10 Worst Cases Of Corporate Greed In U.S. History

via Erica Quinn of investmentzen.com

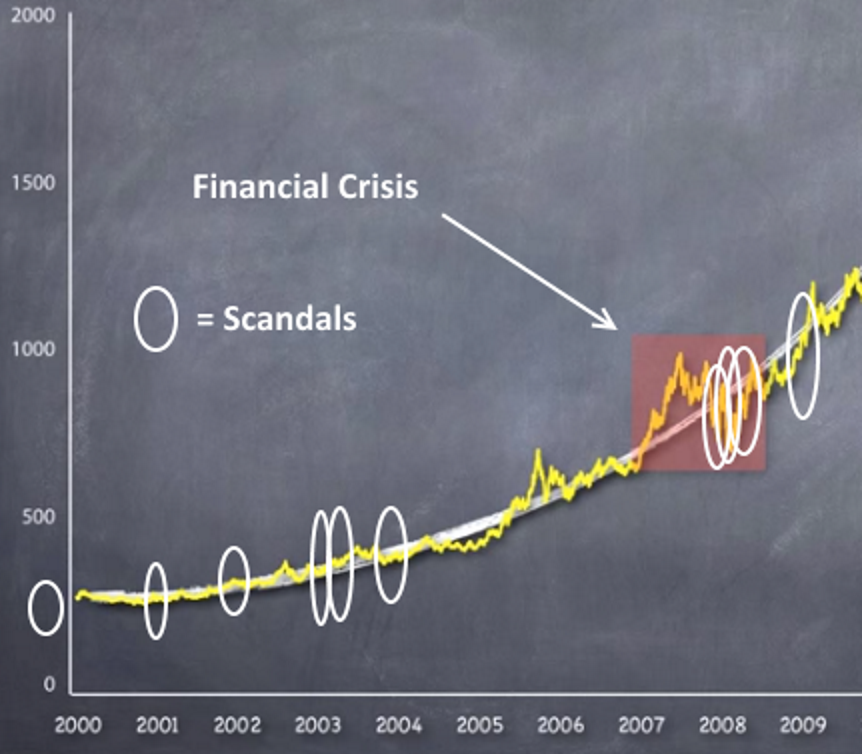

Corporate scandals and financial scams are seemingly always in the headlines, but what are the biggest investment or accounting scandals in U.S. history when you line them up by dollar amount? By our calculations, the Lehman Brothers scandal is the most expensive scandal in U.S. history by a mile with Enron coming in a distant second. Honorable mention goes to Bernie Madoff and Allen Stanford for making the top ten list for running gigantic Ponzi schemes. Here is the full list of the top ten biggest financial scandals in U.S. history totally nearly $900 Billion:

[EDIT: As a reference point, here is Gold's Performance during the years of the worst Financial Scandals in US History - Soren K]

h/t Grant Williams

[EDIT: Here is Erica's Data as she compiled it. You will note at no point was the 'pet rock' guilty of any crimes - Soren k.]

1. Cendant Corporation

- Date: 1998

- Amount: $14 Billion in stock losses

- The Scam: Accounting Fraud

- Restitution: $32.5 million settlement to shareholders

- Criminal Charges: Company Chairman Walter Forbes was sentenced to 12 years in prison and Vice Chairman E. Kirk Shelton, was sentenced to 10 years in prison.

2. Enron

- Date: 2001

- Amount: $78 Billion in stock losses, 5000 employees lost jobs, many lost pensions

- The Scam: Accounting Fraud

- Caught!: Enron employee Sherron Watkins brought it to light.

- Restitution: A Class Action Settlement of $7.185 billion was the largest of all time

- Criminal Charges: Jeff Skilling (former president) got the longest prison sentence at 24 years, his sentence was later reduced by 10 years. CEO Kenneth Lay was convicted of fraud, conspiracy, and bank fraud, but died of a heart attack before receiving a sentence.

3. WorldCom

- Date: 2002

- Amount: $11 Billion

- The Scam: Accounting Fraud

- Caught!: Cynthia Cooper, Vice President of Internal Audit at WorldCom, started investigating and then brought it to light.

- Restitution: A $750 million civil penalty was paid to investor victims.

- Criminal Charges: Bernie Ebbers, CEO, is serving a 25-year prison sentence. Scott D. Sullivan, CFO, was sentenced to 5 years in prison. 3 other WorldCom executives received shorter sentences ranging from 5 months to 1 year plus a day.

4. HealthSouth

- Date: 2003

- Amount: $4.6 Billion

- The Scam: Accounting Fraud

- Caught!: SEC Investigation

- Restitution: Richard Scrushy, CEO, was ordered to pay $2.9 Billion to shareholders in a civil trial

- Criminal Charges: Scrushy was found Not Guilty in the HealthSouth case, but just 5 months later was given an 82-month prison sentence (later reduced to 70 months) for political corruption charges. Aaron Beam, CFO, served 3 months in federal prison. Weston Smith, who served as CFO after Beam, served 14 months.

5. Freddie Mac

- Date: 2003

- Amount: $5 Billion

- The Scam: Securities Fraud

- Caught!: SEC Investigation

- Restitution: $50 million settlement

- Criminal Charges: 4 former Freddie Mac executives paid a total of $515,000 in civil fines and $275,548 in restitution payments.

6. Fannie Mae

- Date: 2004

- Amount: $11 Billion

- The Scam: Securities Fraud

- Caught!: SEC Investigation

- Restitution: $400 million settlement

- Criminal Charges: None

7. Bernie Madoff

- Date: 2008

- Amount: $65 Billion

- The Scam: Ponzi Scheme (the largest in history)

- Caught!: After he confessed to his sons, they called the authorities.

- Restitution: $11 Billion was recovered by officials

- Criminal Charges: Madoff is serving a 150-year prison sentence with 5 other employees also receiving criminal sentences.

8. Washington Mutual

- Date: 2008

- Amount: $65 Billion: An estimated $10 Billion in preferred stock losses and $55 Billion in common stock losses

- The Scam: Mortgage Fraud

- Caught!: FDIC stepped in.

- Restitution: Sold to JPMorgan Chase for $1.9 Billion. Executives agreed to a $64 million settlement, however all but $400,000 of that amount was covered by insurance policies WaMu purchased to protect their executives.

- Criminal Charges: None.

9. Lehman Brothers

- Date: 2008

- Amount: $639 Billion in assets lost in bankruptcy.

- The Scam: Hiding billions of risky investments.

- Caught!: Bankruptcy (the largest in history)

- Restitution: $65 billion to settle creditors’ claims (the equivalent of 14 cents on the dollar)

- Criminal Charges: None.

10. Allen Stanford

- Date: 2009

- Amount: $7 Billion

- The Scam: Ponzi Scheme – 21,000 clients

- Caught!: SEC Raid

- Restitution: 3 waves of settlements totaling around $125 million, or about 2.5% of victims claims

- Criminal Charges: 110 years on 13 counts of mail fraud, wire fraud, conspiracy, and obstruction.

[Here is the data in an InfoGraphic that makes the scandals only slightly less nauseating to us, but well presented- Soren K.]

Contact Erica for more information:

Read more by Soren K.Group