Source: Michael J. Ballanger for Streetwise Reports 01/17/2018

Michael Ballanger discusses why he believes the U.S. stock market is defying gravity with a record-breaking nine years without a significant correction.

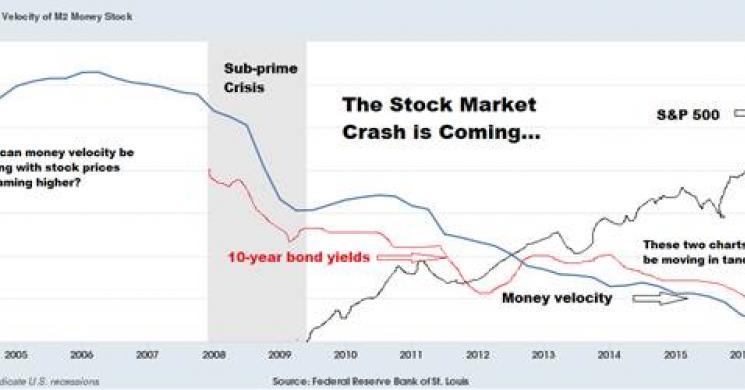

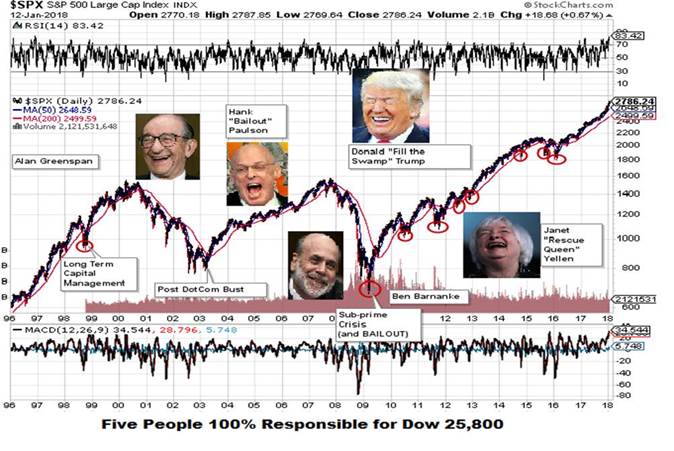

Before I launch into one of my classic, bitter, vitriolic diatribes against all forms of modern-day interventionalist-type, fraudulent excuses for what use to be "free markets," have a gander at the chart below. Pay particular attention to the smiles on all of those beaming faces. . .

Alan Greenspan, Ben Bernanke, sidekick Hank Paulson, "Rescue Queen" Janet Yellen, and finally Donald "the Swamp Filler" Trump have all conspired and colluded to ensure that the world has perennially rising stock prices but the man that really set the table for a feast of fiat largesse was Greenspan.

His arrogance in front of the U.S. Congress will go down in history as a training manual for future Fed chairs and in fact served as a mentor to the finest actor to ever hit the Beltway stage in the form of Hank "Mr. Bailout" Paulson. It was Paulson's plea back on September 26, 2008, who, while down on bended knee, begged Congress to approve his Emergency Stabilization Act, which saved only the banks from annihilation. The actions of the U.S. Fed to rescue the financial institutions that had collectively self-destructed under a mountain of greed-infected leverage was quickly seized upon by their European and Asian counterparts such that the largest publicly reported buyers of stocks since then have been the Bank of Japan and the Swiss National Bank.

It is instructive to know that when I first joined the securities industry back in 1977, ownership of common stocks was considered by the old, blueblood Toronto money as "gambling," while buying corporate bonds was considered "intelligent speculation" and buying government bonds was "investing." In fact, government bonds with less than a 10-year duration were considered "conservative investments" one notch down ladder of risk from "savings" (cash). They also considered gold ownership as "insurance" and while it was rarely a big percentage of their allocations, they viewed gold in the same manner as they viewed cash. It was a necessary evil to hold not unlike household or car insurance.

The reason I am writing this missive is that I am growing increasingly annoyed with the media coverage of this so-called "Trump Rally" or "Reflation Trade" or "Tax Deal Repricing" or whatever narrative is required to explain why "It's different this time." As I written every month of every year since I began writing about markets, the global economies are NOT booming due to the growth of productivity or population or profits; the global economies are simply responding to a torrent of newly recycled credit, massive liquidity excesses, and unbridled government stimuli.

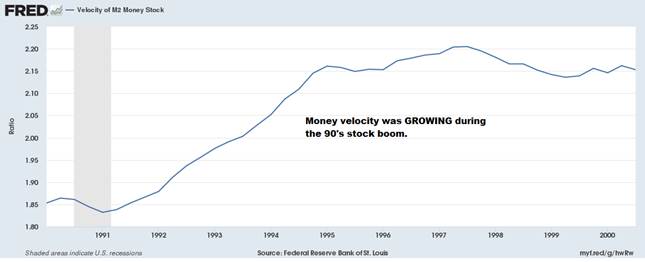

I was taught by the Jesuits years ago that what creates inflation is rapidly escalating growth in money velocity, a far more potent inflation barometer than the growth of money supply. Velocity is how fast money is turning over while money supply is the total amount issued. If the total amount issued sits in savings accounts or gold, it is a depressant upon activity because there are reduced transactions.

