Will Gold and Silver Become Currency Again?

By Erin Fischer

“If our money were backed by gold and silver, people couldn’t just sit in some fancy building and push a button to create new money. They would have to engage in honest trade with another party that already has some gold in their possession.”—Ron Paul

Although it is too early to call this a sweeping wave of reform, there are a handful of states who have taken Former Congressman Ron Paul’s sound money message to heart.

To date, eleven U.S. states have either acknowledged gold and silver U.S. bullion coins as currency or are on their way to accepting the two metals as legal tender. This shift is rooted in Article 1, Section 10, of the U.S. Constitution, which states that “No State shall… make any Thing but gold and silver Coin a Tender in Payment of Debts.”

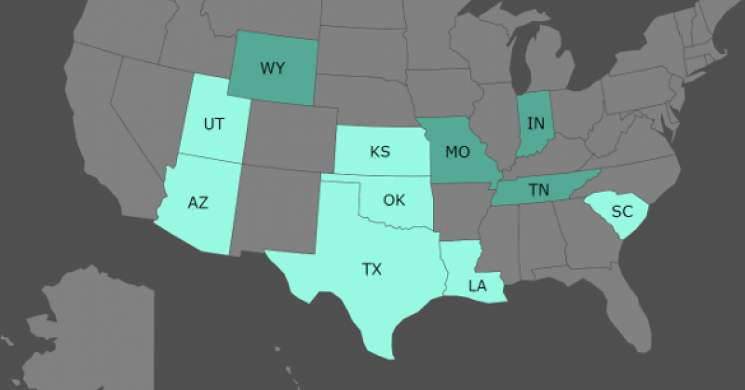

As of now, seven states have already reinstated gold and silver U.S. coins as currency, with Arizona just recently (August 9) added to the list. Four additional states have either tried to reinstate gold and silver as legal tender or are currently in the process. Below is a graphic depicting the seven states that have reintroduced gold and silver as currency (light blue) and the four states that have made attempts to do so (dark blue).

States that have made efforts to reintroduce gold and silver bullion as currency

Furthermore, the state governments of Utah and Texas are already in the process of arranging bullion depositories for private investors to secure their precious metals holdings.

Utah accepted gold and silver as currency as far back as 2011, when it became the first state in 80 years to make gold and silver legal tender. In January of this year, Rep. Ken Ivory (R-Utah) introduced a bill that would add to Utah’s Legal Tender Act, thus further promoting gold and silver as currency. Ivory explains that “secure public transaction is the ultimate goal” of the new bill.

This bill, known as House Bill 224 (HB224), would change state law so that it expands state gold repositories and allows for research on sound money policies. Zero Hedge explains, “Specifically, HB224 would authorize the investment of public funds in specie legal tender held in a commercial specie repository.” Essentially, HB224 would allow Utah to hold funds in gold and silver, in addition to Federal Reserve notes.

In June 2015, Texas governor Greg Abbot signed legislation that approved a Texas gold bullion and precious metals depository. In addition to providing investors a secure place to store their precious metals, this legislation also allows for the use of gold and silver in day-to-day transactions.

As a result of the shift of gold and silver to currency, capital gains taxes on sales of gold and silver would most likely be eliminated in states that accept gold and silver as legal tender, as currency isn’t subject to taxation. States such as Idaho and Arizona have already passed bills removing these taxes. If all 50 states began using gold and silver instead of Federal Reserve notes, the Fed would no longer have control over the nation’s money.

The Long-Term Outlook

William Greene, professor of economics at New York University, explains the following in a paper for the Mises Institute:

“Over time, as residents of the state use both Federal Reserve notes and silver and gold coins, the fact that the coins hold their value more than Federal Reserve notes do will lead to a ‘reverse Gresham’s Law’ effect, where good money (gold and silver coins) will drive out bad money (Federal Reserve notes).

As this happens, a cascade of events can begin to occur, including the flow of real wealth toward the state’s treasury, an influx of banking business from outside of the state—as people in other states carry out their desire to bank with sound money—and an eventual outcry against the use of Federal Reserve notes for any transactions.”

Although we are a long way from seeing gold and silver completely replace the current Federal Reserve-issued currency, this is a positive step nonetheless. As an ASI newsletter subscriber, you understand the value of gold and silver as money. Unlike the U.S. dollar, which has no innate value, other than our trust in the government, gold and silver have held their value for millennia. The dollar, on the other hand, has lost 96% of its purchasing power in a little over one century.

Add Real Money to Your Wallet

For thousands of years, gold and silver were used as currency. Since President Franklin Delano Roosevelt took the U.S. off the gold standard in 1933, the U.S. dollar’s value has come from faith in the government. Today, as a result of a weakening dollar, we’re slowly beginning to see states shift back to accepting gold and silver as currency—as outlined by the Constitution.

How far this movement goes is yet to be seen, but it is encouraging to see states take positive steps toward sound money.

The good news is you don’t have to be from one of these states to build your own, private, gold and silver depository and sound money bank. And, given the recent movement in the precious metals market, now seems like the perfect time to take such action.

Gold and silver have out-performed equities thus far this year… although you wouldn’t know it based upon the limited media coverage. And, gold has out-performed equities over the past decade.

Couple that with a weakening U.S. dollar, nuclear chicken between the U.S. and North Korea, and the beginning of the traditional fall buying season for precious metals, and you know what you should do.