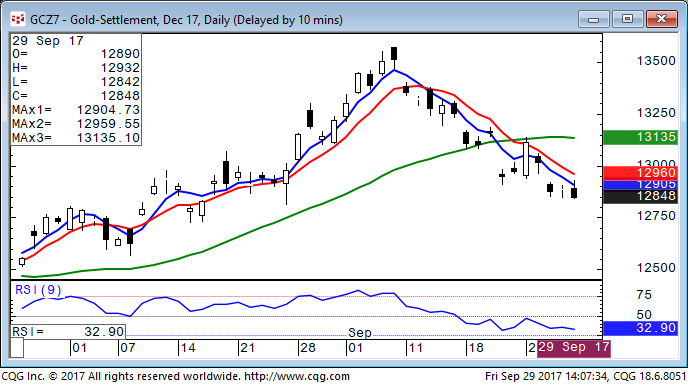

Gold (Z) 9/29/17

Gold (Z) 9/29/17

On a macro basis: There is a macro resistance line coming in at 13511 all next week. We are looking for a multi-week smackdown from where it came in the week of 9/11 at 13522, and are beginning to see this as we have come off $71.1 so far. We left a medium term bearish reversal intact above on 9/18 that also warns of continued pressure in the days/weeks ahead. We have seen $30.4 so far. Decent intra-day trade above 13234 will negate this.

On a shorter-term basis: The decent trade below 13120 (+.7 of a tic (7 cents) per/hour) projects this downward $47 (+). We have seen $31.6 of this so far. This will come in at 13242 (+ .7 of a tic per/hour starting at 6:00pm). If we break back above decently, look for decent short covering to come in—with a run back up toward 13620 (+) likely. We broke below a formation at 12934-35 the decent break below which also warns of decent pressure. This is based off an ‘ok formed’ pattern. We have seen $13 of this so far. This will come in at 12946-51 through Monday. If we break back above here decently, look for decent short covering to come in and I would be out of all macro shorts for the time being. I would note that possible areas of exhaustion for this move down from 13624 come in at 12752-32 and 12492-60. NOTE: a maintained gap higher Monday will leave a short term bullish reversal intact below that will warn of decent short covering, likely for days.

Read more by MarketSlant Editor