******************************

Prepare for the “Trump Trade” Reversal

By Jim Rickards

All good things come to an end. Now, the “Trump Trade,” seems to be reaching its end.

The Trump Trade, also called the reflation trade, is based on the idea that President Trump’s policies of lower taxes, less regulation, and more infrastructure spending will improve corporate earnings, stimulate consumer spending, and therefore result in higher stock prices.

Lower corporate tax rates would mean higher after-tax profits for corporations that had domestic profits. Lower individual tax rates would mean that consumers would have more discretionary income to spend on everything from new cars to eating out.

Trump’s planned repeal of Obamacare would be good for hospitals and insurers who would be relieved of mandates. Trump’s repeal of Dodd-Frank would be good for banks because of reduced compliance costs and greater ability to engage in proprietary trading. Trump’s infrastructure spending plans would be good for construction companies and manufacturers of heavy equipment.

Trump’s infrastructure spending plans would be good for construction companies and manufacturers of heavy equipment.

In short, there was something for everyone in the Trump program.

That’s why, from November 8, 2016, the date of Trump’s election, to March 1, 2017, the Dow Jones Industrial Average staged an historic rally from 18,332.74 to an all-time high of 21,115.55. This was a 15% gain in just 15 weeks!

Better yet, there were no significant reversals along the way; stock market volatility measures have been stuck at persistently low levels. All was right with the world.

But since March 1, it looks like a different story. The Dow fell over 450 points to 20,663.22 during the course of March — a 2% decline in one month. That’s not a meltdown or anything like a bear market, but it’s definitely a shift in the momentum of the Trump Trade.

The Dow’s down another hundred since the beginning of April, as the attack on Syria and rising geopolitical tensions in East Asia have markets worried.

What happened? More importantly, where does the market go from here?

Serious headwinds have now crashed into Trump’s plans, and the stock market is reevaluating its outlook. These headwinds consist of weakness in the U.S. economy, dysfunction in the Congress, and unrelenting resistance to Trump coming from Democrats, the media, the bureaucracy, and even many Republicans.

This reality hit home with a crash on Friday, March 24, when Trump called Washington Post reporter Bob Costas on his cell phone to tell him that the White House and Speaker Paul Ryan had just pulled the Obamacare repeal legislation.

This setback had been weeks in the making as many House and Senate Republicans publicly criticized both the substance and process by which Ryan was advancing the repeal legislation.

As always, stock markets don’t wait for the bad news; they anticipate it and sell off in advance. That’s why the market reversal began March 1 after it became apparent that the Republicans were divided and the repeal process would not be smooth sailing.

Yet, the ramifications of Trump’s loss on Obamacare repeal go far beyond repeal itself. That loss has caused Trump to lose his aura as a winner who can succeed by the “art of the deal.” The damage to Trump’s perceived deal-making abilities goes beyond healthcare, and affects his plans for tax revision, fiscal stimulus, trade deals, and other parts of his agenda.

Trump also faces constraints due to the time wasted on the fruitless Obamacare repeal. Few Americans realize how little Congress actually works. While Americans may get a single day off for a national holiday, Congress takes a two-week “recess.”

Members of Congress clear out of town on Thursday, and don’t return until Monday night; this means they work a three-day week when they’re not in recess. It’s true that staff members put in long hours and weekends, but staff members don’t vote or conduct hearings.

There are precious few days left on the Congressional calendar for the entire remainder of 2017.

The idea that Congress and the White House can somehow revive Obamacare repeal, reform the Internal Revenue Code, pass a major spending bill, raise the debt ceiling cap, and extend the continuing resolution to keep the government going until the budget is complete is sheer fantasy.

The last time the Internal Revenue Code was reformed was 1986 when Ronald Reagan was president. That gives you some idea how difficult tax reform process can be.

It’s more likely that the Congress will descend into partisan fights between Democrats and Republicans, and internal fights among various Republican factions. A government shutdown on April 28 cannot be ruled out.

