Source: Michael Ballanger for Streetwise Reports 10/14/2018

Precious metals expert Michael Ballanger discusses the stock market volatility of the last week and what it may mean for precious metals.

When asked about the dominant theme for the markets last January, I said that the one thing I looked forward to was a return of "VOLATILITY" as the Federal Reserve Board moved to "normalize" the interest rate structure, now commonly referred to as quantitative tightening. What has actually transpired since then was a brief volatility spike in February during which the UVXY tripled in ten days but other than that, markets screamed higher, hitting new high after new high with annoying complacency and irritating certainty while "VOL" collapsed.

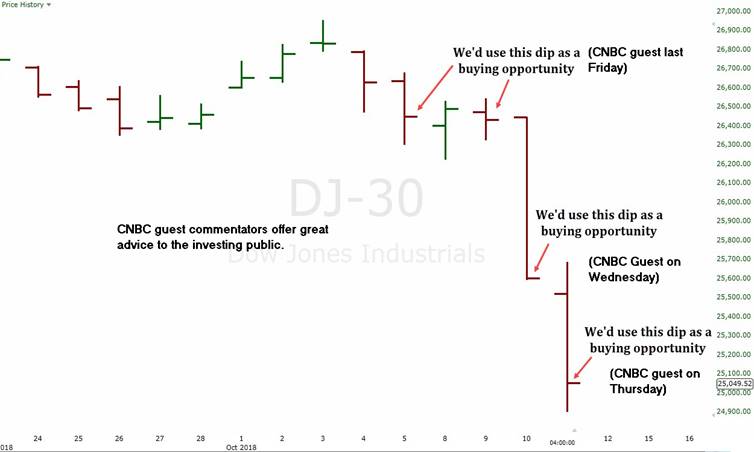

Despite the U.S.-China trade friction, rising yields, weak overseas markets and increasing geopolitical tensions, the NASDAQ has been on fire while Canadian weed deals have dominated water cooler conversations for most of 2018. Volatility has been largely absent – until last week, when it snuck into the upstairs bedroom under cloak of darkness and removed all cash and jewelry from the room. The S&P 500 (after Thursday's close) had given back 7.2% from its 2,940 peak seen in September when every anchor or commentator in the financial media was breathless with glee. S&P began the Friday session up a mere 2.05% YTD, which is still positive for the year, and remains superbly superior to gold's 6.24% decline since 2018 arrived.

In February and in May, gold and stocks were neck and neck but once the Donald decided to ratchet up the trade war, interventions became epidemic and the S&P quickly took off with gold doing the reverse. The gold gurus point to the "China Peg" as the bogeyman in the precious metals bedroom but the reality is that the algobots picked up the correlation and as they did with the gold-yen and the gold-euro pairs in earlier times, they tend to stay with the correlation "that is working" for longer than you can say "rational." I will refrain from debating whether it is a Chinese "policy" peg or an "algo-gone-anal" peg but the reality is that IF the West wants the Chinese currency UP versus the U.S. dollar, all it needs to do is move gold to $2,000 per ounce and the currency issues will be summarily corrected. (As will my net worth issues as well.)

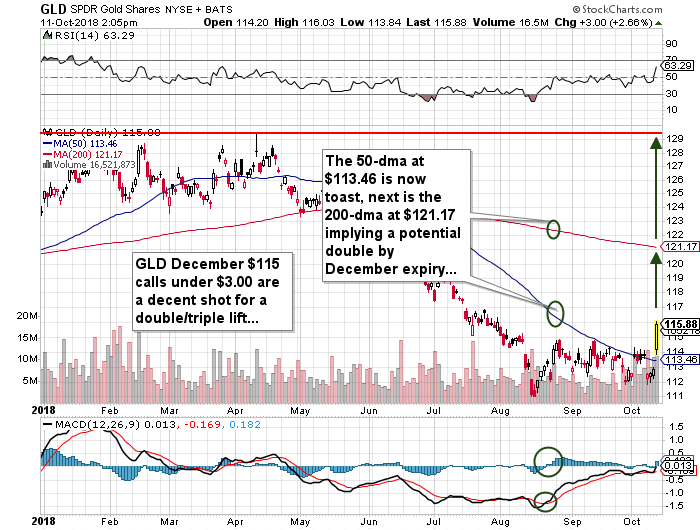

Thursday's $34 move in gold was a reaction of classic proportions to stock market routs occurring around the world with alarming frequency but what was bothersome was that silver failed to catch the slightest of bids closing up a tad despite the impressive move in gold. As you all know by now, precious metals advances that have "teeth" include silver outperforming gold and the miners outperforming the metals so Thursday's action was incomplete in firing up the adrenalin. I tweeted out my intention to add to my holdings on Friday in selected junior explorcos as well as buying the GLD Dec $115 calls for under $3.00. I wanted to see the silver market outperform the gold market Friday (which it did) AND I needed my trusty canine Fido to come out from under the tool shed (which he did) in order for my bravery level to allow me to pull the trigger on these positions.

