. Meanwhile the US enjoys natural demand for its reserve currency even while hitting CTRL-P as much as it wants. We just do not see how the pendulum of monetary policy can swing so far one way without the eventual reversal having so much momentum that efforts to stave off unintended consequences like inflation are useless. The market will destroy someone, but it will not be the oligarch class that has benefited from asset inflation. it will be the working class that will be taxed both directly and through a higher cost of living.

Terminal Velocity and you:

Going back to the imagery of FIAT circling the drain. As water drops towards the bottom, its centripetal force increases in smaller and smaller circles. So to, we think the last legs of global currency debasement will be a juggernaut of unstoppable speed as the bottom of that drain is approached. This will approach terminal velocity and cannot be stopped accept by a true bottom. In this case, the bottom is a complete loss of confidence in that currency as a mechanism of exchange.

Pure Genius: PIMCO buys US Bonds near all time highs while rest of world buys HY junk- not sure if sincere or sarcastic statement yet

Is PIMCO front running the Fed?

We do not know. But what other choice is left for investors? Fundamentals do not matter.Stock prices area function of inflation of the asset class and not earnings. Bond yields are negative. Can you blame them if they are front running order flow?

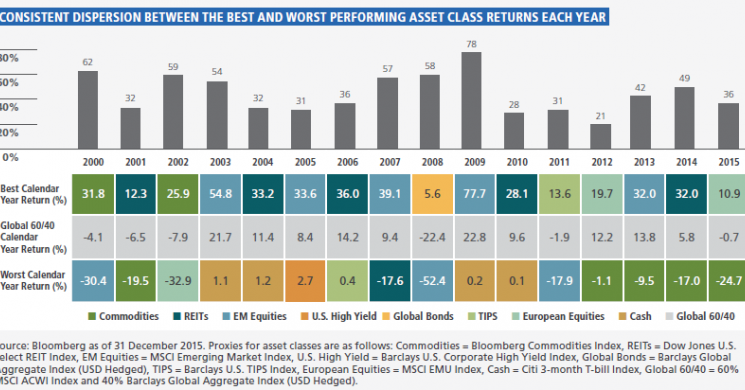

How Good is PIMCO?

You tell us. They struggled post Gross' exit, but seem to have their feet replanted after some horrendous bets and outflows.

BAD PIMCO

GOOD PIMCO- Long TIPs finally paying off.

Read more by Soren K.Group