Source: Streetwise Reports 03/06/2018

Lawrence Roulston, managing director of WestBay Capital Advisors, discusses the mineral-rich, but often overlooked, main island of Fiji, part of the South Pacific Ring of Fire, and several active miners there.

The Gold Report: Lawrence, thanks for joining us today. You've had a long career in mining. Would you tell us about it?

Lawrence Roulston: I've spent about 40 years in all aspects of the mining industry, initially with a major mining company and then management of mid-tier and smaller companies. I spent about 15 years as the editor and publisher of an independent newsletter called Resource Opportunities. Then I spent about four years as a consultant and then the president of the Vancouver affiliate of a big Texas-based investment group. For the last year and a half, I've been an independent consultant/advisor for a number of mining companies and also for institutional and high-net worth individuals, scouting out and doing due diligence on various investment opportunities. I've seen the mining industry from multiple sides and I've had boots on the ground on literally hundreds of projects around the world.

TGR: From all your research and due diligence, is there an area that you're quite excited about?

"Lion One is a truly exceptional investment opportunity at this time."

LR: There are a couple of areas that I think are very highly prospective but under appreciated. One of them is Fiji. A lot of people think of Fiji as a holiday place, but they completely miss the fact that Fiji has a long mining history, and mining is actually an important part of the economy of Fiji. It's been overlooked by the mining industry, and certainly there are very few investors that really appreciate the enormous geological potential of Fiji and the near-term opportunities that are available in Fiji.

TGR: What is it about Fiji that makes it so interesting geologically?

LR: Fiji is part of the prolific Pacific Ring of Fire. Some of the biggest and the highest-grade metal deposits in the world are based in and around that Ring of Fire. The South Pacific part of the Ring of Fire is particularly productive. The Grasberg Mine in Indonesia operated by Freeport-McMoRan Inc. (FCX:NYSE) and Newcrest Mining Ltd.'s (NCM:ASX) Lihir Mine in Papua New Guinea are two of the biggest gold deposits in the world; they both are directly related to the South Pacific portion of the Ring of Fire. There are a number of other very large deposits along that geological feature, and Fiji sits smack in the middle of that big, incredibly productive geological feature.

TGR: Are there companies in Fiji that you're particularly paying attention to?

LR: The one that really opened my eyes to the potential of Fiji is Lion One Metals Limited (LIO:TSX.V; LOMLF:OTCQX). A few years back, when I was doing the investment newsletter, I went to Fiji to tour its Tuvatu project. I had known Walter Berukoff for many years and thought very highly of him. He already had three major successes in gold mining, where he put together projects and sold them for very large profits for shareholders. In fact, Berukoff has created about $3 billion of shareholder value.

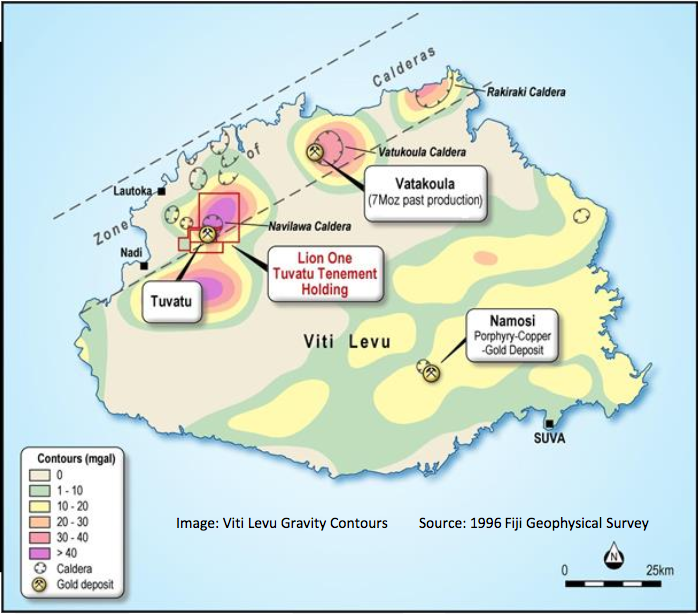

Like so many property visits, seeing Tuvatu on the ground and getting a chance to look at it in detail was a real eye opener. The Vatukoula deposit in Fiji has already produced 7 million ounces (7 Moz) of gold, and there's still about a 4 Moz in place at Vatukoula, with further potential. The Tuvatu system is geologically similar to Vatukoula and on trend. They're both low sulphidation, epithermal vein-type deposits associated with alkaline-intrusive complexes.

There are about 80,000 meters of drill core available for the Tuvatu project. That core gives a good view of the nature of the deposit. The intensity of the mineralization is quite evident: the very high grades that are produced by this system. And the pervasive nature of the gold mineralization. It was also important to see the logistics of the project. It's less than an hour's drive from the international airport, but it is removed from any habitation. The setting is good for mine development: The portal goes into a hillside, with lots of space in the valley for the process plant and other infrastructure.

TGR: Has Lion One put the underground development in place or did it take over an existing facility?

LR: A lot of work was done at Tuvatu by the company that previously operated the Vatukoula mine. It initially looked at Tuvatu to provide high-grade feed to its existing operation. But as the company got into it, it completed a feasibility study on Tuvatu as a standalone operation. That company did 1,400 meters of underground development, in part to explore the deposit but, also, with the intent that it would use that development for production.

That company went bankrupt due to problems with other projects. So that's when Walter Berukoff was able to pick up the Tuvatu deposit.

