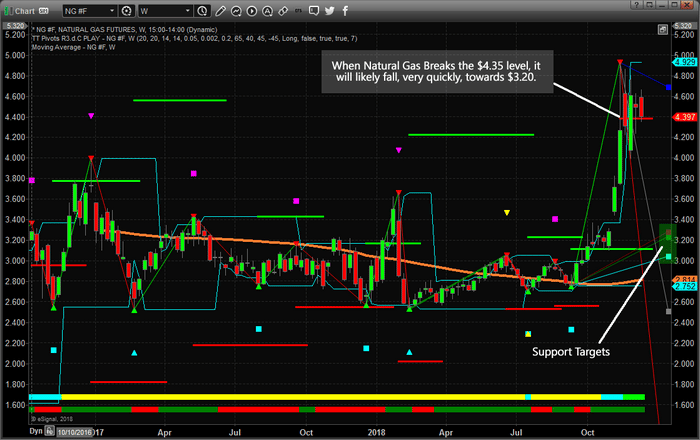

Our proprietary Fibonacci predictive modeling system is suggesting Natural Gas is about to break down below the $4.30 level and move aggressively toward the $3.05~3.25 level. This could be an incredible move for energy traders and a complete bust for existing longs.

This Weekly Natural Gas chart is showing our Fibonacci Predictive modeling system and highlighting the lower support price targets just above $3.00. We believe price weakness will break the $4.30 level very quickly and drive prices well below the $3.40 level – very likely towards support near $3.25 over the next few weeks.

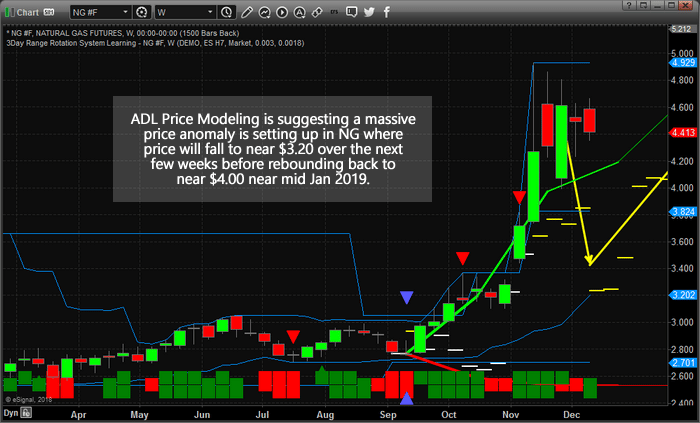

Our Advanced Adaptive Dynamic Learning predictive price modeling system is showing similar results. It suggests a major price anomaly is setting up in Natural Gas that will prompt a massive downside price move over the next 2~3 weeks before an equally incredible price recovery takes place. The total of this predicted price swing is nearly $2.00 ($1.00 down and then $0.85 back to the upside). If this move takes place as our modeling systems are suggesting, this will drive a massive “washout move” pushing the long traders out of their positions on the way down and then pushing a massive short squeeze on the way back up to near $4.00.

This is the type of price swing that makes for incredible success stories if traders can play this move properly. Pay attention to the fact that the lower predicted levels of our ADL system (shown near $3.20) may not be reached in this downward price swing. Our predictive modeling system is suggesting these are the highest probability price outcome based on its internal price and technical analysis. Still, when one takes a good hard look at this chart, it is easy to see the “price anomaly” setup where the current price of Natural Gas is nearly $0.80 above the currently predicted price levels (shown as YELLOW DASHES) and how the ADL Predictive modeling system is suggesting a big downward move is about to unfold.

Want to keep receiving incredible trade setups like this one and learn how our research team and specialized price modeling systems can help you find and execute better trades? Then please visit Technical Traders Ltd. to learn more about our services and tools. We have been helping traders find and execute better educated trading decisions with our specialized tools and research for years. Visit www.TheTechnicalTraders.com/FreeResearch/ to read all of our most recent public research posts and to see how we've been calling these market moves over the past few months.

Chris Vermeulen

Read more by TheTechTrader