In a publication of the Chinese central bank, Huang Zhen, a researcher at Central University of Finance and Economics writes that the " the PBOC it should start its own sovereign digital currency as soon as possible" according to a commentary in the PBOC's own Financial News.

Here is the key excerpt, roughly translated:

In order for the Chinese government to prevent and control the risk of virtual currency, it decided to prohibit the issuance of ICO tokens, and stop the trading of cryptocurrencies and other virtual currencies on exchanges, to better protect the interests of China's financial consumers, and to prevent the spread of currency risk to China's financial system, safeguard China's financial security and the stability of important economic initiatives. The sovereign state is still the fundamental player in global politics, and carries with it the characteristics of the world financial system. Cryptocurrencies and other virtual currencies attempt to challenge the sovereign state's right to issue currency, requiring the nationalization of currency issuance. China has a clear understanding of digital forms of money, and is actively engaging in relevant work. The central bank has set up a research group and a digital money research institute to explore the digitization of sovereign money. After this round of virtual money markets supervision, we expect under the auspices of the Chinese central bank to launch our own sovereign digital currency as soon as possible to help maintain China's leadership in the development of global digital finance.

Translation: decentralized cryptocurrencies, in which the money creation process is no longer controlled by the state (as a reminder, cryptos are not a liability to any central bank and are thus not backed by any official government entity), are the enemy and deserve the scorn and condemnation of every spoke of the establishment, from the central banks' central bank, to commercial banks, to financial newspapers of record, all the way down to brown-nosing wannabe establishment "hanger-on" lackeys. Meanwhile, centralized digital currencies, which are controlled by the state, which can be adjusted and modified anywhere and at any time at a the flick of a switch, and which can be extinguished or multiplied at will during times of NIRP or hyperinflation, are wondrous creations, and China - for one - can't wait to launch one.

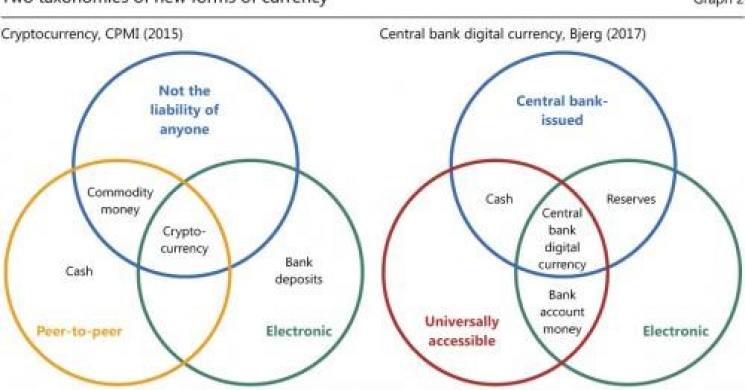

Or as the BIS explained, left bad, right good.

... or even simpler, the difference between Fedcoin and Bitcoin.

Read more by MarketSlant Editor