Over the last 10 days Bitcoin and the whole crypto sector strongly bounced from oversold levels and posted a significant recovery. Some of the altcoins more than doubled already. Before that a two week long base building pattern coupled with extreme negative sentiment divorced the last weak hands from their cryptos. Especially an extremely bearish call from one of my favorite contrarian indicators “The Bank of America” demonstrated how beaten down sentiment was in the second week of April. But by now, anybody who was willing to buy into that weakness has made pretty good returns already for which other asset-classes often need years…

Today Bitcoin is back to well-known resistance around 9,000 USD and is clearly getting overbought in the short-term. A pullback, at least, would be just logical.

Bitcoin Technical Analysis

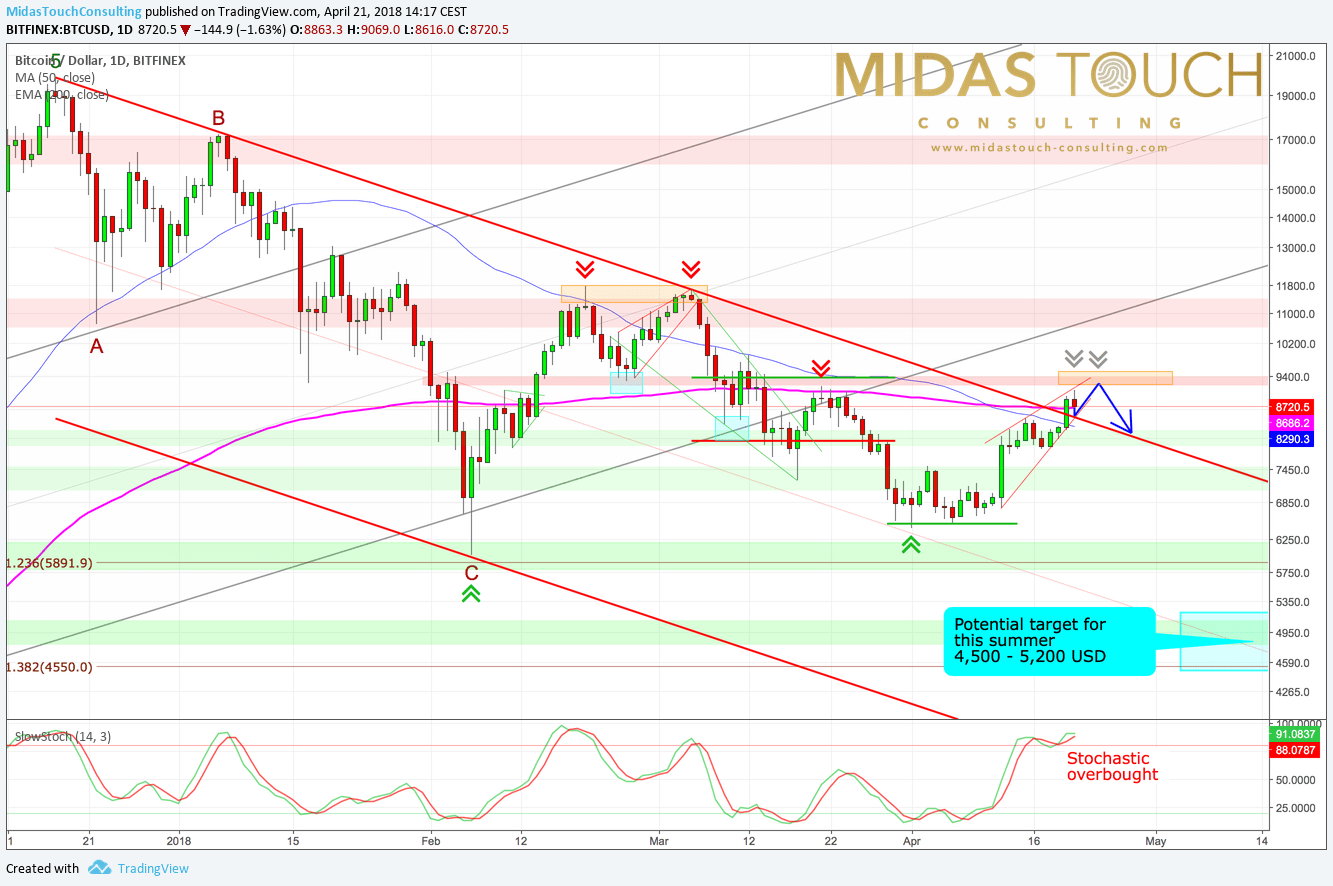

Fortunately, yesterday Bitcoin was able to break out of its downtrend channel on its logarithmic chart! Of course, that is a positive development and improves the big picture. But while reaching the zone around 9,000 – 9,200 USD, bears will come back into the game. In fact, this Saturday morning they were already able to push prices down 450 USD within just a few hours.

Surely, professional money has been taking profits around 9,000 USD. As you remember, in mid of March Bitcoin tried to move above 9,200 USD for five days without any success. Now we are back at these levels in an overbought fashion on the daily chart! As well, the flat 200-EMA is sitting around 8,686 USD strengthening the general resistance in this area.

Looking at the slow stochastic oscillator, it is clear that Bitcoin is overbought and that buying into current levels actually makes zero sense. Instead, professional traders and investors should use any ongoing strength towards and above 9,000 to 9,200 USD to lighten up on positions. There will surely come a new opportunity to buy back into the sector at lower prices. Expect a pullback towards 8,000 USD at least over the next couple of weeks…

Although I am generally still hesitating to call the end of this crypto winter, in the very big picture cryptos remain in a bullmarket. Therefore it makes sense to always have some exposure to this market cause nobody knows the future and bullmarkets always create surprises on the upside! Buying into weakness and sell some of your profits into strength is the way to go. In this case, the market is basically financing your position and with some discipline you will find yourself in a free position without any risk! In our free telegram channel you can learn more about how to trade the exciting cryptomarkets with a profitable, stress-free and low-risk approach.

