What’s going on with gold? Some love it, some hate it and analysts seem mixed on whether its bottom is in.

But, according to one independent researcher on Seeking Alpha, the downtrend is far from over.

“The gold price decrease process observed since early June, is far from completion,” noted Oleh Kombaiev in his latest post.

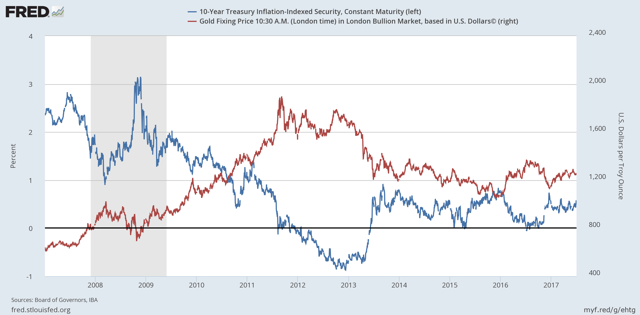

He looked at real interest rates especially because, as he points out, 70% change in the price of gold is due to changes in real U.S. rates.

“I will assume that this dependence will persist in the near future,” he wrote. “The analysis of the fundamental dependence of gold price on real interest rate allows drawing a conclusion that the negative market trend persists.”

He explained that income is growing but not due to increased wages but rather due to additional sources of revenue, which often end up going into savings rather than consumption. In other words, inflation isn’t picking up – another negative for gold, which is known as an inflation hedge.

“As a result, in May, the U.S. inflation was falling for the fourth consecutive month, despite the fact that the economy is close to full employment,” he said.

“As we can see, the real rate is increasing due to the simultaneous decrease of inflation and rising interest rates which is a very, very negative background for gold.”

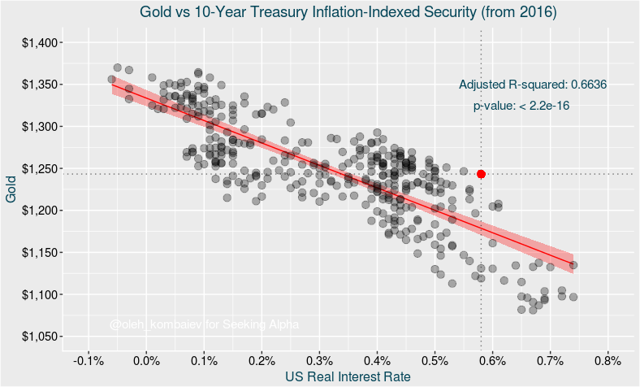

Kombaiev added he sees a correlation between the gold price and real interest rates, and based on his analysis, “gold is already overpriced” and is “at the beginning of a new, downward cycle.”

“According to the linear model of dependency of the gold price on the level of the real interest rate, the current, balanced gold price is at least $60 lower than the actual level.”

Kombaiev also looked at speculative positioning for his assessment on gold.

“It is noteworthy that the money managers operate fully appropriate to the situation, and from this point of view, the future prospects for gold are also not encouraging,” he said.

“If we forecast gold price based on the size of the net money managers’ position, we again will come to the conclusion that gold is currently overpriced.”

Read more by Wall St. Whisperer