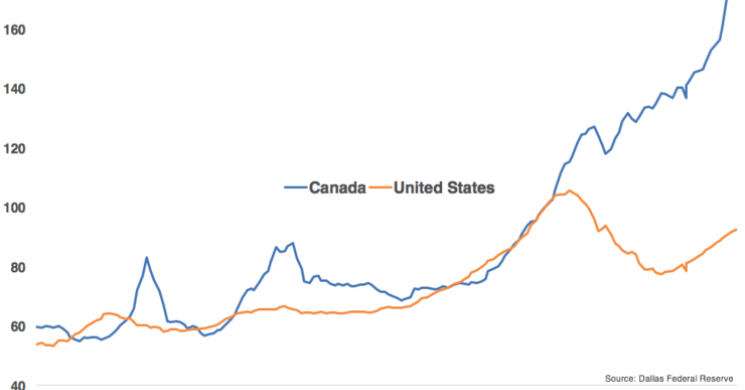

Canada seemed Immune in 2016...

Toronto Home Price Bubble Descends into Bear Market

by MM.LaFleur

With surprise rate hike, Bank of Canada turns against housing market.

Home sales in the Greater Toronto Area, the largest housing market in Canada, plunged 34.8% in August compared to a year ago, to 6,357 homes, with sales of detached homes and semi-detached homes getting eviscerated:

Sales by type:

- Detached houses -41.6%

- Semi-detached houses -37.3%

- Townhouses -27.5%:

- Condos -28.0%.

Even as total sales plunged, the number of active listings of homes for sale soared 65% year-over-year to 16,419, with 11,523 new listings added in August, according to the Toronto Real Estate Board (TREB).

“The relationship between sales [plunging] and listings in the marketplace today [soaring] suggests a balanced market,” the report explained, adding hopefully:

“If current conditions are sustained over the coming months, we would expect to see year-over-year price growth normalize slightly above the rate of inflation. However, if some buyers move from the sidelines back into the marketplace, as TREB consumer research suggests may happen, an acceleration in price growth could result if listings remain at current levels.”

And the average price of all homes, at C$732,292 in August, plunged 20.5% from the crazy peak in April (C$920,761). By this measure, it has now entered a bear market.

The average price in April had shot up 30% year-over-year. To cool this nutty business, the Ontario government introduced a laundry list of measures on April 20. It included most prominently a 15% transfer tax on nonresident foreign speculators. That appears to have done the trick.

Given the enormous price gains in recent years, the market remains hyper-inflated, and the four-month downturn into a bear market hasn’t even brought prices back to the year-ago level, with the average price for all types of housing up 3%, and the condo price up 21.4% year-over-year.

To cool a similarly nutty housing bubble in Vancouver, the government of British Columbia had passed a year ago similar legislation with a 15% nonresident foreign speculator tax. But worried about an outright implosion of the bubble, it has since been subsidizing with taxpayer money down-payments aimed at first-time buyers and condos, which has inflated the condo bubble and condo speculation to new heights.

Politicians – they’re desperately dependent on extracting property taxes from homeowners – don’t want the world’s most majestic housing bubble to implode. They just want it to remain stable so that taxes can be extracted from willing homeowners that have gotten rich off years of house-price inflation. But for now, the Ontario government is letting the market ride.

The TREB report said that the sharp drop in average prices “points to fewer high-end home sales this year compared to last.” So are speculators with the most money abandoning the market?

Even the Bank of Canada has been warning home buyers – particularly speculators – all year long about big potential losses. Then in July, it raised its target for the overnight rate by 0.25 percentage points. Another rate hike was expected in December, to match the Fed’s presumed rate hike.

But today, in a surprise move, it raised rates again by 0.25 percentage points, to 1% – and there are now expectations that it might raise its target rate a third time later this year. In response, the loonie jumped 1.3% against the US dollar this morning.

These rate hikes “would just further dampen” the housing market, explained Bank of Montreal chief economist Doug Porter, adding that the surprise increase so soon after July’s rate hike “accentuates” the Bank of Canada’s urgency to raise rates.

“So I wouldn’t brush it off – I think that will put a bit more upward pressure on some of the medium and longer-term mortgage rates as well, and of course the variable rates will move almost instantaneously,” he said.

Variable-rate mortgages account for about 30% of all mortgages in Canada. So these rates ticked up after the July hike; they will after this hike; and if there’s another hike later this year, they’ll tick up again. A 0.75 percentage points increase in the interest rate on a C$800,000 mortgage would raise the annual interest costs by C$6,000.

Homeowners with variable-rate mortgages will now have to come up with more money to pay for their homes. And potential homebuyers are looking at steeper costs – something they will likely keep in mind, now that easy price gains may no longer be so easy, and that the Bank of Canada, rather than just warning about it, is actively working to deflate the housing bubble.

Read more by Soren K.Group