Op-Ed: Bitcoin is more akin to the Nasdaq than gold and is not a safe haven asset

- Buying the Nasdaq represents a risk-on move and I'd argue so does buying bitcoin.

- Despite a fall in the gold price after the election of President Donald Trump, bitcoin continued its rally.

Editorial written by Arjun Kharpal and posted CNBC as an op-ed

"I wish I'd invested in bitcoin," is a response I usually hear when I tell people how much they could have made off the cryptocurrency if they bought it at the start. Just to be clear, if you bought $100 worth of bitcoin in 2010 when it was worth 0.003 cents each, you'd be sitting on over $88 million.

It all sounds so easy. But for regular investors in bitcoin – those not heavily involved in the cryptocurrency world – bitcoin has often got a confusing reputation. It's known to be highly volatile with wild price swings, but at the same time some, such as Bobby Lee, co-founder and chief executive of bitcoin exchange BTCC, have called it a safe-haven asset.

"When the existing money system has problems, people turn to bitcoin sort of like people used to go to gold in the old days," Lee told CNBC in a recent interview.

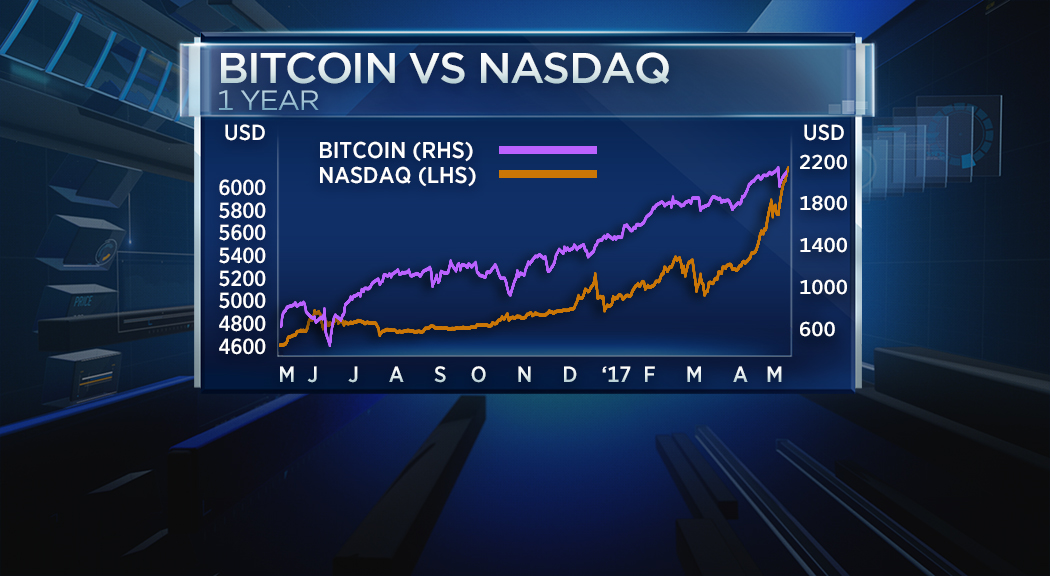

I've never been a big believer in bitcoin as a safe haven asset. Sure it has got a touch of support when politics has been rocky. However, a comparison on bitcoin's performance over the past year against the Nasdaq – a tech-heavy stock index – and the typical safe-have asset of gold, shows that the cryptocurrency has more in common with the former.

From around mid-June of 2016, both bitcoin and the Nasdaq have been on a steady climb higher with the stock index recently breaking the 6,000 point barrier and continuing to hit fresh record highs. And it appears there isn't a day that goes by where bitcoin doesn't hit a fresh record high.

Buying the Nasdaq represents a risk-on move and I'd argue so does buying bitcoin, a currency that can see swings of over $100 in a few hours.

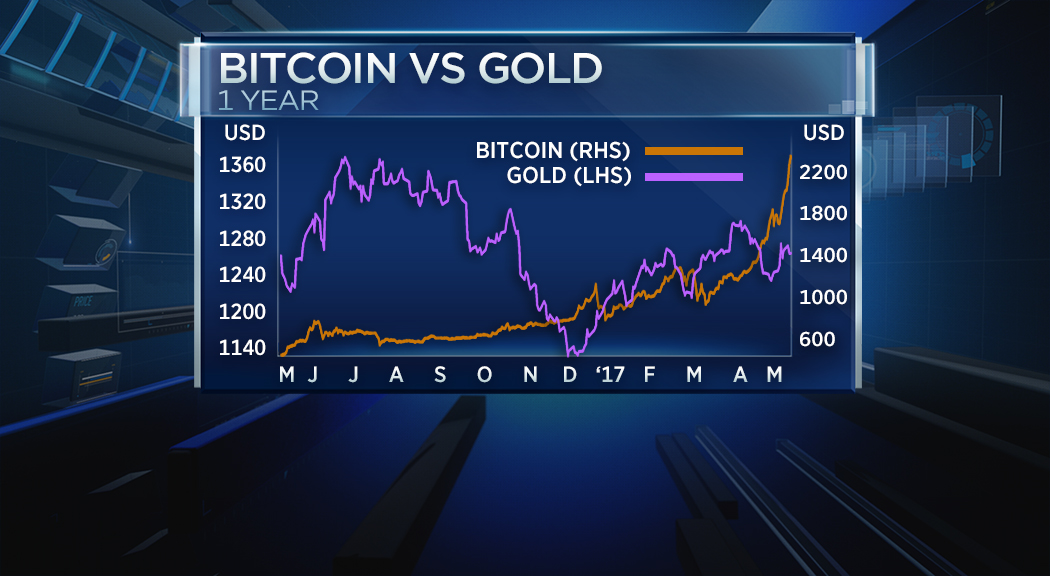

A look at bitcoin's trading pattern versus gold in the last year also gives a glimpse into how the cryptocurrency isn't really a safe haven asset. Gold saw a lot of support between mid-June of 2016 and the middle of October. Bitcoin was just bubbling along quietly. But once President Donald Trump was elected, investors moved out of gold into riskier assets on the promise that increased spending by the new U.S administration as well as tax reform could boost stocks. At the time the gold price continued to decline, bitcoin rose, and while the precious metal saw a bit of renewed support in the first few months, the cryptocurrency continues to skyrocket.

It's clear that investors are flocking to bitcoin, not because it offers stability, which it quite clearly doesn't, but more to find solid returns on an asset that is up over 150 percent year-to-date.

Investors still believing bitcoin is a safe-haven asset might find themselves on the wrong side of the trade.

Follow @ArjunKharpal on twiter

Read more by Soren K.Group