A Bad Sign For The Global Economy

via SRSrocco

The once Great Chinese Dragon Economy seems to be burning out as its economic indicators continue to weaken and smolder. One such indicator is China’s rapidly falling industrial silver consumption. At one time, Chinese industrial silver fabrication was consuming nearly a third of the global total. However, this has fallen considerably over the past two years.

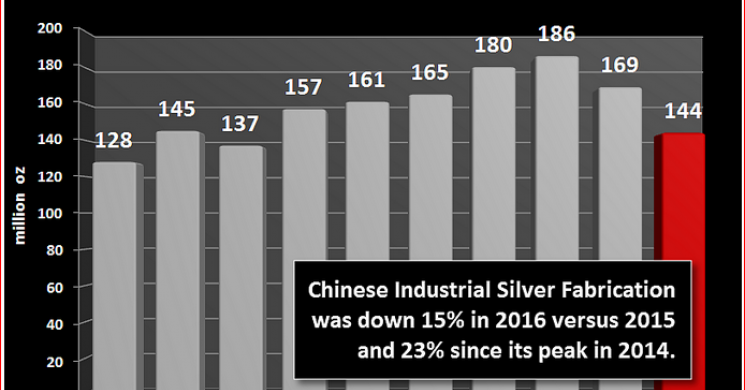

According to the data in the 2017 World Silver Survey, China’s industrial silver consumption fell 15% in 2016, from 169 million oz (Moz) in 2015 to 144 Moz last year. That’s a 25 Moz decline in just one year:

Furthermore, Chinese industrial silver fabrication has fallen 23%, (42 Moz) from its peak of 186 Moz in 2014. While some may believe the decline in China’s industrial silver usage had something to do with rising silver prices. This couldn’t be, as the average annual silver price was $19.08 in 2014, $15.68 in 2015 and $17.14 last year.

So, as we can see, the Chinese consumed a great deal more silver for industrial silver applications when the price of silver was higher in 2014 than either 2015 or 2016. Which means, it had nothing really to do with the price. That being said, there is an even more alarming trend.

Chinese industrial silver demand last year was the lowest since the 2009 Global Financial Meltdown. In 2009, China consumed 137 Moz of silver for its industrial applications, compared to 144 Moz last year. Moreover, China continued to see a slow but steady increase in silver consumption from 2010 to 2014 for industrial fabrication, but it really started to deteriorate over the past two years.

This suggests that domestic and global demand for Chinese industrial products (that use silver in their manufacture) has been declining significantly since 2014. Some readers may assume that the decline in Chinese industrial silver consumption is due to the efficiency in solar manufacturing. While the manufacturing of Photovoltaic Cells has most certainly become more efficient, from 0.5 grams silver per cell in 2011 down to 0.15 grams in 2016 (data: 2017 World Silver Survey), consumption of Solar PV silver increased to 76.6 Moz in 2016 versus 57.2 Moz in 2015.

Thus, overall consumption of silver for PV Solar manufacturing has continued to increase from 51.8 Moz in 2014 to 76.6 Moz last year. So, this does not explain the big drop in Chinese silver industrial fabrication over the past two years.

Now, if we look at global silver industrial fabrication over the past decade, we can spot an interesting trend:

When the price of silver was at its highest level in 2011 (average was $35.12), the world consumed the most silver for industrial applications (661 Moz). However, global silver consumption in the industrial sector has continued to decline, reaching a low of 562 Moz last year. This is nearly 100 Moz less than it was in 2011.

Yes, it is true that the world is using less silver for Photography, but it hasn’t fallen that much since 2011. According to the data in the 2017 World Silver Survey, silver consumption in the Photographic industry only fell 16 Moz since 2011. However, the biggest decline in silver consumption came from the “Electrical & Electronics” sector. Silver consumption in that industry fell from 291 Moz in 2011 to 234 Moz last year.

Again, we can’t blame rising prices for the decline in silver consumption in the electrical or electronics sector because it fell more than 50% since 2011. You would think silver consumption in electronics would have risen as the price fell by more than half.

So, what does this all mean? It means the world economies that are being propped up by a massive amount of monetary printing, debt and Central Bank asset purchases aren’t really growing in REAL TERMS, but rather they are contracting.

Sure, some sectors might be growing, such as the automobile industry, but this is not sustainable. Why? Because, using easy money, subprime finance and extending payments are the last stages before the market falls off a cliff, as it did in 2008.

Of course, many investors have heard all this already as they become increasing frustrated that the “TIMING OF THE CRASH” continues to be delayed. I see this sentiment on my site as well as others. While I can understand the frustration these investors are feeling… it doesn’t bother me a bit. I moved out of the BIG CITY in 2007 and relocated to the country when I knew the market crash was coming. So, when everything fell apart in 2008 and 2009, I wasn’t surprised. However, I was surprised how long the Central Banks could prop up the system.

But….. there is an expiration date or time when the propping will no longer work. While I don’t know the exact timing of this event, I can tell you that the lousy indicators taking place in the oil industry provides a clue that it will likely occur sooner than most realize. Now, I am not saying tomorrow, next week-month or next year… but I can see BIG PROBLEMS by 2020, and it could come sooner.

Which is why, you don’t want to play with fire and TIME your exit out of these insane markets. However, most investors think they KNOW BETTER. So, it will be interesting to see when things fall apart, just how well that strategy worked.

IMPORTANT NOTE: Falling industrial silver demand is not a bad indicator for the future price of silver. First… I don’t look at short-term supply and demand factors as indicators of price. Second… I focus on the longer term trends in the silver market for clues on the timing when the value of silver will move to a high-quality store of value. Lastly, the most important indicator for the future value of silver (or gold) is energy. This energy fundamental is overlooked by the majority of precious metals analysts.

Please stay tuned over the next several weeks as I plan on putting out some interesting articles. While most of the respected precious metals analysts continue to discuss the economy and financial system in terms of FIAT MONEY, DEBT, DERIVATIVES, GEOPOLITICS and CENTRAL BANKS, very few if any understand the dire energy predicament we face.

I believe those who follow the work on the SRSrocco Report site will be more informed about the coming ECONOMIC COLLAPSE (due to energy) than those analysts who remain focused on the more superficial information and data.

Check back for new articles and updates at the SRSrocco Report.

Read more by Soren K.Group