Gold prices are poised to get a boost as economic cycle change in Europe, allowing the dollar to soften against other major currencies. Gold investments become more attractive as the dollar moves lower, because gold, is quoted in dollars, and becomes less expensive in currencies other than the greenback. Gold trades like a currency, even though it’s a commodity, as traders see the yellow metal as a substitute for a currency.

Investing in gold coins, has long-term benefits but there are fundamental factors that you should consider as you diversify your portfolio with gold bars or silver coins. One of those fundamental factors is the current state of global monetary policy which can provide you with a view of the direction of the dollar.

What is Monetary Policy

Monetary policy describes the interest rate policy of a central bank. In the U.S. the Federal Reserve is in the process of normalizing interest rates following ultra-accommodative policy that has been in place since the 2008 financial crisis. It took the U.S. 7-year to begin to tighten interest rates and this year, the Fed announced a further reduction of its bond purchase program. In Europe, countries are still easing monetary policy, but recent data and commentary from European Central Bank officials would lead one to believe that monetary policy could begin to normalize in 2018.

The European Central Bank is Poised to Alter Policy

The most recent ECB meeting minutes show that not all members are on the same page. While it is unlikely that the ECB would vote to terminate the current bond purchase program early, many want to discuss steps that signal to the market that September could be the end of quantitative easing. Additionally, economic data has been stronger than expected. Manufacturing Purchasing Manager’s Surveys, GDP growth and job data has been stronger than expected. The caveat is inflation which appears to be relatively soft around the globe.

A change in the tone of European monetary policy would allow the Euro to gain traction against the dollar. While continued normalization of U.S. monetary policy is priced into the current market, a change to policy normalization by the ECB is not, which is why the Euro could be gaining traction.

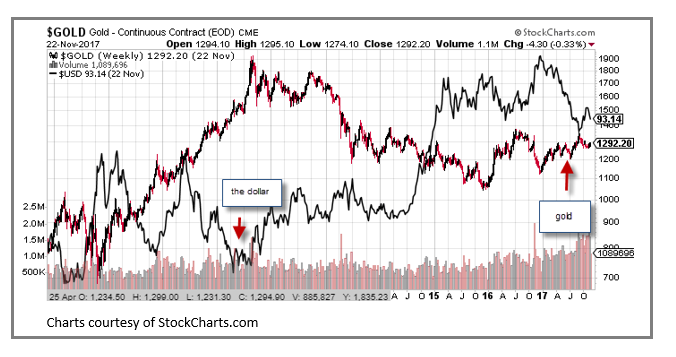

The chart above shows gold prices versus the U.S. dollar index, which is a basket of currencies versus the U.S. dollar. The largest component of the U.S. dollar basket is its relative value compared to the Euro, the European currency. What you can surmise from the chart gold prices and the U.S. dollar is that gold prices and the dollar exchange rate basket generally move in opposite directions. Gold price are trading sideways, but the dollar appears to be topping out, and forming a pattern that portends a lower exchange rate level. A weaker dollar would potentially pave the way for higher gold prices.

Timing the market can be a difficult proposition, and many investment managers believe that you are better served formulating a longer-term view and potentially adding gold to your portfolio in increments. If you are interested in adding gold bars or silver coins to your portfolio call Treasure Coast Bullion Group and ask for a free investment kit.

The global monetary policy cycle environment is poised to change as Europe begins to normalize interest rates. The U.S. and the U.K. are already on this path, and if Europe soon follows the value of the Euro will increase relative to the dollar helping gold prices move higher.

Good Investing,

Treasure Coast Bullion Group

Read more by Treasure Coast Bullion Group, Inc - Staff Writer