“China is the largest ultimate, paying customer for gold. " -Sergey Kashuba, Russian Union of Gold Producers

- Russia's largest bank to register on SGEX to sell gold

- Second largest Russian bank to export 643,000 ounces in 2017

Summary

Written by Vince Lanci- Sberbank CIB, Russia's largest bank, plans to register on the SGEX for purposes of selling Gold in China. VTB Capital, a division of Russia's second largest bank has already set up shop in China adn has been selling its Gold on the SGEX since April 2016.

What is Mined in Russia, Stays in Russia

Russia was the second biggest Gold producer in 2015, mining 290 metric tons. Much of the metal stays in country. The Russian Government "encourages" domestic miners to keep its sales within Russia by using its banks to buy gold from them. We have no reason to doubt that the Russian Central Bank (RCB) uses its larger banks as intermediaries between itself and its mining industry, much like China does.

The Old Logistics- not unlike a mafia structure

- Russian Miner produces Gold- soldier does the job

- Miners are "encouraged" to sell locally to Russian Banks- if the soldier wants to keep "earning"

- Miner sells to Bank over his cost but under spot price- soldier "kicks up" to his capo regime

- Banks sell to RCB at spot price- Capo Regime kicks up to the Don

- So why the interest in selling to China now? Because that is where the money is

Why are Russian Banks Now Selling Gold in China?

Profits of course. That and some permission from the RCB to do so. The mark up from bank to end user is why Russia's banks are looking for access to Chinese demand. Rising incomes and few investment options in China are driving demand for gold jewelry, bars and coins in China. In July, SGEX volumes almost doubled from a year earlier to 1.7 trillion yuan ($255 billion).

The New Logistics- Capo Regimes expand territory with the Don's permission

- Russian Miner produces Gold

- Miners encouraged to sell to Russian Banks- "benefits" include being permitted to operate with unbroken legs

- Banks buy from the Miner at spot price- good for miner, good for bank and nobody gets hurt

- Banks sell to Russian Central Bank- at little to no mark up and no-one gets hurt ,da?

- Banks ask RCB permission to allocate some Bullion for sale to China- Da, but you give us piece of profits, no?

- Russian Banks set up shop on the SGEX

- Banks sell their Gold to China clients who pay higher prices

The Russian Players

Sberbank PJSC, largest Russian Bank

- Will be selling Gold in China thru its Sberbank CIB division on SGEX

Otkritie Bank- second largest Russian Bank (privately held)- on SGEX

- Sells Gold on SGEX as of August 2016

- projects 5 tonnes sold this year in China

VTB Capital- a unit of Russia's 2nd largest bank- on SGEX

- Sells gold on SGEX as of April 2016

- Owns shares in Otkritie

- projects sales of 20 metric tons in China for 2017

- projects 100 tonnes in 2018

Russian Banks' Gold Price Outlook

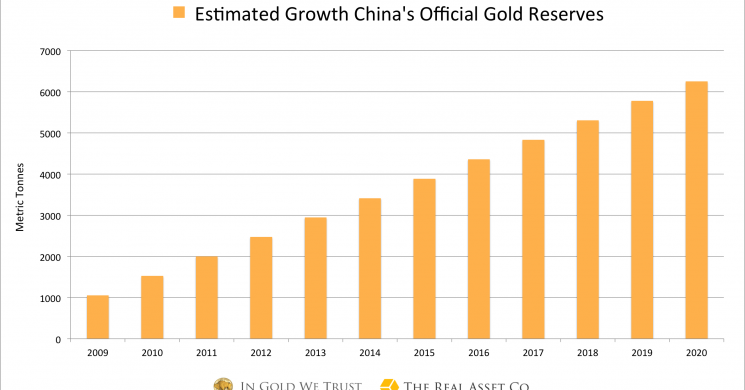

As long as China continues to encourage its citizenry to accumulate Gold in addition to the PBOC buying there will be a premium to spot paid in China for purchasing, storage and portfolio management. As the quote goes:

"China Owns Gold Through its People"

But not officially until the PBOC confiscates it

- “We believe that the macroeconomic environment will stay supportive for gold and expect the metal to trade above $1,250-$1,300 per ounce in the mid-term with risks skewed to the upside," Sberbank CIB said

- “Any drop below $1,300 per ounce should be viewed as a buying opportunity,”VTB Capital

-Vince Lanci

- Daily Digest 21 September

- Back to the USSR? Putin Resurrects KGB

- Technicals: $1380 and $20.36 for Starters

- Gold Could Touch $1900 by Year End- McEwen

cbar

Read more by Soren K.Group