TGR: And has Lion One conducted comprehensive exploration of the property?

"Lion One has a fully permitted mine well on the way to production."

LR: Initially, Lion One looked at the large-scale potential of Tuvatu, but then elected to focus on the near-term production potential. That made a lot of sense, with an extensive data base from the earlier drilling and with underground development in place. The company now has all the permits for mine development and has started construction.

Lion One's early exploration efforts pointed to potential well beyond the resource area. But, the company was constrained by its property position at that time. Last November, Lion One secured title to another 100 square kilometers, so it now controls the entire geological system. That gives Lion One control over a caldera complex on the same scale as the system that hosts the Vatukoula mine. It is also similar geologically, and of a similar size, to the Lihir complex, another very large gold deposit.

Work by Lion One and previous explorers identified gold values throughout the caldera. The focus was on Tuvatu, as that's where the previous drilling was concentrated. There are numerous other areas that are equally promising. For example, recent sampling at Jomaki included a value of 502 grams per tonne over 0.7 meters from a trench. That exceptional value was a follow-on to an earlier sample that returned 125 g/t in the same area. There are a cluster of veins at Jomaki that are similar to Tuvatu. I expect that other areas will turn up similar results as Lion One puts the time and effort into detailed sampling of these other prospects.

But, exploration will be secondary to getting the mine into production. The intent would be to carry out a larger exploration program with cash flow generated from the mining operation.

TGR: Do you know when it expects to begin operation? Does it have the permitting it needs to develop the mine itself?

LR: Lion One has all the permits needed to develop the Tuvatu mine. In fact, the company has begun construction. Some of the long lead items are already underway, funded from cash on hand as Lion One continues to round out the financing needed to complete the mine development. Detailed engineering is progressing; earthworks are underway; other infrastructure items are progressing; construction is underway on the assay lab. Lion One is close to awarding a contract to a mining contractor to continue the underground development and build up a stockpile of ore. If the company can get the funding in place soon, it should be in production within a year. The initial phase of development will produce about 60,000 ounces a year. That number could increase as Lion One continues to prove up more material around the mine.

TGR: What is the anticipated life of mine?

LR: The plan now involves about a six-year mine life, based on the existing resource. Outside of that resource, there are a lot of drill holes that have shown that the gold mineralization extends well beyond the area of the current resource. The recent drill results are further confirmation that there's lots of upside potential immediately around the proposed mine. The intent is to continue to explore as they are mining. There is good potential to boost that production level and to extend the mine life, based on the indications around the existing resource. The newly acquired ground provides a great deal more upside potential, both in terms of higher production levels and longer mine life.

Lion One is a truly exceptional investment opportunity at this time: The company has a fully permitted mine well on the way to production. It also has exploration upside on the scale of the Vatukoula mine, which has produced 7 Moz of gold to date.

TGR: Are you following other companies in Fiji?

LR: The biggest player in Fiji is Newcrest Mining, a major gold producer based in Australia. It is working on the Namosi deposit, which already has 5 Moz of gold in a resource and about 11 billion pounds of copper.

There's another junior that is also very interesting. I have to disclose that I'm a director of that company. I was invited to join the board in part based on my familiarity with Fiji. The company is called Thunderstruck Resources Ltd. (AWE:TSX.V; THURF:OTC.MKTS). It has a very large exploration property located between Namosi and Tuvatu. It's early stage but highly prospective. There was quite a lot of work done on it a couple of decades ago by one of the majors—AngloGold—but it pulled out of Fiji. Thunderstruck has acquired that extensive property and is building on the data base generated by the major. It has validated the earlier work and also demonstrated exploration potential well beyond the work that was done by the major. It's an earlier stage project than Lion One but it's also very, very interesting.

Given the enormous geological endowment in Fiji, and the welcoming attitude of the government, its surprising that there aren't more companies. To a large extent, the companies that are there had first pick of the projects.

TGR: The Fijian government is supportive of mining?

LR: It's very much mining friendly. The Vatukoula mine has operated there for 80 years and it remains an important part of the economy. The government is very pro-mining. Lion One had full cooperation from the government at all stages through the permitting process. It had to go through all the steps that it would go through in any other jurisdiction, but the government was supportive and the rules are stable. And the same for Thunderstruck: It has received all the permits it needs to carry out its work. The Fiji government is very much open to investment by foreign companies; it wants to bring more jobs into the mining industry. Fiji is highly prospective geologically, and a great place to work.

TGR: Thanks, Lawrence, for your insights.

Read what other experts are saying about:

Lawrence Roulston is an expert in the identification and evaluation of exploration and development companies in the mining industry. A geologist with engineering and business training, he is the managing director of WestBay Capital Advisors. He generated an impressive track record for Resource Opportunities, the subscriber-supported investment newsletter of which he was founder and editor. He is now an advisor, director and/or CEO of several companies in the mining sector and also works on behalf of institutional and high net worth individuals to scout opportunities and do due diligence.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new interviews and articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure: 1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None. 2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: Lion One Metals. Click here for important disclosures about sponsor fees. As of the date of this interview, an affiliate of Streetwise Reports has a consulting relationship with Lion One. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Lawrence Roulston: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Thunderstruck. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: I have a stock option in Thunderstruck. My company has a financial relationship with the following companies mentioned in this interview: None. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview. 4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Read more by MarketSlant Editor