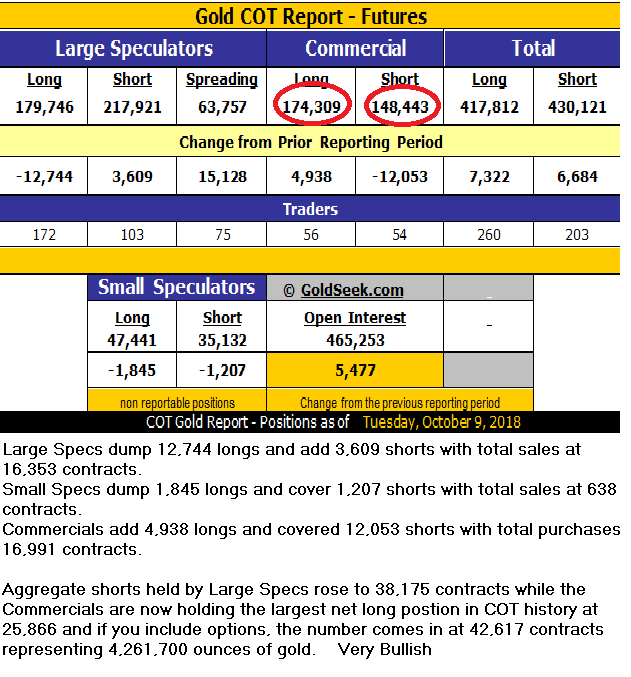

Back on August 27, I published my letter under the title of "Back up the truck..." in response to the terrific technical action of gold as it was coming off the $1,167 lows since from August 16 with a proviso that I needed the market to remain above the $1,200 level for more than a millisecond in order for me to go "ALL-IN." For the next five weeks, gold meandered over and under $1,200 a dozen times with the lows being in the mid-$1,180s while the omnipotent COT Report (tongue firmly planted "in cheek") failed to ignite anything more than a yawn despite the more-than-often-right Commercials actually long gold for the second time in 20 years and amazingly long silver for the first time ever.

Coupled with record shorts held by Large Speculators in both gold and silver, the potential for a short squeeze was high and rising then and even higher and rising now. However, I still need to see the dips be bought and the rallies left alone in order to convince myself that this is finally the point where money flows back into the U.S.-dollar denominated price of gold, which in turn will send the stock jockeys piling into the Junior and Senior Miner ETFs as well as the little explorcos. I believe this is an ongoing process that will accelerate as returns in the NASDAQ fade and money moves in search of alternative returns as happened in 2002 and late 2015. In Canada, as soon as the weed deals get crushed, money will also gravitate back to mining so the right course of action is to accumulate physical gold and silver in advance of this "Great Rotation" out of paper assets and into hard assets.

This past week's highlight was Thursday's big rally in gold but as of Tuesday, the bullion banks had accumulated the largest long position in gold futures since the CME began reporting the COT numbers. Up until this week, COT structure extremes had gone largely unnoticed as the algobots continued to press their short bets while the Commercials were tickled pink to accommodate. Thursday's action was terrific in that I got a chance to witness what happens when a large amount of emotion spills over into the relatively miniscule precious metals markets and catches the 'bots on the wrong side. Being devoid of emotion, the 'bots simply follow the signals and if it is time to cover shorts or initiate new longs, they do it "at market" and will keep at it until either the software commands it or the price managers pull the plug.

