In an industry known for its picks and shovels, in the hunt for gold treasures, the mining industry going through a technology renaissance, that many tech investors are missing, focusing on SAAS, PAAS, and IAAS companies in Silicon Valley. Yet mining production locations are ideal locations for autonomous implementation because the production occurs in a relatively more controlled environment than rolling out a self-driving car in downtown Sydney, London, or Vancouver. Rio Tinto has been the first mining company to deploy a fully autonomous ‘robot’ train to make deliveries of iron ore.

In July, the autonomous train made its first delivery traveling over 280 km. The project is called AutoHaul Project and will be the largest fully autonomous train network for heavy hauling in the world.

Note: Autonomous Driving Starts at 01:30

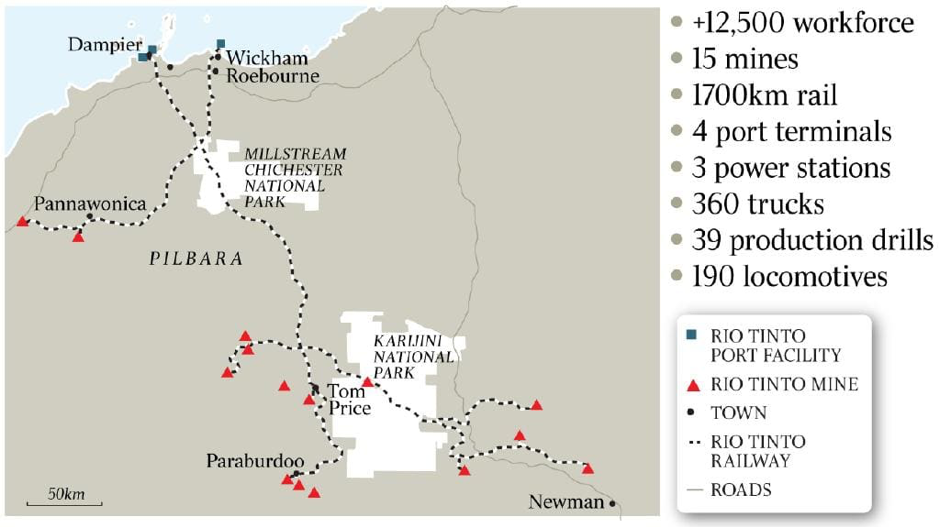

Rio Tinto’s fully automated train will haul iron ore from its operations in the Pilbara region to Western Australia port facilities. Rio Tinto has more than 200 locomotives, across more than 1,700 kilometers of tracks in the Pilbara region. At the end of the first quarter, there were 1,100 km’s of track already automated, with the remainder of the tracks finished by the end of 2018. [1]

Rio Tinto Railroad Track

Source: The Australian Miner

Bottomline Impact:

“The system, which began testing this year, would allow Rio to run driverless trains across its rail network, eliminating the need for upwards of 500 drivers and delivering a savings of more than $100m annually.” (Source:WEForum).

We estimate this automation would add about $0.05 USD to Rio Tinto’s earnings.

“In 2012-2013, an Australian mine worker earned US$137,100, while his Brazilian counterpart earned US$76,800. Similarly, BHP Billiton reports that Pilbaran train drivers earned an average of US$190,694 in 2013; they bring a high degree of technical skill to this remote location—necessary to safely transverse the diverse topography while carrying such heavy freights.”(Source:WEForum).

What are the other diversified miners doing for rail automation?

Fortesqcue:“Developing its own integrated train control system for its network based in Perth that will track its trains via GPS and digitally deliver operating instructions.”[2]

BHP: “(BHP) has indicated that it would prefer to allow others to develop automated train technologyand then adopt the second-generation technology when it becomes available.”[2]

VALE: “Vale relies on a multi-user railway and cannot turn to automation as easily. It therefore decided to cut costs in its Brazil operations instead, investing US$20bn in a project that will build a railway through the Amazon and replace mining truckswith a 23-mile-long conveyor belt in the hopes of reducing mine-to-port costs”. [2]. These initial form of transportation improvements should facilitate further automation going forward.

What has already been deployed for automation in mines?

Caterpillar and Komatsu have already deployed self-driving dump trucks across mine operations. The controlled operations of the mines make it ideal for this type of automation. Glencore Technology’s Isa Mills are largely already in operation by Minera Peñasquito, Xstrata Copper, Xstrata Zinc, Teck, OceanaGold, Kalgoorlie Consolidated Gold Mines, MMG & Heron Resources. [2] This increased automation will reduce labor on the mines during the commodity price acceleration because of increased technology usage implemented. You also have Volvo build a self-driving truck for underground mines, over a 6 km track.

Labor Market Will Transform With Key Winners

Just like how farmers transitioned to manufacturing during the 1930’s-1940’s. This third industrial revolution, where automation now is focused on very specific industries outside of traditional tech, that will truly transform the labor force over the next 10 years. Mining is a low hanging fruit sector because of the controlled environments, remote locations, high labor costs, labor sourcing challenges, and cost pressures from a low-commodities price environment. Equipment providers turning to deliver more automation for companies should be able to increase equipment providers margin, as we think over time we will see more Tesla attempts to automate as much of the equipment manufacturing. Higher value technology offerings by equipment manufactures should boost their margins as they are able to offer new SAAS and PAAS as part of their product offering to miners. The OEM’s that are able to transform with more technology in their offerings, should be able to gain more competitive advantages, and thus monopoly or duopoly positioning. There are also the GPU manufacturers like NVIDIA inside the vehicles, and TE connectivity which provides the heavy-duty equipment sensors that can be benefactors of increased transportation automation.

WHERE WILL FUTURE SAVINGS COME FROM?

Mines operations are becoming one of the most automated operations in the world. The remaining factor comes down to, how much more cost efficiencies can be made if the miners have already automated major items like hauling and milling? One remaining area would be in implementing solar on operations to reduce diesel and costs in these remote locations. We think there are value chain opportunities outside of the traditional miners that both technology and mining investors are missing, to a rebound in the natural resource sector over the next 3-5 years.

In case you are wondering, no one was inside the cab when it was delivering the ore.

Paul Farrugia, BCom. Paul is the President & CEO of First Macro Capital. He helps his readers identify mining stocks to hold for the long-term. He provides a checklist to find winning gold and silver mining producer stocks, including battery metals.

Read more by First Macro Capital