Amid swirling rumors of a Gold import ban, and already realized of a crackdown on cash itself, the India Times reports that banks are no longer doing currency swaps on the eliminated 500 and 1000 Rupee bills. They are now accepting them as deposits only. The usual excuses are being made for this outrageous tightening of floating currency: "Less exchange demand", and people need encouragement. Note the following quotes blatantly stating the government needs more money out of mattresses and in their control. India's economic freedom is being destroyed and they don't even have to lie about it

"It has further been felt that people may be encouraged and facilitated to deposit their old Rs 500 and Rs 1000 notes in their bank accounts. This will encourage people who are still unbanked to open new bank accounts. Consequently, there will be no over the counter exchange of old Rs 500 and Rs 1000 notes after midnight of 24.11.2016"

Once that money is deposited, do you think it will be able to be withdrawn so easily? We are witnessing in real time a country herding its population into financial serfdom. Bear in mind these note denominations are less than $US 20.

This leaves a decreasing number of avenues for the use of the now-demonetised high-value notes - deposits into bank accounts or payment of dues and arrears to select government departments - and pushing towards the government's idea of a cashless economy. Earlier in the day, Union Finance Minister Arun Jaitley had said there are 80 crore (800MM) debit cards in the country, of which 40 crore (400MM) are active.

The Way to Eliminate Economic Freedom- India Edition

- Eliminate larger denominations of currency via bill exchange, then

- Permit only deposit of said denominations... next

- Cite the lack of cash outstanding as excuse to go to electronic currency... then

- remove or restrict all other means of portable wealth like Gold

This is happening globally right now. India is using steps 1 and 2 so far. Steps 3 and 4 are happening in other countries as we speak.

The goal is to ring-fence the tax base, to prevent individuals from enjoying benefits of globalization even while corporations and governments exploit it.

Who Benefits in India From This? VISA, MASTERCARD.. AKA Banks as fee makers, Government as string pullers

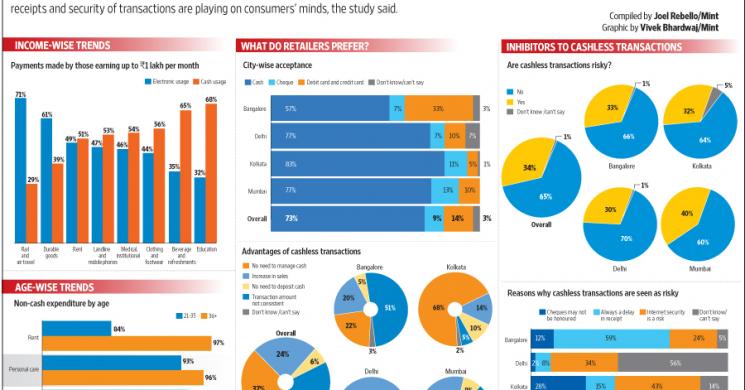

Road to Less-Cash, a study prepared by Gurgaon-based research foundation India Development Fund (IDF) and industry body Internet and Mobile Association of India (IMAI) for Visa Inc.

The Song Remains the Same- Kill the Individual's means to Act on his Rights

Different countries are using different tactics and are at different stages of the demonetization of their own currencies but they are all singing the same song.The removal of financial and economic freedom is for our own good. This is going to result in less class mobility globally down the road as well we feel.

- India- demonetize the currency

- Sweden- create an e-Kroner

- USA- increased rhetoric and Fed presentations about abolishing cash

- China- All Gold must go through the Government owned SGE

Countries that can, just mandate it. Those that cannot are floating trial balloons. Once the ability to transact in cash is gone, the war on gold will go into full swing:

- Confiscate it where you can- China's market structure is set up to enable this when needed.

- Demand that all Gold be submitted for branding or CUSIP. "if its not in the system, it is not usable for transactions"- coming soon

- sell the idea that you are protecting the populace from crime.- as always, they know what is good for us

- refuse delivery on demand, increase waiting periods for physical delivery- Xetra Gold Story

There are so many ways to separate the people from their real wealth and replacing it with a piece of paper stating the wealth is still yours. But make no mistake about it, control is more important than ownership. And who controls the vehicles that store your wealth? Who can shut down their ATMs, declare "holidays', force martial law when they fear the people's discontent? Your Government, once it has control of your economic means, has control of your economic freedom.

Bitcoin Is Not Your Friend

Bitcoin will not save you. Yes, the stock itself may be a buy. Right now Blockchain technologies for Bitcoin are being tested for rollout and systematizing of transactions. The CME may as well own Bitcoin as we have seen their steady, smart business model move on creating a centralized liquidity pool for it. CME is not evil, they are a smart business. But who has replaced the TBTF banks post 2008 as the Government's centralizer of risk? And recently, Goldman and other banks have withdrawn form the Blockchain group to make their own product. No, if you cannot hold it in your hands and transact with it, you will not be able to in the future.

How to Separate Gold from the People

Gold will be confiscated in wealth terms if it can be. It will literally be confiscated in countries with even less freedom than our own.in some instances it will be spoofedlower o na grandscale. This will force the unwashed masses ot liquidate their holdings. Who will be buying then? If India prohibits Gold imports under the pretense of slowing black market money laundering, what will happen to Gold? It will dive much lower on irrational selling. We suspect if that happens it will be the Central Bankers of the world on the buy side. And if they cannot get people to exchange their Gold for other monetary representations, they will simply outlaw it outside the system.

Incentives/ Difficulties to Hold Gold Coming

- bank holds it, you can withdraw cash on it

- ETFs stop making delivery, offer cash value instead

- CUSIP-labeled Gold is the only Gold accepted

- futures settle in cash only- delivery eliminated

- electronic Gold- a promissory note for your gold on deposit with a firm that was once outside the system will be a part of it

Are you watching closely?

Mastercard

Read more by Soren K.Group