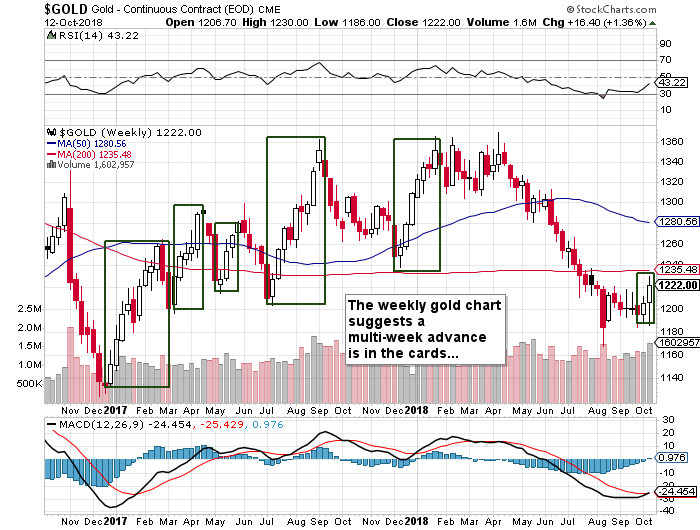

To have a $6 pullback after that massive move on Thursday was a large "NOTHING" but next week I will need to see (and EXPECT to see) a follow-through surge with silver coming out of the starting blocks on fire. I cannot stress enough the significance of this COT report; it is historic. The net long position of the always-short Commercials is 42,617 contracts and that compares with the December 2015 bottom at $1,045 when they came in at a wildly bullish net short of "only" 2,911 contracts. What followed was a truly massive rally in bullion (37%) and a 280% advance in the HUI. We are coming off an August/2018 low that is $122 above the December/2015 low with the HUI 54 points above the January 2016 capitulation low of 99.17.

With sentiment so drastically negative, the potential exists for a multi-quarter advance that can resemble that spectacular eight-month rally in 2016 but if you want to know the truth, I say it will be more akin to 2002, where those positioned in silver at $10 even after it was up 300% saw another 500% advance by 2011. As for the outlook for the miners, Goldcorp was a $4 stock in 2002; it peaked at over $45 in September 2011. Think about it.

If we get a move north of the 100-dma at $1,240 next week, the stage will be thoroughly set for an advance to 200-dma at $1,295 where it will need to spend a great deal of time consolidating as the magic $1,300 was a major area of support in May until it got crushed on June 21. For now, I am confident that the mid-August lows are your stop-loss floor and the assault on $1,400 is now officially underway. I backed up the proverbial truck and filled up the bed back in August-September but with the weekly chart looking so positive, it is finally time to find something with a tad more cargo space and just to give you an idea of how bullish I am for Q4/2018 and beyond, the appropriate vehicle to be loaded this time is a large ocean liner or an oil supertanker.

One final note: You may have noticed a trace of exasperation in my writings of late and if indeed you did, you are distinctly on the money as there is no question that my affinity for gold hit a career low last month but it had nothing to do with gold or silver. It had to do with an almost perverse sense of regret in recommending and investing in Western Uranium. I have consistently made above-average returns in trading gold and silver since I entered the securities industry in 1978 but the recent arrival of the algos into the gold pits have taken away from me the ability to use gut feel or tape sense or pit instincts to make decisions and execute. I liked Western Uranium in 2016 after meeting the principal investors in the deal but the timing was wrong and I saw my $1.70/unit investment go into terminal crash-dive mode as uranium continued its death spiral to $18/lb. I assisted with the financing effort six weeks ago at $0.68 per unit (including a half-warrant at $1.15) and watched with amazement as investors decided out of nowhere that vanadium was undervalued and then followed it up with a similar revelation for uranium.

Call it morbid curiosity or outright cynicism but I have become so engrained with the dismal action in gold and silver and the miners that to see WUC scream out of the gate and quintuple eight weeks after the placement closed put me squarely into a state of disbelief. Since the financial crisis of 2008, we have watched no fewer than twenty-five events that should have taken gold through $2,000 per ounce but constant interventions and manipulations continually to plagued precious metals price performance in truly maddening fashion. As gold investors, when was the last time that we had a gold stock go from $0.68 to $3.32 in two months on a valuation reset? Therein lies the root of my angst. After all I have tried to convey over the years, when was the last time a gold (or silver)-related security actually became a brilliantly successful trade? A few have, but the majority are usually doomed to the mediocrity of shitty markets or shitty management, both of which I deem a most-convenient cop-out.

The frustration I feel lies in the truth that underlies the 2018 landscape; the elite class want the bankers, politicians and regulators to ignore 5,000 years of history. They would instead prefer to demand that their appointed central banker like Greenspan or Yellen or Powell simply follow the plan that was originated after the 1987 market crash and ensure that markets behave according to the carefully crafted script, which means gold and silver are the enemy, stocks are our saviors, and bonds don't count. As stated earlier, the bullion banks that have been pointed to as the major culprits in the gold and silver rigging scheme are now heavily positioned for an up move and have been since August. The inevitability of the Commercials crushing the hedge funds is the reason I expect the miners to begin to perform like the uranium/vanadium stocks, where REAL supply and REAL demand ex-interventions create a free and natural upward hydraulic so absolutely critical to properly-functioning markets.

This coming week will tell us whether can welcome a new paradigm for the precious metals or whether we simply devolve back into the status quo. Stay tuned and cross your fingers.

It is time.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Western Uranium & Vanadium Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: Bonaventure Explorations Limited is owned by me and my wife and has earned consulting fees from Western Uranium & Vanadium in the past. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium & Vanadium. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Uranium & Vanadium Corp., a company mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Read more by MarketSlant Editor