Prepare for a Chinese Maxi-devaluation

By Jim Rickards for the dailyreckoning.com

China is a relatively open economy; therefore it is subject to the impossible trinity. China has also been attempting to do the impossible in recent years with predictable results.

Beginning in 2008 China pegged its exchange rate to the U.S. dollar. China also had an open capital account to allow the free exchange of yuan for dollars, and China preferred an independent monetary policy.

The problem is that the Impossible Trinity says you can’t have all three. This model has been validated several times since 2008 as China has stumbled through a series of currency and monetary reversals.

For example, China’s attempted the impossible beginning in 2008 with a peg to the dollar around 6.80. This ended abruptly in June 2010 when China broke the currency peg and allowed it to rise from 6.82 to 6.05 by January 2014 — a 10% appreciation.

This exchange rate revaluation was partly in response to bitter complaints by U.S. Treasury Secretary Geithner about China’s “currency manipulation” through an artificially low peg to the dollar in the 2008 – 2010 period.

After 2013, China reversed course and pursued a steady devaluation of the yuan from 6.05 in January 2014 to 6.95 by December 2016. At the end of 2016, the Chinese yuan was back where it was when the U.S. was screaming “currency manipulation.”

Only now there was a new figure to point the finger at China. The new American critic was no longer the quiet Tim Geithner, but the bombastic Donald Trump.

Trump had threatened to label China a currency manipulator throughout his campaign from June 2015 to Election Day on November 8, 2016. Once Trump was elected, China engaged in a policy of currency war appeasement.

China actually propped up its currency with a soft peg. The trading range was especially tight in the first half of 2017, right around 6.85.

In contrast to the 2008 – 2010 peg, China avoided the impossible trinity this time by partially closing the capital account and by raising rates alongside the Fed, thereby abandoning its independent monetary policy.

This was also in contrast to China’s behavior when it first faced the failure of its efforts to beat impossible trinity. In 2015, China dodged the impossible trinity not by closing the capital account, but by breaking the currency peg.

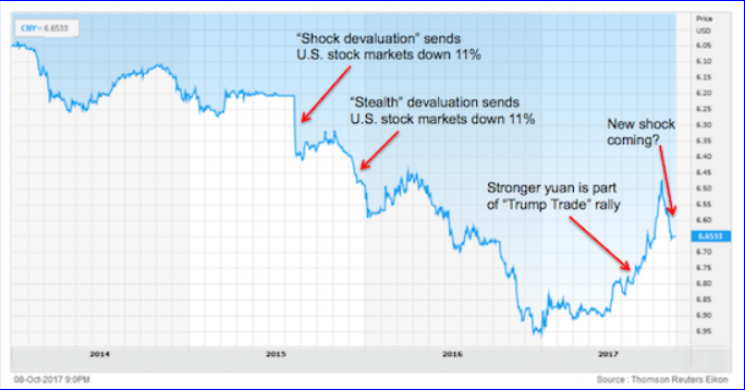

In August 2015, China engineered a sudden shock devaluation of the yuan. The dollar gained 3% against the yuan in two days as China devalued.

The results were disastrous.

U.S. stocks fell 11% in a few weeks. There was a real threat of global financial contagion and a full-blown liquidity crisis. A crisis was averted by Fed jawboning, and a decision to put off the “liftoff” in U.S. interest rates from September 2015 to the following December.

China conducted another devaluation from November to December 2015. This time China did not execute a sneak attack, but did the devaluation in baby steps. This was stealth devaluation.

The results were just as disastrous as the prior August. U.S. stocks fell 11% from January 1, 2016 to February 10. 2016. Again, a greater crisis was averted only by a Fed decision to delay planned U.S. interest rate hikes in March and June 2016.

The impact these two prior devaluations had on the exchange rate is shown in the chart below.

Major moves in the dollar/yuan cross exchange rate (USD/CNY) have had powerful impacts on global markets. The August 2015 surprise yuan devaluation sent U.S. stocks reeling. Another slower devaluation did the same in early 2016. A stronger yuan in 2017 coincided with the Trump stock rally. A new devaluation is now underway and U.S. stocks may suffer again.

By mid-2017, the Trump administration was once again complaining about Chinese currency manipulation. This was partly in response to China’s failure to assist the United States in dealing with North Korea’s nuclear weapons development and missile testing programs.

For its part, China did not want a trade or currency war with the U.S. in advance of the National Congress of the Communist Party of China, which begins on October 18. President Xi Jinping was playing a delicate internal political game and did not want to rock the boat in international relations. China appeased the U.S. again by allowing the exchange rate to climb from 6.90 to 6.45 in the summer of 2017.

China escaped the impossible trinity in 2015 by devaluing their currency. China escaped the impossible trinity again in 2017 using a hat trick of partially closing the capital account, raising interest rates, and allowing the yuan to appreciate against the dollar thereby breaking the exchange rate peg.

The problem for China is that these solutions are all non-sustainable. China cannot keep the capital account closed without damaging badly needed capital inflows. Who will invest in China if you can’t get your money out?

China also cannot maintain high interest rates because the interest costs will bankrupt insolvent state owned enterprises and lead to an increase in unemployment, which is socially destabilizing.

China cannot maintain a strong yuan because that damages exports, hurts export-related jobs, and causes deflation to be imported through lower import prices. An artificially inflated currency also drains the foreign exchange reserves needed to maintain the peg.

Since the impossible trinity really is impossible in the long-run, and since China’s current solutions are non-sustainable, what can China do to solve its policy trilemma?

The most obvious course, and the one likely to be implemented, is a maxi-devaluation of the yuan to around the 7.95 level or lower.

This would stop capital outflows because those outflows are driven by devaluation fears. Once the devaluation happens, there is no longer any urgency about getting money out of China. In fact, new money should start to flow in to take advantage of much lower local currency prices.

There are early signs that this policy of devaluation is already being put into place. The yuan has dropped sharply in the past month from 6.45 to 6.62. This resembles the stealth devaluation of late 2015, but is somewhat more aggressive.

The geopolitical situation is also ripe for a Chinese devaluation policy. Once the National Party Congress is over in late October, President Xi will have secured his political ambitions and will no longer find it necessary to avoid rocking the boat.

China’s President Xi Jinping awaits appointment to a second term at the 19th National Congress of the Communist Party of China, starting October 18. His reappointment is a foregone conclusion.

China has clearly failed to have much impact on North Korea’s nuclear weapons ambitions. As war between North Korea and the U.S. draws closer, neither China nor the U.S. will have as much incentive to cooperate with each other on bilateral trade and currency issues.

Both Trump and Xi are readying a “gloves off” approach to a trade war and renewed currency war. A maxi-devaluation of the yuan is Xi’s most potent weapon.

Finally, China’s internal contradictions are catching up with it. China has to confront an insolvent banking system, a real estate bubble, and a $1 trillion wealth management product Ponzi scheme that is starting to fall apart.

A much weaker yuan would give China some policy space in terms of using its reserves to paper over some of these problems.

Less dramatic devaluations of the yuan led to U.S. stock market crashes. What does a new maxi-devaluation portend for U.S. stocks?

We might have an answer soon enough.

Read more by Soren K.Group