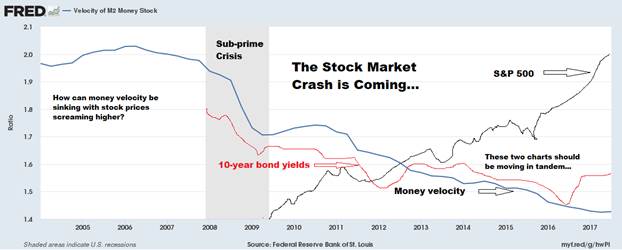

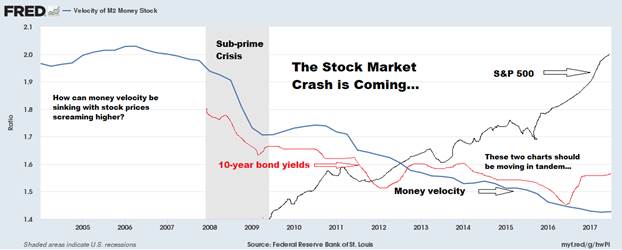

With the money-printing rescue that began in 2009, markets were forecasting that eventually, the $14 trillion in printed U.S. dollars would awaken from its low-velocity slumber and once roused, would rain down a mountain of inflationary pressures upon the consumer, which is what is about to happen in 2018. However, the chart below tells a very different story at first glance because you are seeing a steady decline in velocity despite unprecedented monetary growth and stimuli pretty much for the last ten years. The chart below says that bond yields and money velocity are watching the same maestro's baton while stocks are listening to ear buds with blinders on. Sadly, we know from history that dichotomies like this cannot last; they die an agonizing death and take a pile of souls along for the descent.

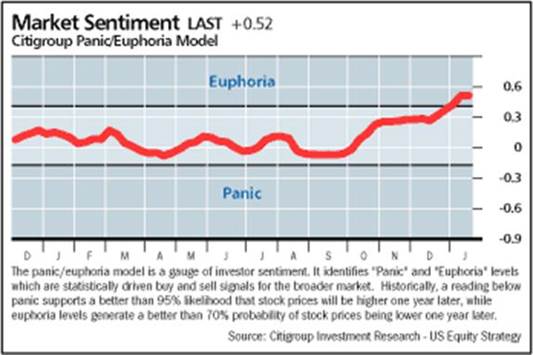

The next graphic is one that I have used for years—the Citigroup Panic/Euphoria Model—and it now resides squarely in "euphoria" mode, a condition that has tended to usher in many of the bear markets of the past few decades. Bob Moriarty refers to Jake Bernstein's "Daily Sentiment Index" for the S&P and NASDAQ, and says that it has broken into the 90s and traded up to 95 in that move, a reading not unlike my RSI readings above 70 for the Gold Miners in that they historically spell "T-O-P."

The chart below has the RSI for the S&P above 80 and marks the sixth time since February 2017 that this has occurred. Now, based upon DJT's tweets, we know that he is delighted with the performance of the stock markets under his "watch" but when you combine the Panic/Euphoria Model with the DSI and the RSI for the S&P, you have to be taking some very serious anti-depressants to stay invested.

Now, there is nothing in this world that I would love to report more than a major shift in thinking by your dutiful author. In the 1990s, the emergence of the Internet changed a great many ways of doing business and improved efficiencies and productivity in a manner that fully justified the decade-long boom and the concomitant ascent in stock prices. However, there is no such technological or geopolitical event that has occurred (NO it is not Bitcoin or blockchain) responsible for the boom in equities. And to prove just one difference between the 1990s and where we are today, I offer up one more chart from the Saint Louis Fed showing how money velocity was growing THEN versus the abysmal decline we have witnessed pretty much since 1998.

When I wrote about the "True Meaning of Bitcoin's Success" in early December as it approached $20,000, what followed was a torrent of hate mail from the Bitcoin/blockchain longs (who have since been crushed) whose responses varied from extremely erudite dissertations to outright obscenities with the common thread being that I really did not "understand" the generational opportunity represented by this "alternative currency." They were absolutely correct in their assessment of my cognitive shortcomings to the extent that they can now rejoice that I am committing the same cognitive indignity when it comes to stock prices. They are so correct! I do NOT understand Bitcoin and I do NOT understand this advanced mania/love affair with U.S. stocks.

I long for the days when a company's value was dependent upon the amount of dividends it could (and would) pay to shareholders, which could be handicapped by observing the properly accounted for financials where free cash flow could be measured. I long for the days when an exploration company's discovery would be celebrated with massive upside volume as savvy investors appreciated the rarity and wealth effect of a major drill core intercept. I yearn for a return to free markets where men and women delivered orders to buy and sell and were the collective respiration of the creature called a "market." This techno-centric era of instantaneous gratification and engrained entitlement is now fully reflected in the melt-up in everything that resembles banker collateral, which is anything upon which they can earn a fee, whether duplicated or not. This irrational race for valuation supremacy by all-things-bank-controlled is matched in its ferocity only by an ignominious obsession to suppress the only time-tested stores of value (gold and silver) if only as a means to show us all that "it really is DIFFERENT this time."

The title of this missive should not be confused as a portent of things to come; the "replacement value of equities" has already reflected investor disdain for savings and is a past era soon coming to an end. The move off the 2009 lows is nearly nine years old and is now in the record books for the length of advance without a meaningful correction. For the reasons mentioned above (and more than a few others too long to recount), I think that finally the very people that have controlled the advance—the central bankers—are finally fearful of this monstrous speculative entity they have created. Just as they are reeling in Bitcoin, the global central banks will reel in stocks and whether that comes via rate increases or the cease-and-desist orders on stock-supporting algorithms, it is finally time for the beast to exhale.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure: 1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and images courtesy of Michael Ballanger.

Read more by MarketSlant Editor