Opec Wins, UK Grins, and Gundlach thinks the bond market is crazy.

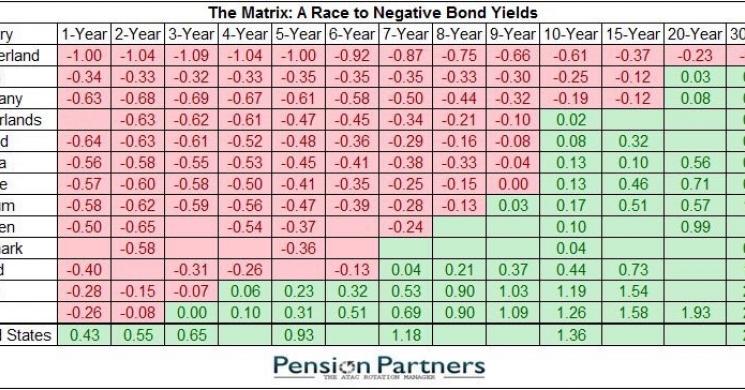

This is the bond market on drugs

Oil Production Climbs

- Saudi's get their way. Other OPEC members obey

- New projects are not viable unless Oil over $60/ Barrel

- Existing Shale projects may eb viable over $50

- Rig counts dont matter as much as wells do.

UK's Cameron to hand PM to Theresa May today

- transition calms UK markets

- GBP still under Brexit levels, but bottom likely in

Gundlach Calls Yield Search a Mass Psychosis

"Call me old-fashioned, but I don’t like investments where if you’re right you don’t make any money,” Jeffrey Gundlach, chief executive officer of DoubleLine Capital said

- Germany issued negative yielding bonds for first time

- Switzerland issued more negative yielding bonds going out to 2058

- Gundlach thinks that makes US Bonds a buy relative to their counterparts

- Doubli Line is long Gold and outspoken on the topic

Industrial Commodities Rally on Stimulus

- Copper, Silver and Rebar are all higher

- Oil weaker on its own data, but still higher post Japan Stimulus announcement

Equities Slow Rally

- Nikkei Strong

- Uk and EU lose tail wind from regional open issues

- USA markets pause for breather

-Soren K.

Read more by Soren K.Group