Bitcoin CoT-Report

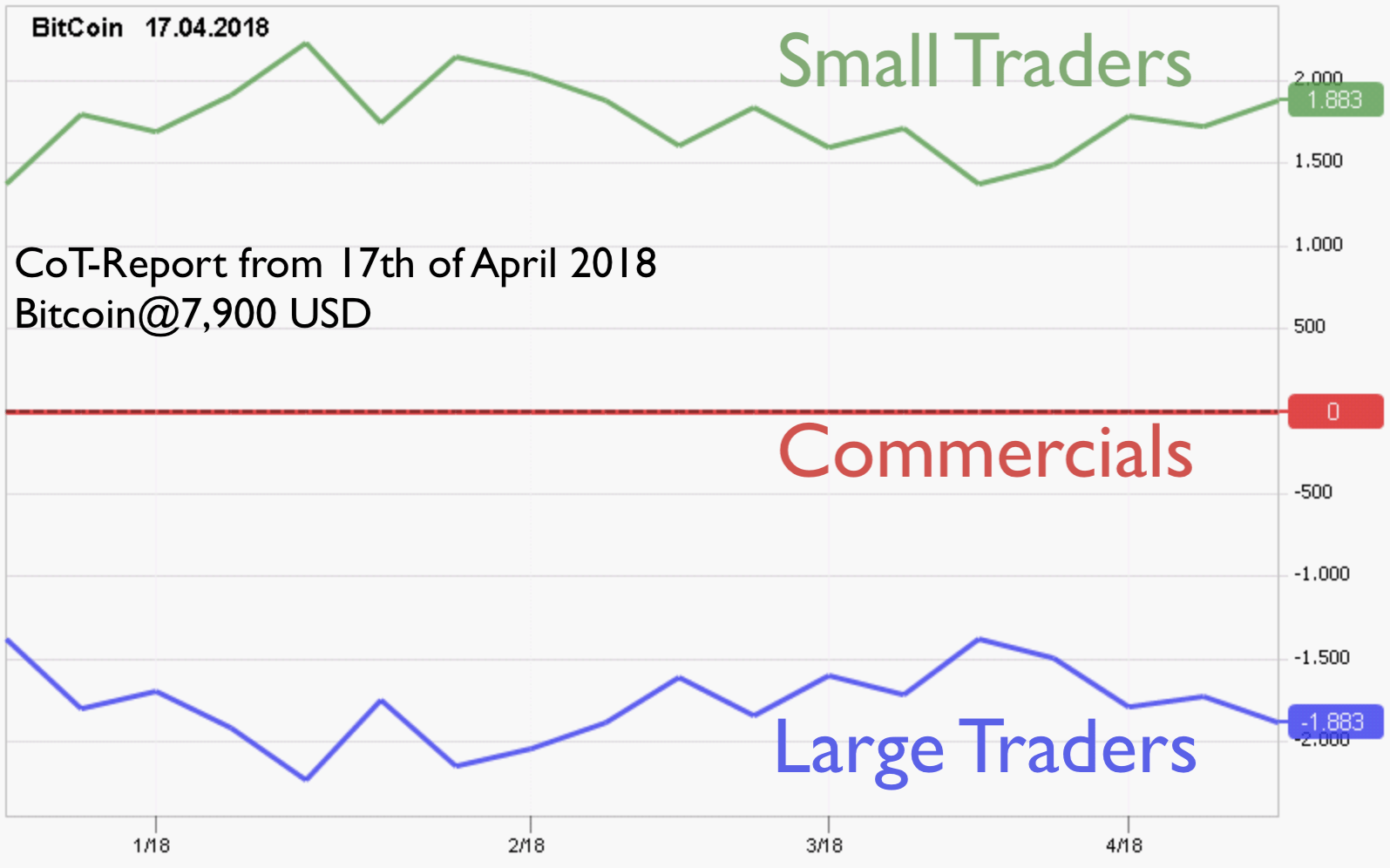

The latest CoT-report for Bitcoin futures shows that the small traders did extend their long positions into the recent strong rally while the large traders (hedgefunds etc.) have increased their shortposition again. Of course, with Bitcoin now being more than 1,000 USD higher the numbers should already have changed quite significantly. As well, we are still missing enough data over a longer time frame to be able to make good assessments here. On top, the best contrarian indicator, “the commercials”, are still not active in this market as there are not yet enough structured or derivate products which they would have to hedge via the futures market. Overall, the current CoT-report paints a neutral picture for Bitcoin.

Bitcoin Sentiment

Over the last two weeks sentiment has strongly recovered! According to the lastest data from sentimenttrader market participants are getting overly optimistic again. The latest numbers are just barely sitting below excessive optimism levels. Even though that doesn´t mean that Bitcoin and the crypto sector have to pullback immediately, it certainly sends a warning signal and a clear call for patience and profit-taking at current levels!

Conclusion

Once again, Bitcoin and the crypto sector have recovered with light speed (could be typical for a bearmarket rally!). Nowhere else it can be so rewarding by simply buying weakness and selling strength. Now that Bitcoin is up 2,630 USD from its recent lows (+40% in 10 days), it is time to step back, take profits and let the market do whatever it does. We might see another attack towards 9,200 USD very soon. Even a prolonged rally towards 10,000 USD is possible, but with such an overbought setup I am lightening up and will patiently wait for new opportunities.

Read more by MarketSlant Editor