Meanwhile, all of this dysfunction and delay comes against the backdrop of an economy hitting stall speed and on the brink of a recession.

The Federal Reserve Bank of Atlanta indicates that first quarter 2017 growth may be 0.9%, which is just above recession levels. One more Fed rate hike in June, which I do expect, could be the last nail in the coffin of the current economic expansion.

The Fed may realize how weak the economy is by mid-summer, but by then the damage will be done. As usual, the Fed won’t see trouble coming, and will respond too late when they do.

Taken as a whole, we have the set-up for a major stock market correction beginning this summer. The stock market is priced for the perfect Trump policy scenario. Instead we have dysfunction, delay, and declining growth.

The market’s fantasy view might persist for a few more months, especially since the market misinterprets Fed rate hikes as a sign of growth. (That’s backwards. Growth is an indicator of rate hikes, not the other way around).

What the market is missing is that the Fed is not raising rates because of strong growth. They’re raising rates so they can cut them in the next recession. The problem is that by raising rates, the Fed will cause the recession they are preparing to cure. Combined with Trump policy dysfunction, the stock market is set for a fall.

The most important point is that the economy is in the grip of what economists call “regime uncertainty.”

The most important point is that the economy is in the grip of what economists call “regime uncertainty.” This is a term proposed by Charles Kindleberger to explain the persistence of the Great Depression from 1929-1940. Earlier U.S. depressions had lasted a year or two, but the Great Depression lasted eleven years. Why?

Kindleberger blamed policy uncertainty caused both by President Hoover and President Franklin D. Roosevelt. Both administrations tried one ad hoc policy intervention after another. Some were legal, some were declared illegal by the courts. Some policies seemed to work, others didn’t. But they kept trying.

The problem was that corporations and investors never knew where things stood. It was impossible to make long-term investment plans when the rules of the game kept changing. In a phrase, “capital went on strike.”

We see the same problem today. Business does not know if the tax code will be amended to disallow deduction for interest expense. Business does not know if full first-year write-offs will be allowed for purchases of new equipment. Small business does not know if it will be excluded from health-care mandates.

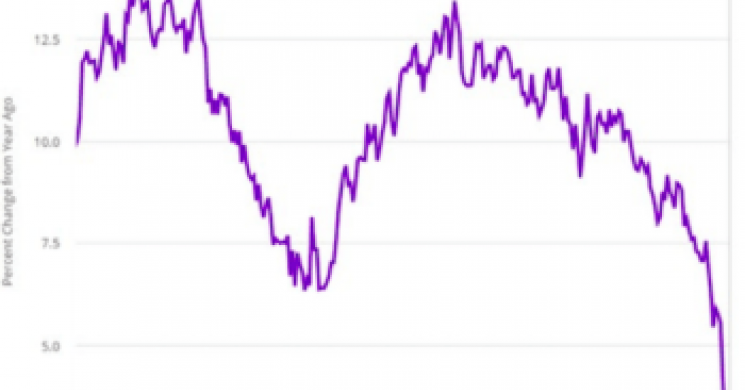

The result is that capital is on strike. Demand for commercial loans is drying up. New investment is on hold. Hiring is also on hold until the rules, and associated costs, become clear. As the chart below shows, growth in bank commercial loans, which was already slowing before the election, has plunged since the election.

Percentage change in Commercial and Industrial Loans year-over year as reported by commercial banks. Source: Federal Reserve Bank of St. Louis and The Daily Shot.

This “capital strike” will continue until Congress and the White House sort out policy and get some legislation passed. Unfortunately, this will not happen soon, and may not happen at all this year.

The stock market will soon give up pricing for the best outcome, and start pricing for the worst.

End

About:The Soren K. Group of writers are currently 5 persons writing collectively. Backgrounds are professional, ranging from Finance to Banking to Real Estate. Topics include politics, markets, and Global Macro situations with a libertarian bent. Some posts are collaborative, some individually written.

Email: Sorenk@marketslant.com

Twitter: @Sorenthek

Read more by Soren K.Group