If Trump Wins, Buy Gold, Sell Stocks- Citigroup

CITI: Market Not Pricing Trump Victory

In a report we received today, Citigroup’s Chief Global Political Analyst Tina Fordham and her team of strategists think the markets are not discounting the possibility of a Trump Presidential victory enough. The analysts instead cite what we call “creeping reality”, in which the denial of admitting one’s potential error is greater than the acceptance of it.

How Can that Be True?

You see it most often when a bearish analyst begrudgingly changes their annual price target on a stock/ commodity in the face of a rallying asset. Sometimes, they trail reality by so much that for them to be right, probabilities must be ignored. Like when a bearish gold analyst raises his price target to “average $1250” for the year in September. Gold would have to trade down to $900 (it could) in the next month for that to be feasible. People cling to their ideas by nature. But that is hazardous in trading and in picking price targets as an analyst.

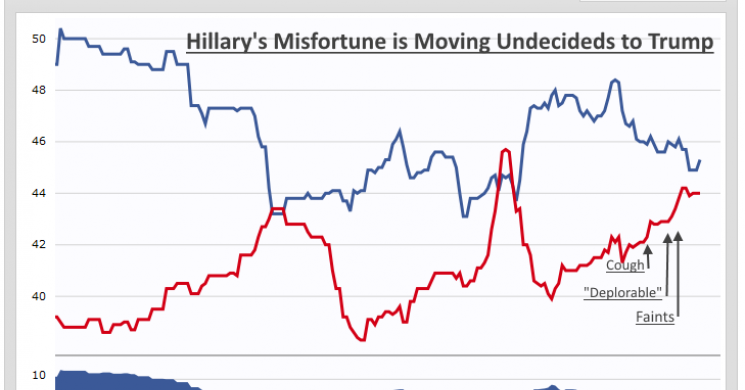

Also, Polling is much less relevant now. probabilities are a function of the law of large numbers. Here we do not have enough data. And that data has a high STD based on "shock" events.

Fordham agrees:

"A 35 percent probability for a Trump victory is more meaningful than investors may be appreciating," the team, led by Chief Global Political Analyst Tina Fordham, writes in a note published on Tuesday. "Political probabilities are not like blackjack — there is only one roll of the dice, and 35 percent probability events happen frequently in real life."

Trump's "Victory Creep"

Here, the Citigroup team applies that concept to the election.

- Press not saying Trump can win

- But his chances are creeping higher from 35 to 40% in just a week

We cannot agree more. And think the stock market just began pricing in a potential Trump victory. Eight days ago we said as much. We think the reason is exactly what Ms. Fordham implicitly describes: Denial. We have collectively become so dependent on others to make our decisions, Wall Street included, that groupthink is worse than ever. Wall Street actually ran out its bearish fundamentals right after the stock market dropped Friday in the hopes the Fed will save them. The Nanny mentality, combined with our technological pacifiers has enabled a deeper denial at a higher level than before. But enough group psychoanalysis for now.

CITI'S Trump Trades

A Trump Presidency will likely bring with it:

Lower Stocks

- S&P 3% lower from here- See the USD below

- MSCI as much as 10% lower- Emerging Markets will suffer on trade

Stronger Dollar

- Trump effect on Mexican Peso from “promise” to rewrite its trade agreement

- Other potential trade agreement issues will not help

Weaker Bonds

- 10 year target of 1.75- 2.00%

- 30 year target of 2.60-2.75%

Higher Gold

- Increased uncertainty will send more investors into it

- Citi Target of $1400 if Trump wins

And none of these markets has properly discounted the potential for a Trump win.

Due Diligence: Questions for Citi

We note that some of their opinions seem to contradict themselves in context of the whole story. And we are genuinely curious as to the weighting and rationale for the (non) contradictions. The aim here is to understand the rationale for the calls that seem to a layman to contradict each other. Specifically:

- Stronger Dollar but Weaker Bonds

- steeper yield curve?

- less int'l trade means less foreigners lending us money?

- Fiscal spending, Monetary tightening?-

- Gold Higher and Dollar Higher

- Domestic policy or Foreign Policy uncertainty?

- If had to give ground on one which would you choose: USD, or Gold

On this one we agree Gold will go higher. Just not on the "uncertainty" concept. Trump seems transparent in his ambitions, and anything foolish will result in congress doing its job. We think he is more likely to outspend Hillary on infrastructure while raising taxes and/or rates somehow. If the uncertainty is about foreign trade, then that makes more sense, but still, how does that benefit Gold and the USD? Is it just a matter of degrees?

thanks

Related Reading

- Trump Better for Gold, But He won't Win (July 22)

- Four Simple Trades if Trump wins-BBG

- Why Dilbert's Author backs Trump

Read more by Soren K.Group